Semiconductor solutions provider Broadcom Inc (NASDAQ: AVGO) is preparing for one of the biggest tech buyouts after successfully tapping into new opportunities created by the pandemic-driven digital transformation, thanks to its strong product portfolio and continued innovation.

Though the company’s market value declined modestly in recent months amid the stock market selloff, it looks poised to fully recover from the temporary slowdown in the second half. The stock is trading well below the peak of December 2021, but it has often stayed above the long-term average in the recent past. Interestingly, analysts following AVGO unanimously recommend buying it, citing the impressive growth prospects.

Where to invest as the semiconductor industry enters a new era

The bullish outlook – value estimated to reach $660 in the next twelve months — combined with the low price, makes the stock an attractive investment. Since a rebound from the current lows is almost certain, those looking for an entry point can consider adding Broadcom to their portfolios. Besides that, the company’s dividend growth is one of the best in the industry, and the healthy cash flows should allow it to go for further hikes

Financial Performance

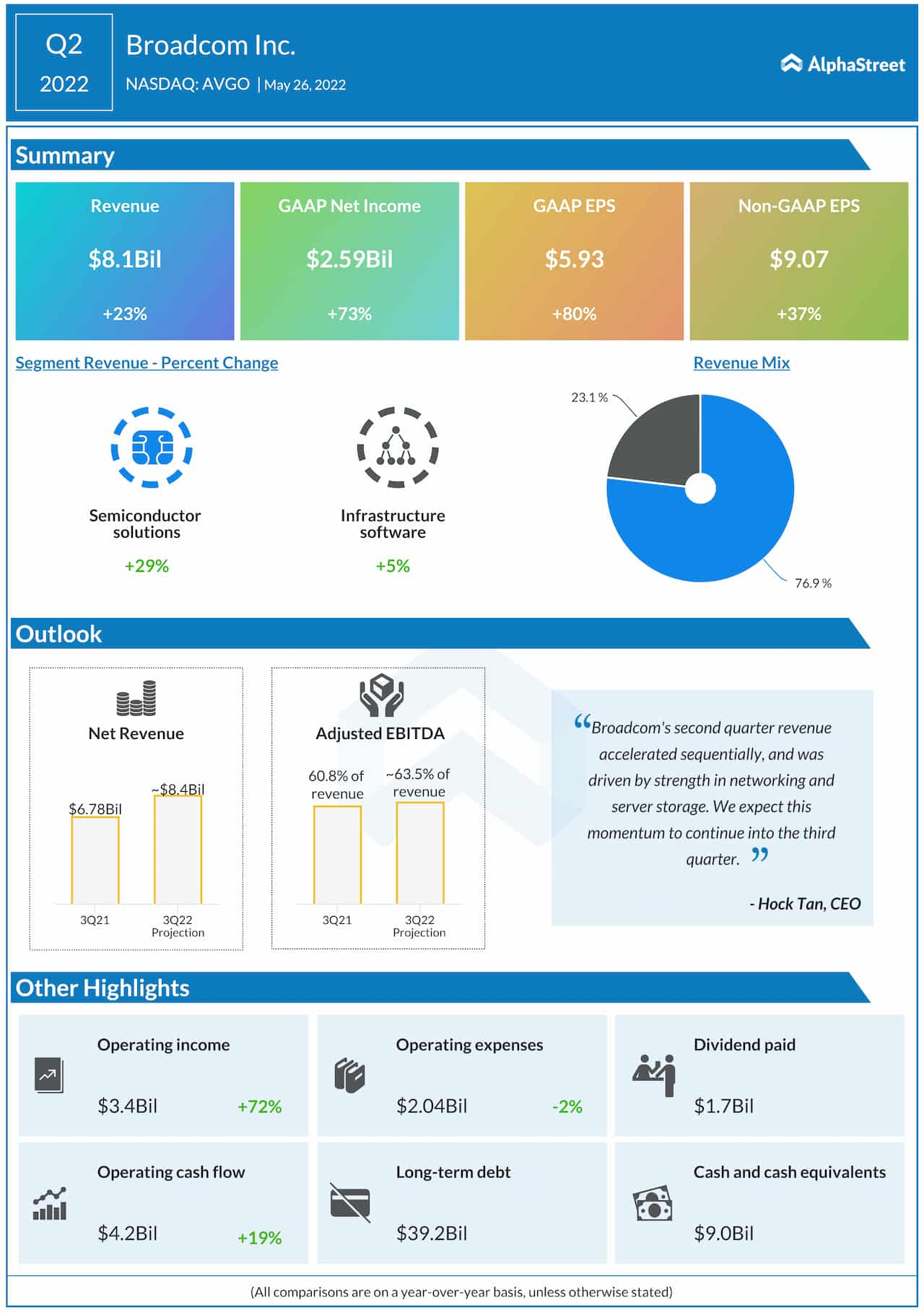

In recent quarters, net profit reached new highs amid an acceleration in revenue growth, even as fast-paced technology adoption continued to push up chip demand. Also, quarterly results exceeded forecasts almost every time. Extending the positive momentum, adjusted profit increased by more than a third to $9.07 per share in the second quarter when revenues rose sharply to about $8 billion.

The top line benefitted from a strong performance by the server storage and networking businesses, a trend that should continue in the current quarter and beyond. The booming smartphone market and aggressive cloud adoption across industries could catalyze future growth. The company is scheduled to publish third-quarter results on September 1 after the close of regular trading.

On the flip side, being a fabless chipmaker, Broadcom is more exposed to supply chain disruption than integrated device manufacturers. Delays at third-party manufacturers often impair the company’s ability to make timely deliveries, which is bad at a time when the market is facing severe chip shortage.

VMware Deal

In line with the consolidation spree the semiconductor market is witnessing, Broadcom expanded its business through a series of acquisitions over the years. The company, which has also made inroads into the software space to diversify the portfolio, is all set to acquire cloud computing firm VMware for a whopping $61 billion.

Broadcom Inc Q2 2022 Earnings Call Transcript

Commenting on the acquisition, Broadcom’s president Tom Krause said in a recent statement, “As we come together with VMware, this represents the same level of transformation for our software business and we stand to benefit from VMware’s unparalleled brand, trusted apps, a long-standing position as an iconic software platform within a robust vibrant ecosystem of hyper-scalers, solutions and cloud providers and channel partners, among others. We’re excited to announce that following the closing of the transaction, Broadcom Software Group, will rebrand and operate as VMware.”

Last week, Broadcom’s stock closed sharply lower, after experiencing volatility throughout the week. Meanwhile, it has recouped most of the losses that followed the last earnings announcement.