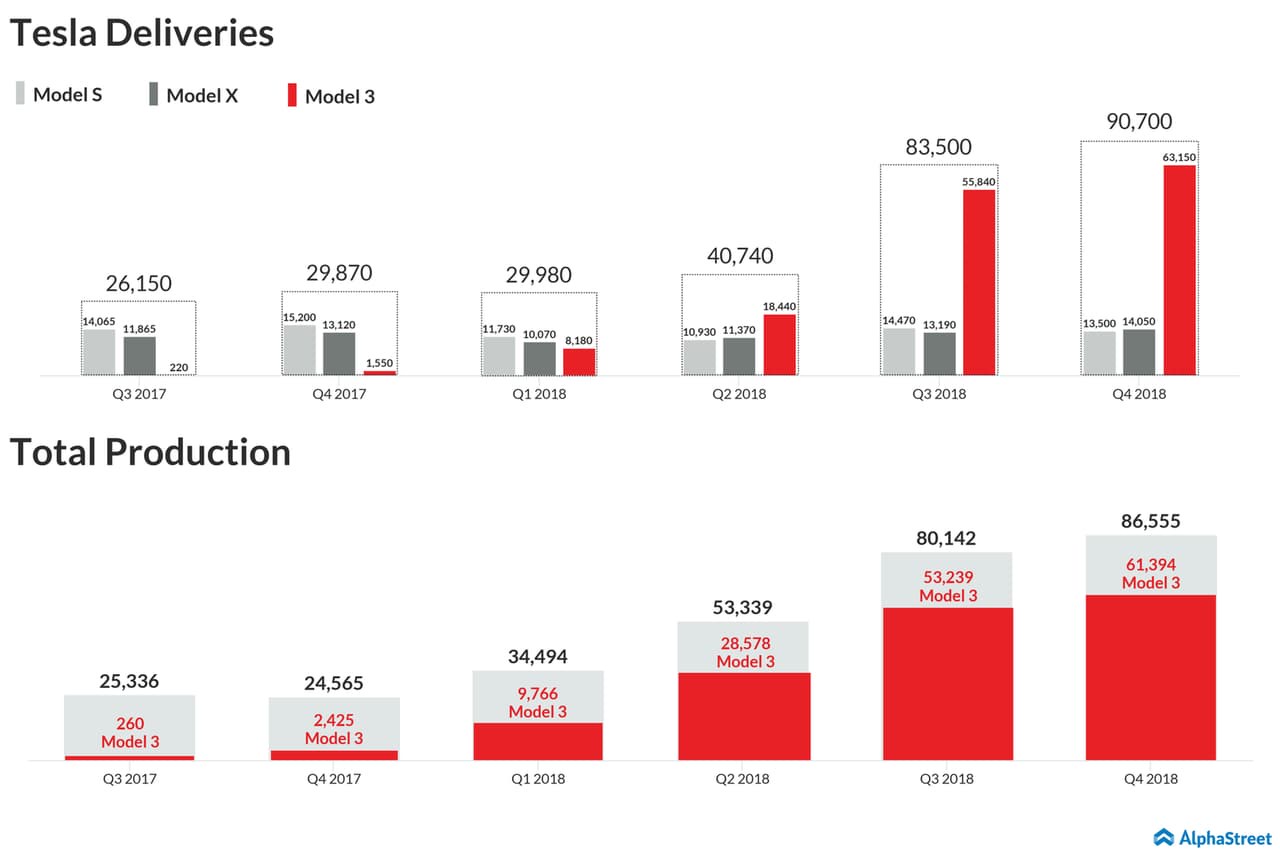

Of late, there has been growing concerns about the weakening demand for Tesla’s flagship Model 3 sedan, especially after initial estimates revealed a record decline in deliveries in the early months of 2019. The poor show added to the negative sentiment among investors, who are already worried about the company’s inability to meet production targets in recent months.

Of late, there has been growing concerns about the weakening demand for Tesla’s flagship Model 3 sedan, especially after initial estimates revealed a record decline in deliveries in the early months of 2019. The poor show added to the negative sentiment among investors, who are already worried about the company’s inability to meet production targets in recent months.

The Chinese government recently slashed subsidies on electric vehicles, at a time when some of the global players including Tesla were expanding their presence in the Asian country and other markets like Europe.

There has been growing concerns about the weakening demand Model 3, especially after initial estimates revealed a record decline in deliveries this year

Overall, there are clear indications that the going is getting tough for Tesla, and the situation casts doubts over the company’s ability to meet the production and delivery goals going forward. Also, CEO Elon Musk’s efforts to improve the cash position and reduce debt are yet to yield the desired results. In the future, Tesla will be facing tougher competition from the traditional automakers, who are busy preparing to roll out their EV models.

Also see: Tesla stock falls as Model Y launch fails to enthuse market

Last month, the company’s stock suffered after its long-awaited Model Y crossover SUV failed to impress the market. The lackluster response suggests that orders for the new car might fall short of expectations. The first unit of Model Y is expected to hit the road only next year, or even later.

Tesla’s stock was down 3.6% in pre-market trading Thursday, after closing the previous session higher. Currently passing through a volatile phase, the shares lost about 11% so far this year and 8% in the past twelve months.