Thor Industries (NYSE: THO), a leading manufacturer of recreational vehicles, is slowly regaining momentum after losing significant market value last year. The Elkhart, Indiana-based firm is estimated to have earned $1.64 per share in the third quarter, the results of which will be published Monday early morning.

While the forecast

represents a 35% decrease from last year, revenues are expected to grow 17%

year-over-year to $2.63 billion.

Softening Demand

The demand crunch in the recreational vehicle market, especially when compared to last year’s robust numbers, might have squeezed margins in the to-be-reported quarter. The unfavorable market conditions point to a challenging year ahead for the company. Sales will be affected by the reduction in inventory at the recreational vehicle dealers, who continue to streamline stock in response to the dismal retail scenario.

In contrast, the had dealers witnessed double-digit growth in inventories a year earlier. Since then the trend reversed, marked by a deceleration in growth which slipped to the negative territory in Thor’s most recent quarter.

The demand crunch in the recreational vehicle market is likely to have squeezed margins in the to-be-reported quarter

In what could be the warnings of a slowdown, the company in its recent statements hinted at cutting production to rein in the inventory imbalance. However, it is estimated that the dip in dealer demand will be short-lived. Thor’s solid production capacity, which got a boost after the acquisition of Jayco a few years ago, contributes to the inventory backlog.

Looking Back

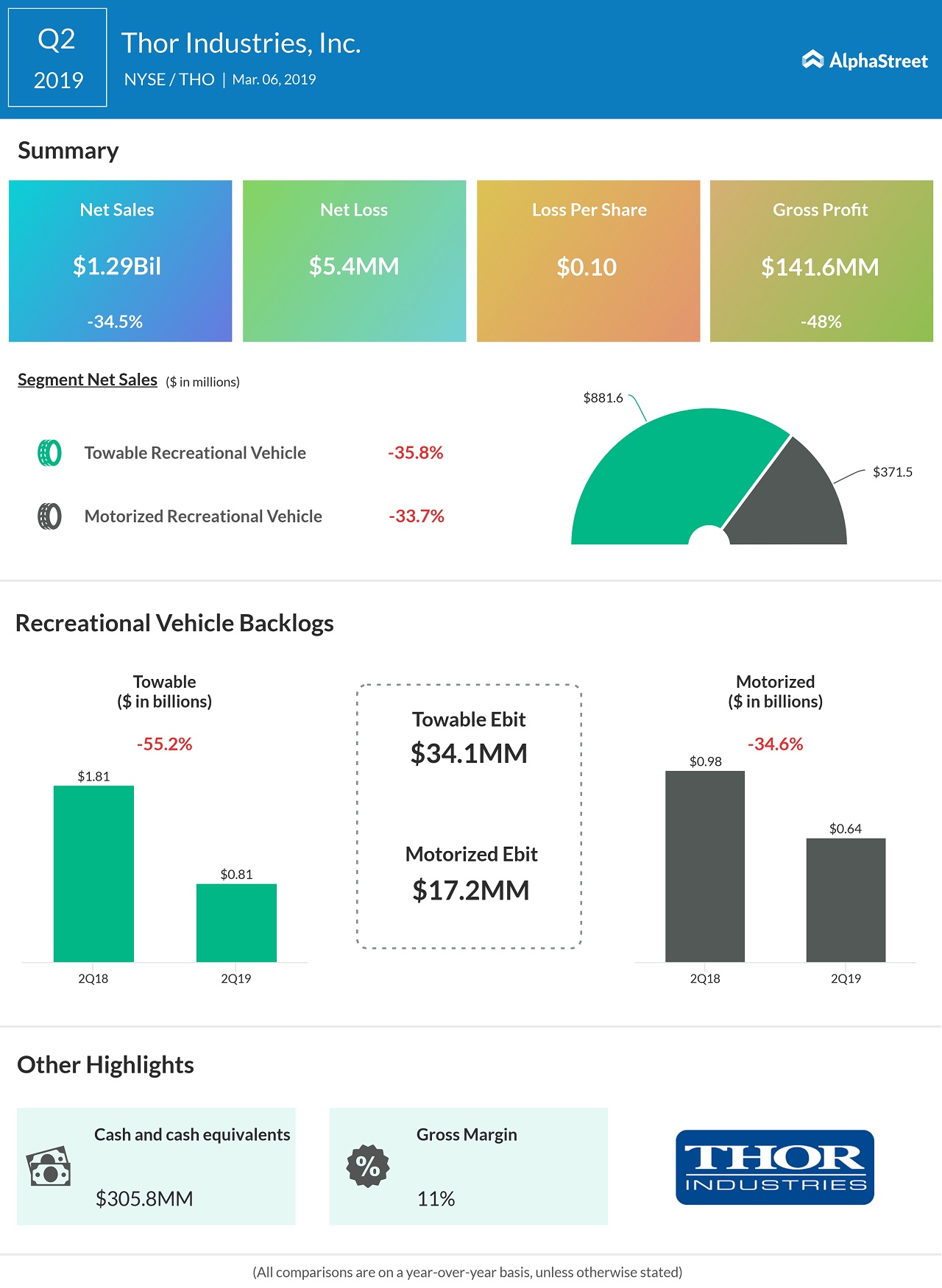

Thor had a dismal performance in the second quarter when it slipped to a net loss of $0.10 per share, hurt by a 35% fall in revenues. Both the business segment registered a double-digit decline in revenues. The results, which were also impacted by costs related to the acquisition of Erwin Hymer, fell short of expectations and triggered a stock sell-off then.

After falling to a multi-year low in December last year, shares of Thor showed signs of a recovery in early 2019. However, it pared the early gains as the year progressed. The stock lost about 47% in the past twelve months.