Intuitive Surgical, Inc. (NASDAQ: ISRG) is a market leader in the manufacturing and distribution of robotics-assisted surgical systems. The company’s products, designed for minimally invasive surgery, help healthcare professionals conduct procedures with high precision while significantly reducing the recovery time for patients.

Since the company’s devices are made mainly for elective surgeries, sales were affected during the pandemic when such procedures were postponed due to shelter-in-place orders. But the unique business model and highly efficient products helped it regain momentum pretty quickly. Last year, revenues increased steadily, weathering the adverse market conditions.

The progressive recovery, marked by stronger-than-expected bottom-line performance in every quarter since early 2020, drove up the stock initially. However, the shares retreated after hitting a record high in the final weeks of 2021, and the weakness deepened as macro headwinds battered stock markets in recent months.

Is ISRG a Buy?

The question is what this downturn means to investors. First of all, Intuitive’s resilience to the pandemic itself is a testament to its underlying strength. Healthcare systems across the world are shifting to minimally invasive surgical procedures, and the favorable demand conditions bode well for Intuitive. If experts’ bullish view on the stock is any indication, the time is ripe to buy ISRG since the stock is expected to hit the recovery path soon and go beyond the $300-mark in the near future.

Read management/analysts’ comments on Intuitive’s Q1 2022 earnings

Of late, the company has transitioned from just a provider of robotic surgical systems to one that imparts training to surgeons on using the products. So, it is better positioned when it comes to retaining clients, who are unlikely to switch to other brands like Medtronic and Johnson & Johnson (NYSE: JNJ) after investing in Intuitive’s products.

That is important because a major chunk of the company’s revenues come from after-sale services and the supply of disposables and accessories. It won’t be easy for competitors to match the efficiency of its package. Moreover, the use of the company’s flagship product, da Vinci surgical systems, has expanded to areas like archeologic procedures, and thoracic surgery, internationally, which is having a positive effect on sales.

“For 2022 our top priority is to support supply and train our customers as they navigate a challenging environment. We are also focused on helping general surgeons in the United States to adopt our technologies in diversifying our business outside the United States, beyond urology, and executing on our new platforms in digital tools,” said Intuitive’s CEO Gary Guthart during a recent interaction with analysts.

Financial Performance

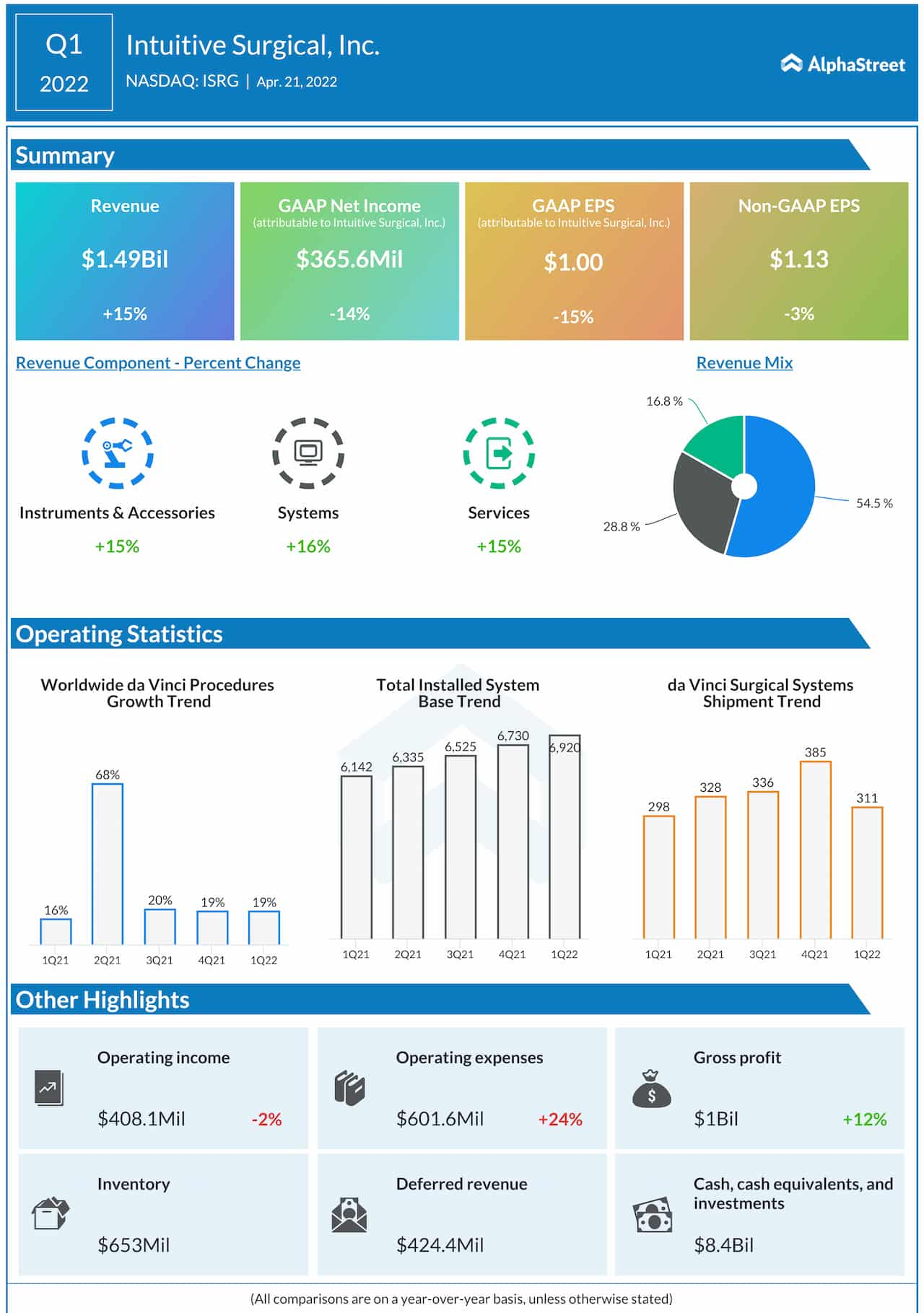

After increasing sequentially in recent quarters, shipments of da Vinci surgical systems decreased in the most recent quarter. Also, growth in worldwide da Vinci systems procedures languished at recent lows after recovering from the COVID-induced slowdown last year. The factors behind the weakness are temporary since clinical procedures are expected to return to the pre-COVID levels in the near future.

Is Merck & Co. a good investment after Q1 earnings?

In the first quarter of 2022, revenues increased 15% annually to about $1.50 billion as all three operating segments registered double-digit growth. However, a sharp increase in operating expenses weighed on the bottom line and earnings dropped 3% to $1.13 per share. The results exceeded Wall Street’s prediction.

Shares of Intuitive traded lower early Wednesday after closing the previous session higher. It has lost about 46% in the past six months, often underperforming the market.