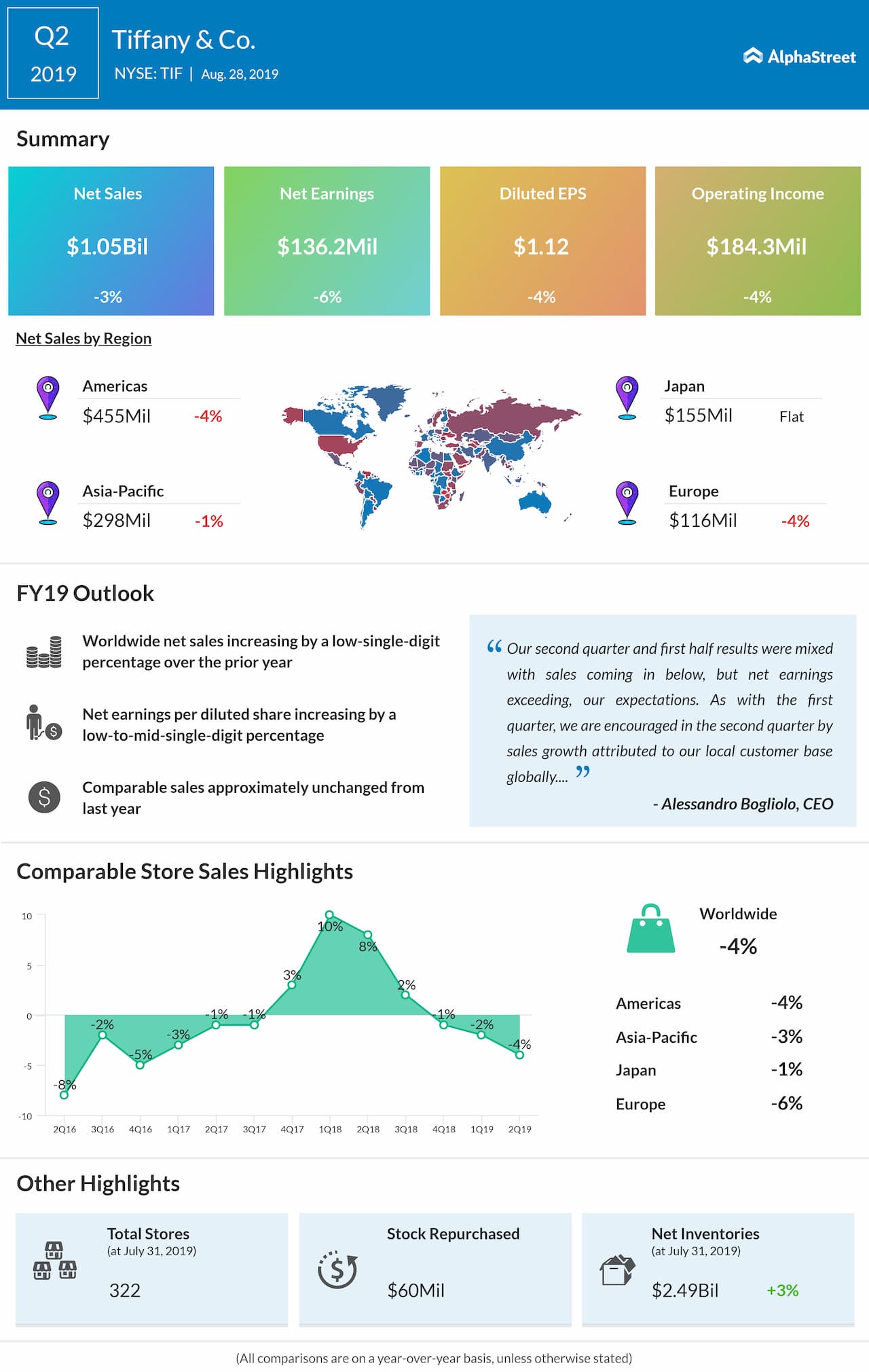

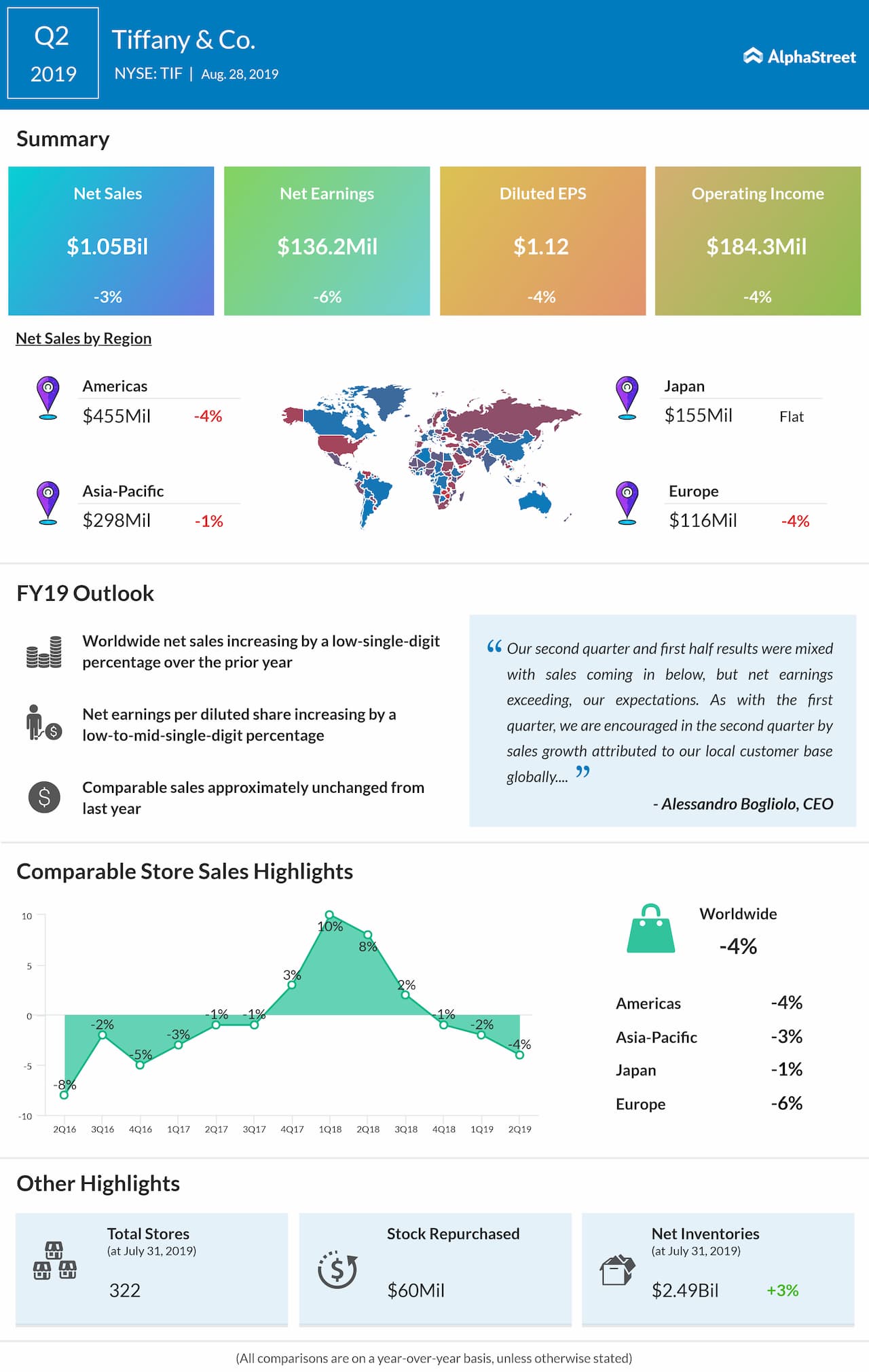

Tiffany & Co. (NYSE: TIF) reported a 6% drop in earnings for the second quarter due to weak demand from foreign tourists, currency exchange rate pressures, and continuing business disruptions in Hong Kong. The bottom line exceeded analysts’ expectations while the top line missed consensus estimates.

Net income dropped by 6% to $136 million or $1.12 per share. Net sales declined by 3% to $1.05 billion. Comparable sales fell 4%.

On a constant-exchange-rate basis, net sales declined by 1% from the prior year and comparable sales decreased by 3%. The company saw declines in both net sales and comp sales across all its geographical regions last quarter.

Looking ahead into fiscal 2019, the company expects worldwide net sales to increase by a low-single-digit percentage from last year and worldwide comparable sales will remain approximately unchanged as compared to the prior year. Earnings, on a per-share basis, are forecast to grow by a low-to-mid-single-digit percentage. The estimate for capital expenditures is about $350 million.

For the second quarter, sales from the Americas decreased by 4% and comparable sales declined by 4% due to lower spending by foreign tourists and, to a lesser extent, local customers. In Asia-Pacific, sales declined by 1% and comparable sales decreased by 3% due to the effect of foreign currency translation.

Read: Veeva Systems Q2 earnings review

In Japan, sales remained unchanged from last year and comparable sales declined by 1%. In Europe, sales dropped by 4% and comparable sales fell by 6% due to the effect of foreign currency translation and broad-based regional softness. In the jewelry categories, sales from Jewelry Collections was unchanged while that from Engagement Jewelry declined by 3% and Designer Jewelry dropped by 10%.

In the first half, Tiffany has opened three Company-operated stores and closed two. At July 31, 2019, the company operated 322 stores, out of which 124 in the Americas, 90 in Asia-Pacific, 56 in Japan, 47 in Europe, and five in the UAE.