Overview

AbbVie’s oncology business aims to treat complex forms of cancer through its Imbruvica and Venclexta products. Imbruvica is currently used in the treatment of chronic lymphocytic leukemia, mantle cell lymphoma and marginal zone lymphoma, among others. Venclexta is used to treat chronic lymphocytic leukemia, small lymphocytic leukemia and acute myeloid leukemia.

Performance

Sales of Imbruvica and Venclexta have consistently improved over the past three years. Imbruvica registered a year-over-year growth of nearly 40% in 2018 and 30% in 2019 while Venclexta saw its sales increase more than 500% over the past three years. In fiscal year 2019, Imbruvica revenues amounted to $4.6 billion while Venclexta revenues totaled $792 million.

Imbruvica revenues benefited from the continued penetration of the product for the treatment of chronic lymphocytic leukemia as well as favorable pricing. Venclexta gained from market share gains due to additional regulatory approvals.

In the first quarter of 2020, total sales of oncology increased 32% with a nearly 21% increase in Imbruvica and an over 100% increase in Venclexta. In the second quarter, Imbruvica gained due to strong performance in chronic lymphocytic leukemia where the company is the market leader. Venclexta saw strong growth in chronic lymphocytic leukemia and acute myeloid leukemia.

Pipeline

AbbVie has several data readouts and study starts happening this year. The company reported positive results from the Phase III VIALE-A study for the treatment of Venclexta plus azacitidine in patients with acute myeloid lymphoma. The company also initiated two Phase III studies to evaluate Venclexta as a maintenance therapy in acute myeloid lymphoma.

AbbVie announced an oncology collaboration with Genmab to develop and commercialize three next-generation bispecific antibody products and establish a discovery collaboration to create additional differentiated antibody-based therapeutics for cancer.

Outlook

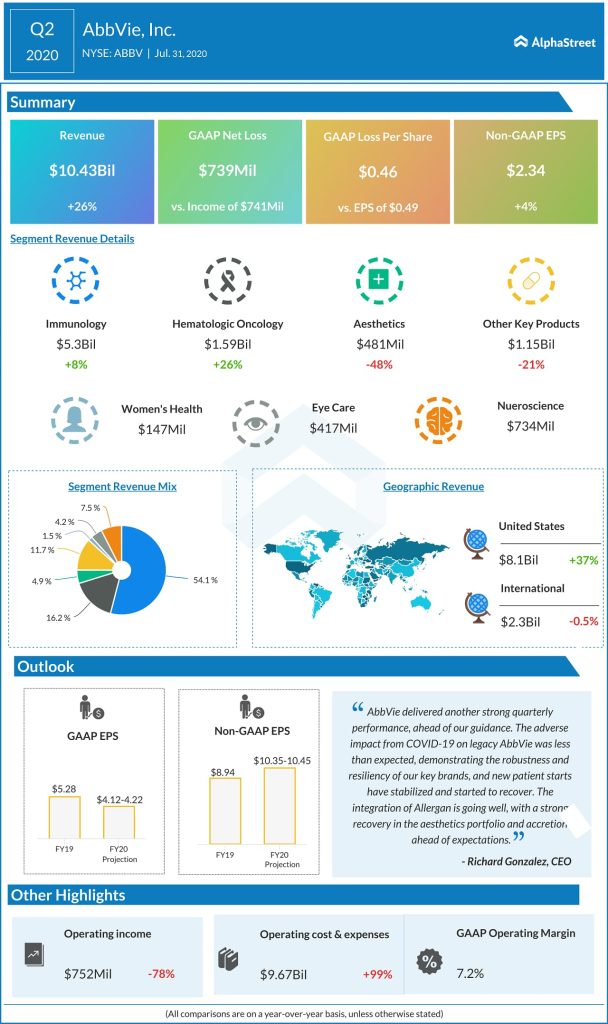

Following its acquisition of Allergan, AbbVie issued combined company guidance for full year 2020. The company expects GAAP EPS to be $4.12-4.22 and adjusted EPS to be $10.35-10.45.

Also read: AbbVie (ABBV) Q2 2020 results beat estimates; updates FY20 outlook