Tiffany & Co. (NYSE: TIF) has been one of the closely followed Wall Street firms ever since the luxury jeweler agreed to be acquired by France-based LVMH Moët Hennessy a few months ago. When the $16-billion deal was announced – one of the biggest in the sector – it triggered a major rally and the stock moved close to last year’s peak.

Under the LVMH fold, Tiffany is expected to enter a new phase of performance growth, while the French conglomerate will gain access to the lucrative US market. The transaction, which was finalized after several rounds of intense negotiation, is scheduled to close mid-2020.

Hold TIF

The latest developments have left the market speculating about the future of the stock even as the year comes to a close. Meanwhile, the not-so-impressive third-quarter outcome dampened investor sentiment to some extent, raising concerns about the stock’s high valuation. Experts call for patience as far as trading in the stock is concerned, with the majority of analysts giving it hold rating. The target price of around $130 represents a 3% downside.

A Turning Point

The buyout is perhaps a significant turning point in the company’s history of nearly two centuries as the combined entity would command a dominant position in the global luxury goods market. The stock needs to be kept under close watch until a clear picture emerges. The general view is that the price would grow significantly in the next twelve months. Tiffany’s ability to create long-term shareholder value makes the stock a reliable investment option.

Dismal Q3

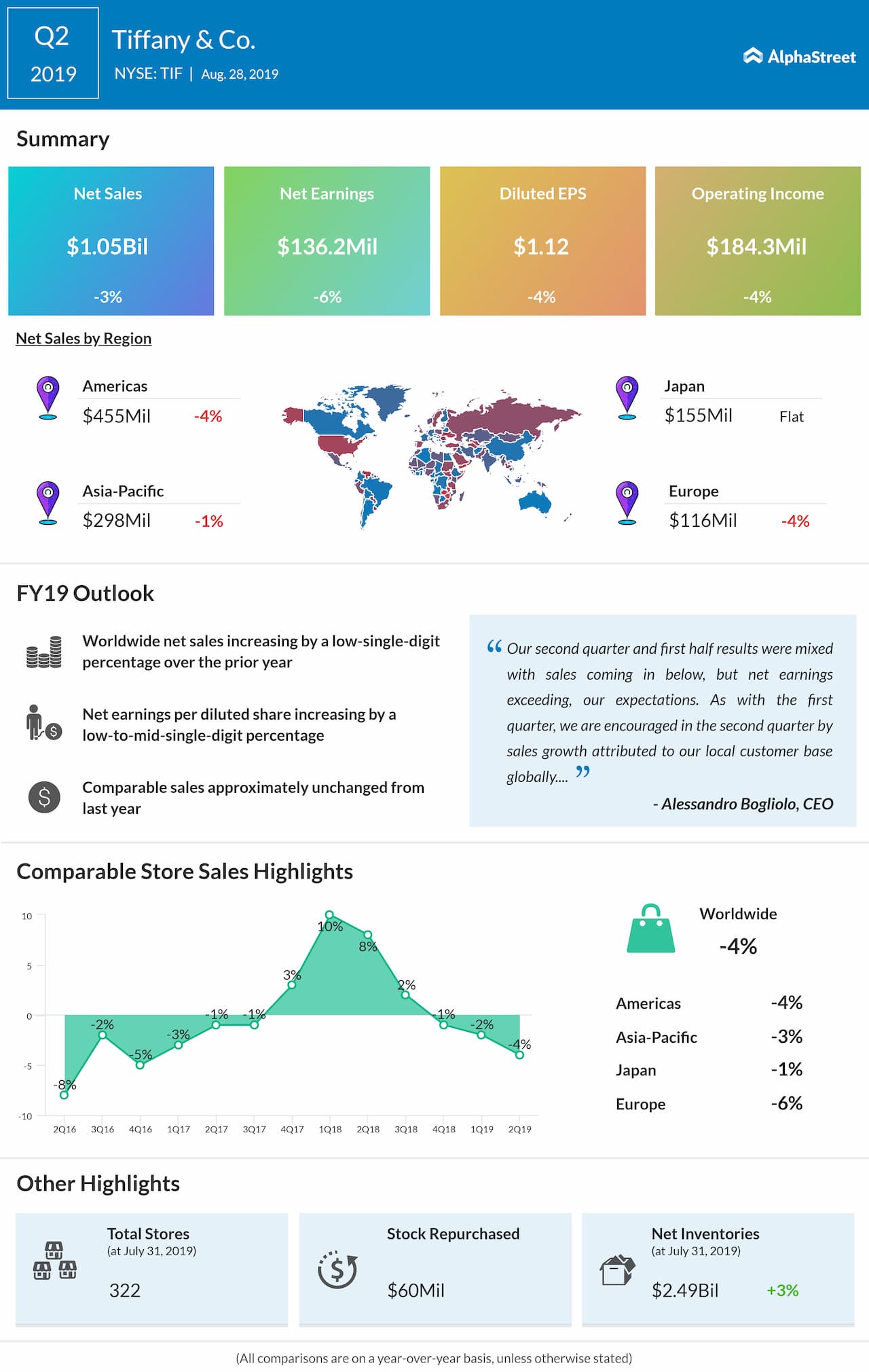

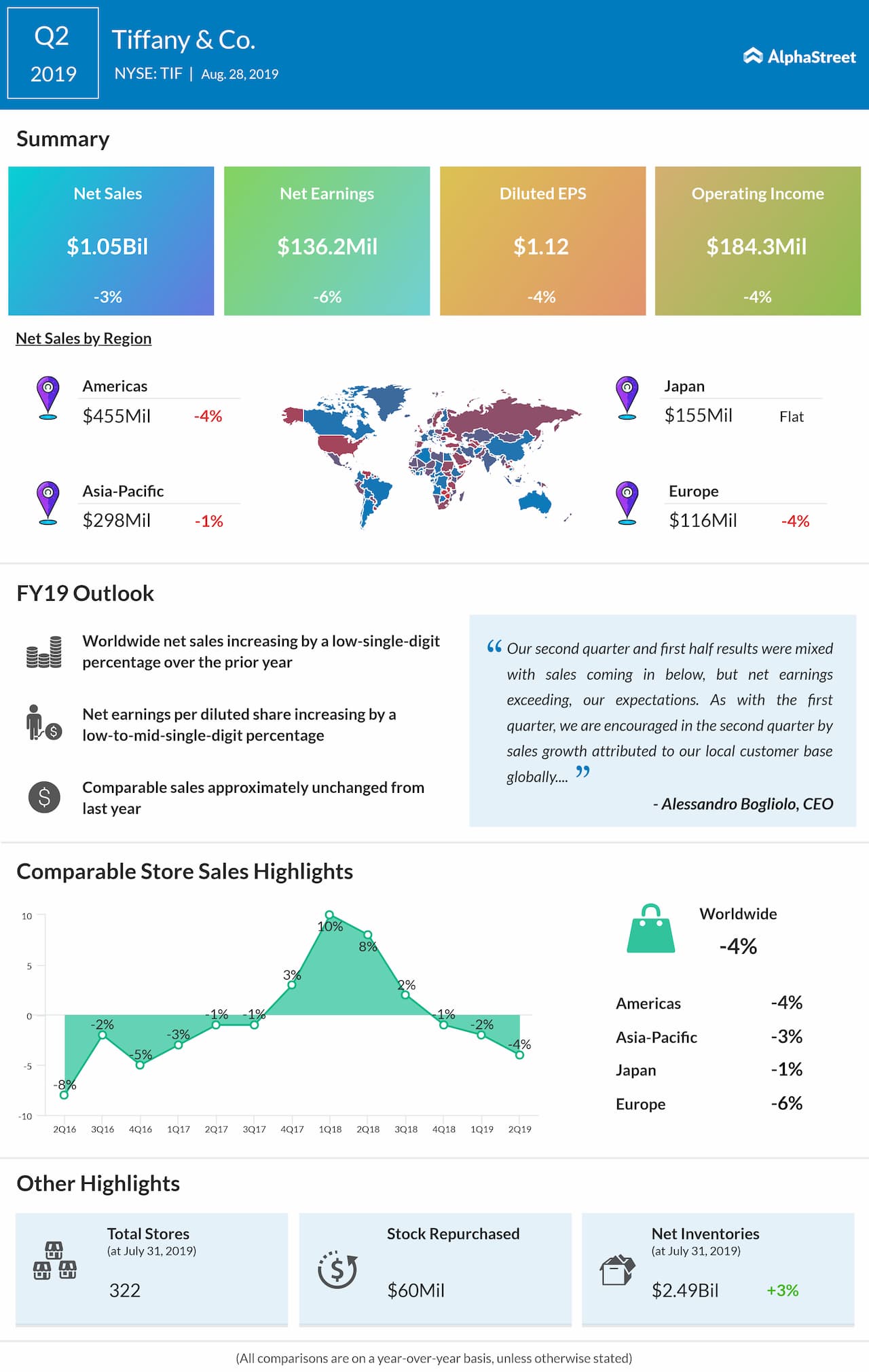

In the third quarter, earnings declined 16% year-over-year to $0.65 per share and came in below the estimates. At $1.01 billion, sales remained broadly unchanged from last year, amid flat comparable-store sales, but fell short of expectations. Initial estimates indicate the company generated impressive sales this holiday season, with all the key markets including the US, Europe, and China witnessing high demand.

Related: Accenture to thrive on digital, cloud prowess next year

While positive consumer spending and declining prices bode well for the American jewelry market, issues like stiff competition and funding constraints remain a challenge for manufacturers. Among Tiffany’s peers, Signet Jewelers (SIG) has been on a losing streak for a long time. The stock traded at a ten-year low this week, after falling steadily in recent months amid poor earnings performance.