Uncertainties related to macroeconomic challenges and disruptions have set new trends in the business world, forcing enterprises to revisit their strategies and adapt to the changing dynamics. While the corporate world, in general, was negatively impacted by the pandemic, the widespread technology adoption triggered by the crisis came as a double-edged sword for semiconductor companies.

Most chipmakers witnessed a surge in orders as the digital shift gained steam — mainly to meet the remote-work/study requirements and facilitate the mass migration of workloads to cloud networks. On the other hand, the companies struggle to meet the high demand due to short supply of raw materials and choked supply chains. Though recovery is picking up amid improvements in the pandemic situation, the continuing chip shortage remains a concern.

Ailing Titan

The market headwinds came as a setback for Intel Corp. (NASDAQ: INTC) since the chip giant has been losing market share to its competitors lately. Also, INTC was left out when tech stocks recouped a part of the losses they suffered in the market selloff, casting doubts over the company’s ability to meet its ambitious five-year plan.

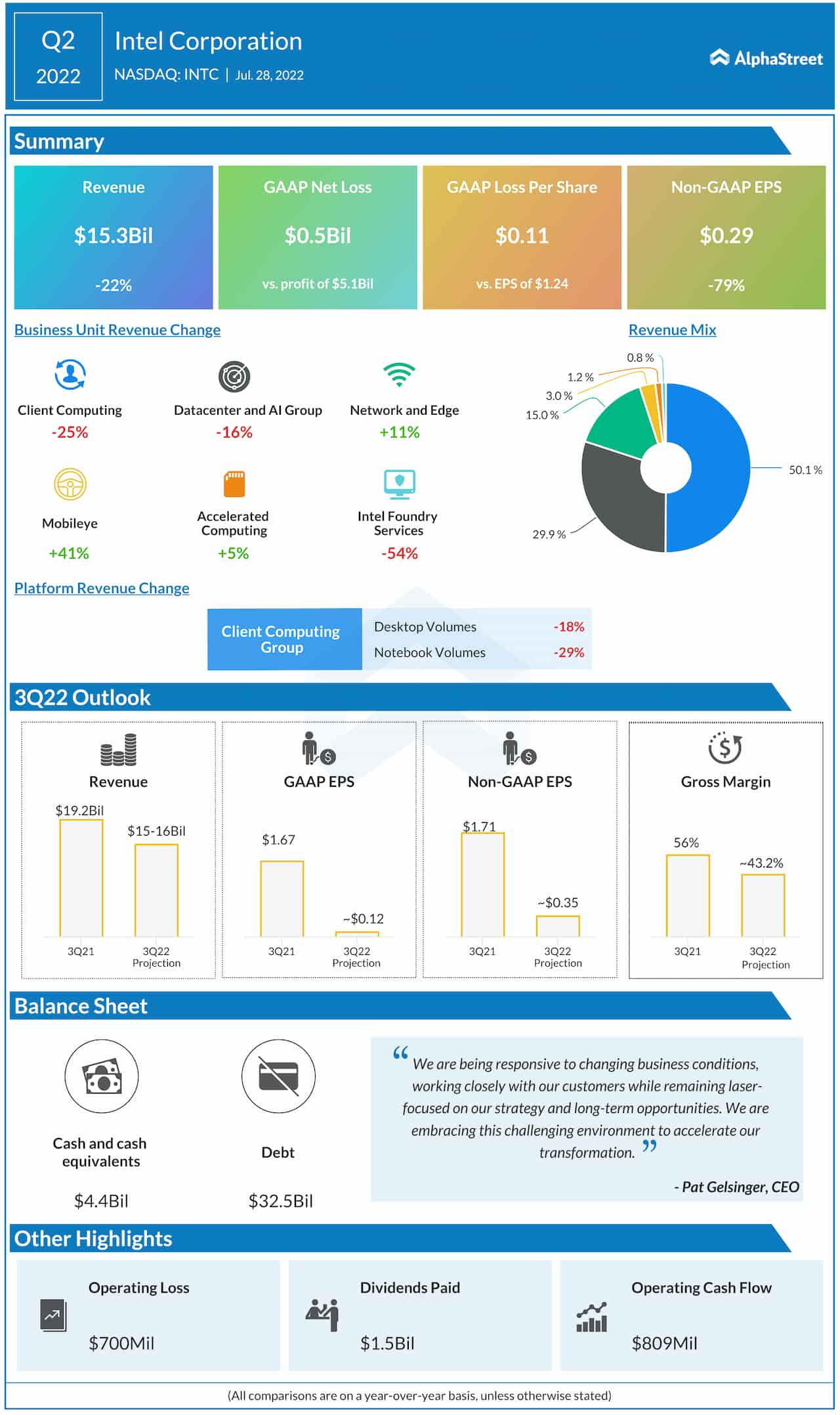

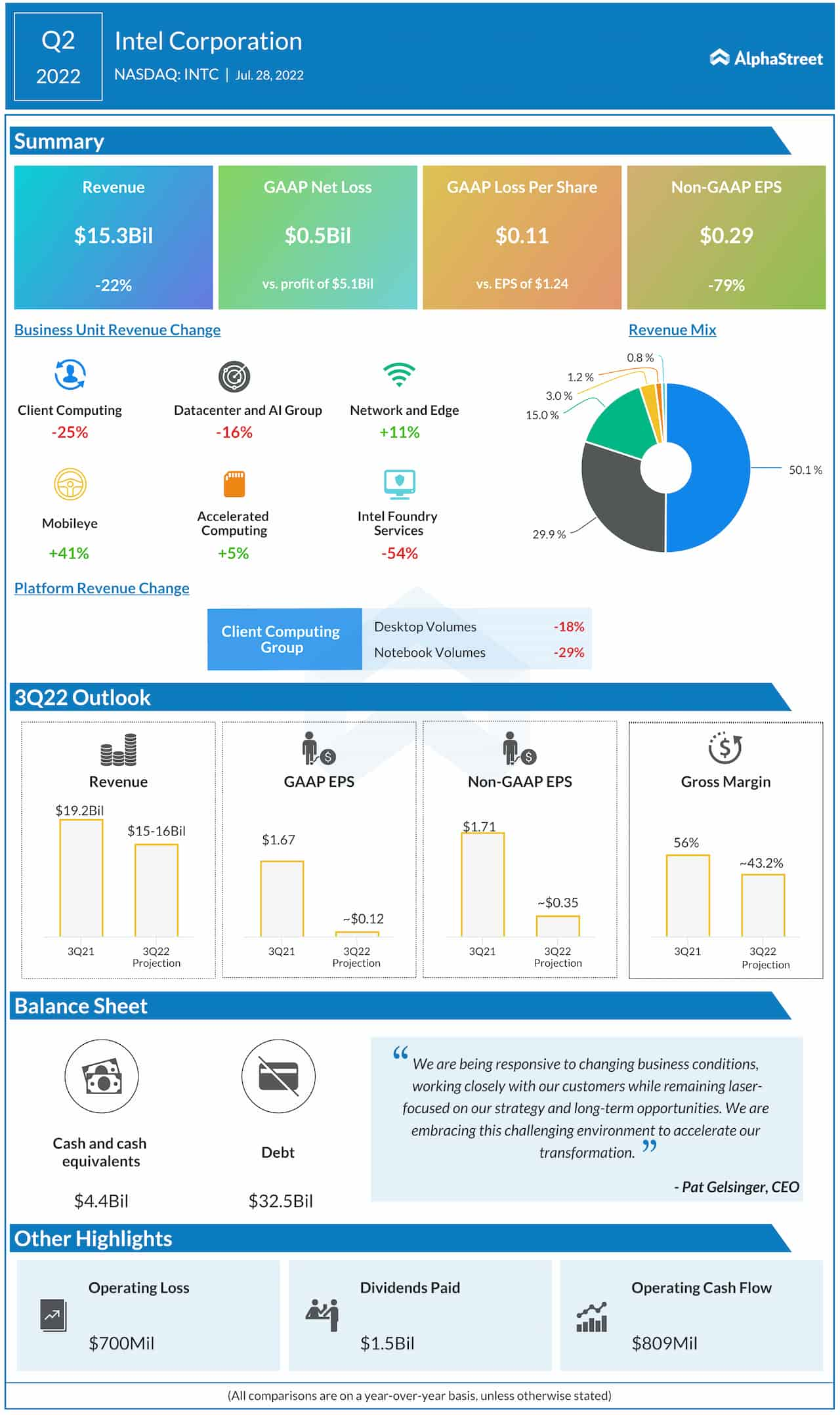

In a dismal show, Intel posted weak revenues and profit for the June quarter that fell short of expectations. Adjusted earnings plunged 79% annually to $0.29 per share, hurt by a 22% fall in revenues to $15.3 billion. The stock fell sharply soon after the announcement in late July and languished at a multi-year low since then.

Intel Corporation Q2 2022 Earnings Call Transcript

The stock has lost about 35% so far this year, dragging down investor sentiment amid fears that it might not regain the lost strength in the near future. Interestingly, from the investment perspective, the only bright spot is the cheap valuation. But investors might not find it attractive because better options are available.

Making Inroads

The growing demand for high-tech semiconductor products – supported by new technologies like AI and deep learning– is ushering the semiconductor industry into a new era where players with advanced technology will get a significant advantage. It seems Advanced Micro Devices, Inc. (NASDAQ: AMD) knows the pulse of the market better than others. The company continues to grab market share from Intel on the power of its futuristic products and innovation. As a result, it has consistently generated stronger revenues and earnings, with the bottom-line beating estimates almost every quarter in the recent past. In the second quarter, revenues surged 70% year-over-year to $6.6 billion, driving up adjusted profit to $1.05 per share, which is up 67%.

The good news is that the moderation in AMD’s market capitalization — thanks to the market selloff — has created a great investment opportunity that is significant because the stock is expected to make solid gains going forward. The management believes that growth would accelerate in the coming quarters. The portfolio is balanced and revenue contributions from all operating segments – Datacenter, Client Gaming, and Embedded – keep growing.

In the first half, the company successfully weathered the slowdown in the PC market by leveraging the strength of its smartphone and commercial notebook segments. The trend is expected to continue, given the multiple design wins and high demand for AMD’s new-generation chips among OEMs. The stock looks like a safe bet, and the time is ripe to invest in it.

Graphic Power

Meanwhile, both Intel and AMD lag behind Nvidia Corp. (NASDAQ: NVDA) when it comes to graphic chips. The graphic cards of Nvidia, which pioneered the GPU technology, are widely used in gaming PCs and cryptocurrency mining systems across the world. Though AMD has made significant progress in tapping into the GPU market, it still has a long way to go before catching up with Nvidia. The latter also holds major partnerships with auto manufacturers and mobility service providers to offer advanced processors for self-driving.

The fabless chipmaker has an impressive track record of posting better-than-expected quarterly earnings over the years, reflecting the stable revenue growth. It entered fiscal 2023 on a positive note, reporting a 46% growth in first-quarter revenues to $8.3 billion, and a 50% rise in adjusted earnings to $1.36 per share. However, of late, elevated operating expenses have put margins under pressure.

NVIDIA Corporation Q1 2023 Earnings Call Transcript

Though the stock experienced volatility after retreating from last year’s peak, it mostly outperformed the market during that period. Analysts overwhelmingly recommend buying NVDA, citing its solid growth prospects.