TD Ameritrade Holding Corp. (AMTD) reported a 103.4% jump in earnings for the first quarter helped by record asset gathering in both retail and institutional channels as well as a jump in revenues. The results exceeded analysts’ expectations.

Net income soared 103% to $604 million and earnings surged 105.8% to $1.07 per share. Adjusted earnings climbed 38.8% to $1.11 per share. Revenue grew 20.6% to $1.52 billion.

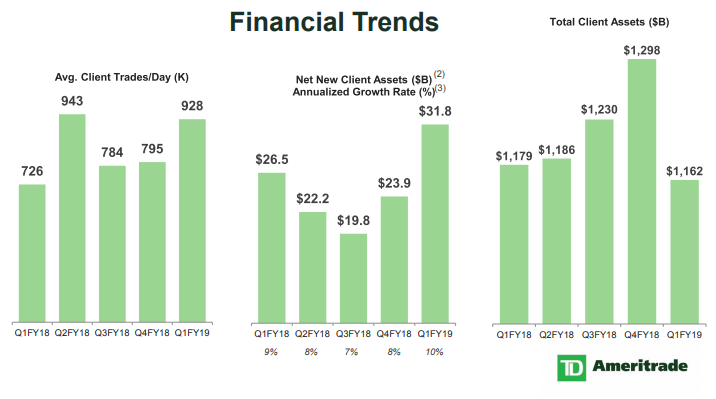

The company gathered a record $32 billion in net new client assets, an annualized growth rate of 10%, and reported client trading activity of about 928,000 client trades per day, on average, up 28% year-over-year.

Trading was also strong in the first quarter with 14 days eclipsing 1 million trades, and mobile trading reaching new highs, averaging 240,000 mobile trades per day, up more than 50% from last year.

The company benefited from heightened investor activity in the face of increased market volatility, as well as the ongoing positive tailwinds provided by higher interest rates and significant asset gathering.

Net interest margin rose by 13 basis points sequentially, on strong growth in BDA balances, benefits from the removal of the FDIC surcharge, higher interest rates, and steady average margin balances.

Looking ahead to the remainder of 2019, the company would remain focused on maintaining organic growth and building its long-term earnings power. TD Ameritrade expects a seasonal increase in the ad spends in the second quarter that could continue into the third quarter, depending on market conditions. The company remained focused on managing expenses within its control.

The company has declared a quarterly cash dividend of $0.30 per share on its common stock. The dividend will be paid on February 19, 2019, to all shareholders of record as of February 5, 2019.

During the December quarter, the company paid $145 million in cash to repurchase 2.9 million shares. As of December 31, 2018, the company has about 18 million shares remaining for share repurchases under its stock repurchase program.

Shares of TD Ameritrade ended Tuesday’s regular session down 0.81% at $54.92 on the Nasdaq. Following the earnings release, the stock inched up over 1% in the after-market session.