Experiments

Meanwhile, there is skepticism in the market about the initiatives, including the Polaris program that was launched with the aim of strengthening the store portfolio and driving traffic on the digital platform by enhancing customer experience. Adding to the pessimism, the much-hyped Story boutiques, designed to give a unique shopping experience, failed to evoke interest among customers.

Related: Urban Outfitters: Tough retail climate adds to volatility

After closing several stores in recent years, the company is planning to discontinue its under-performing stores in the coming months, underscoring the continuing slowdown in store footfall across the retail sector. Macy’s is forced to trim the vast store network it created in the past through an aggressive expansion program.

Capital

However, with more asset sales in the offing, the company stands to benefit from a potential improvement in cash position, which can be used for reducing debt. The uptick in cash flow, combined with the ongoing drive to strengthen the digital channel, should help Macy’s get back on track. But the whole process is going to take a long time, which does not offer the shareholders much to cheer about in the near term.

Also see: Macy’s Q4 2019 Earnings Conference Call Transcript

Said that, it is an undeniable fact that the retailer’s fundamentals are strong enough to give it a new lease of life. When it comes to returns, shareholders need to be extremely patient while Macy’s goes through its extensive and time-consuming transformation. So, it makes sense not to sell the stock at a loss, but to hold it. In the opinion of experts, the current slump can be viewed as a buying opportunity as it is not permanent.

Mixed Q4

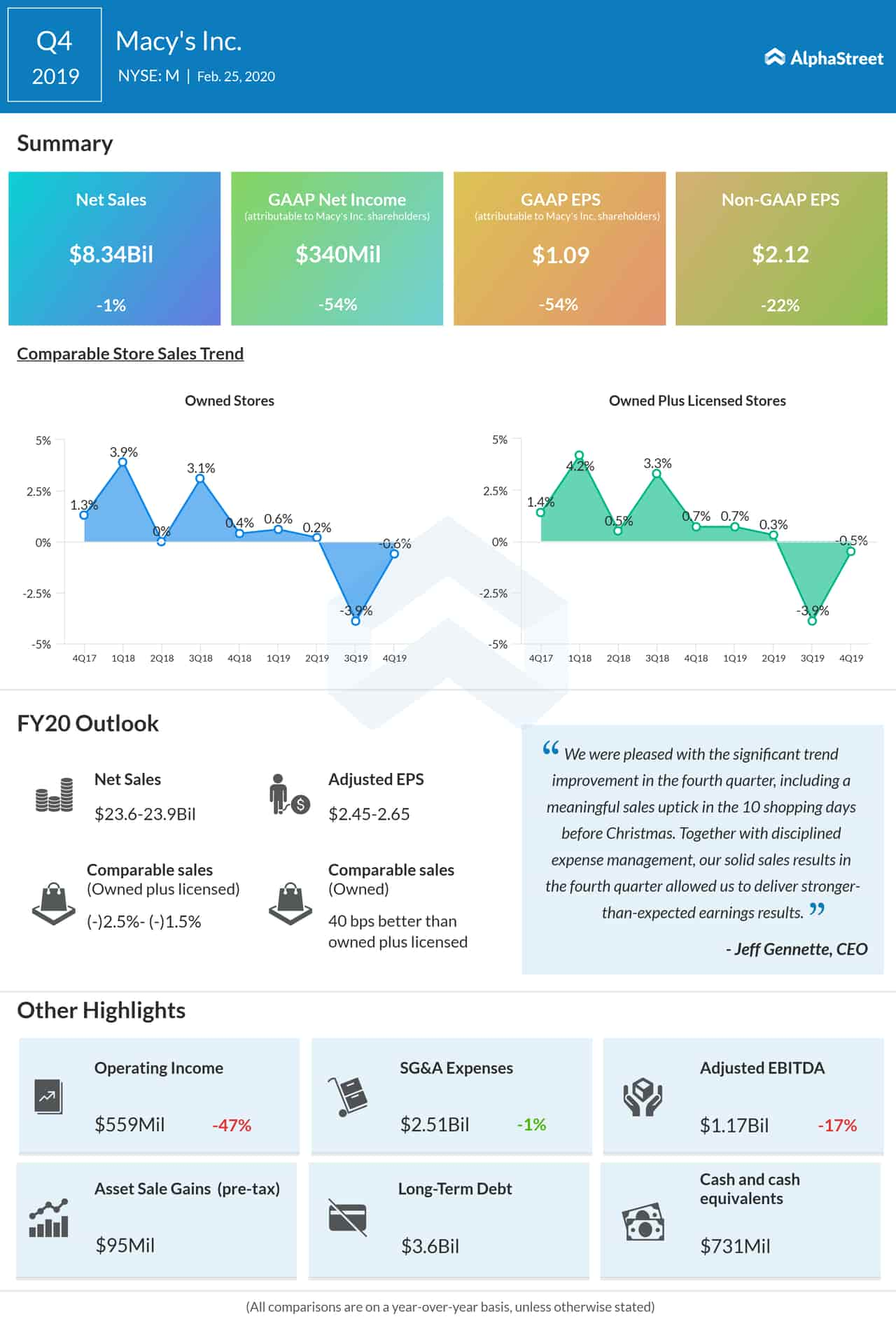

In the fourth quarter, comparable store sales came under pressure from weak holiday sales and declined year-over-year. Consequently, earnings dropped in double digits to $2.12 per share, while revenues remained broadly unchanged at $8.3 billion. Though the results beat estimates, the management forecast a marked decline in comparable sales for fiscal 2020, further dampening market’s sentiment.