Comparable digital channel sales soared 31%, contributing 1.7 percentage points to Target’s overall comparable sales growth. Same-day fulfillment services accounted for 80% of the company’s digital comps growth.

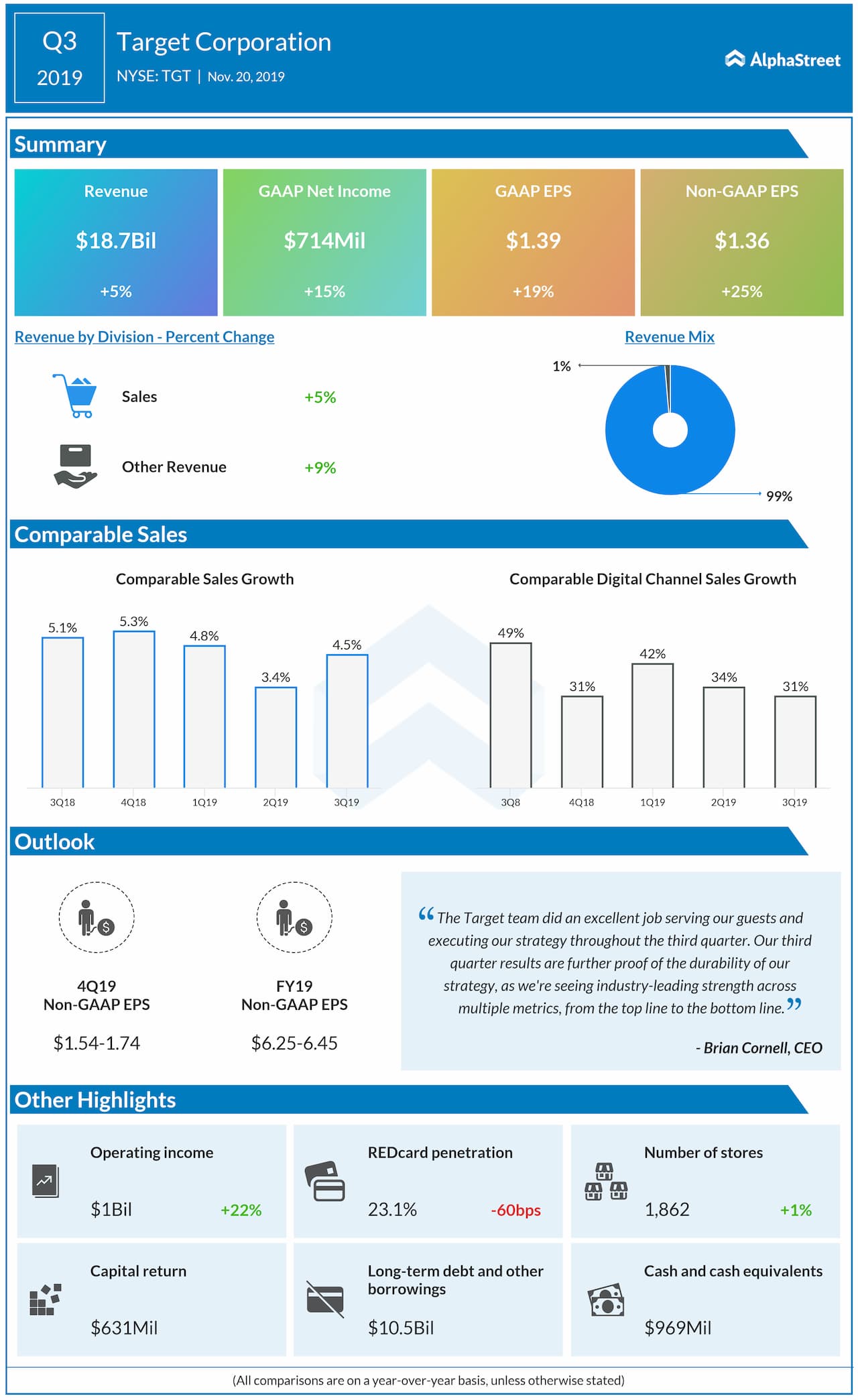

Looking ahead into the fourth quarter of 2019, the company expects comparable sales growth of 3% to 4%. Target predicts GAAP EPS from continuing operations of $1.55 to $1.75 and adjusted EPS of $1.54 to $1.74 for the fourth quarter. For fiscal 2019, the company now expects GAAP EPS from continuing operations of $6.27 to $6.47 and adjusted EPS of $6.25 to $6.45. This is compared to the previous estimate of $5.90 to $6.20.

Read: Urban Outfitters Q3 earnings review

ADVERTISEMENT

For the third quarter, the gross margin rate rose to 29.8% from 28.7% a year ago, reflecting the benefit of merchandising efforts to optimize costs, pricing, promotions, and assortment, combined with the favorable category sales mix.

For the third quarter, the guests are increasingly selecting the convenience of its same-day services outpacing Q2 adoption. The company continued refining the store operating model it rolled out to all stores this summer to ensure its teams are ready to offer an unrivaled shopping experience during the peak season. Target opened 9 stores in the third quarter.