Q1 results

COVID-19 updates

Tilray stated that it didn’t have any material changes to the supply chain because of COVID-19, except for some brief interruptions. In March, some of the adult-use deliveries were delayed by a few days in Canada. But overall, the company didn’t witness significant COVID-related distribution challenges in Canada or internationally in Q1 and throughout April and the first part of May. While COVID-19 did create some headwinds, legal cannabis has emerged as a new product category that represents an enormous global growth opportunity. Despite COVID-19 emergency orders, cannabis was recognized as an essential business in Canada, Germany, Portugal, Australia and multiple U.S. states.

[irp posts=”49264″]

Tilray believes that this pandemic will make legal cannabis more like a consumer staple business. When answering an analyst’s question, CEO Brendan Kennedy said,

“I think as people are concerned about quality and safety, I think that COVID may lead to a faster migration of Canadian consumers from the illicit market to the legal market.”

Partnerships

Tilray’s joint venture with Anheuser-Busch InBev was the first to launch two CBD-infused beverage products in Canada. Tilray stated that it’s seeing more interest from international partners who are looking at other CBD products in certain countries and medical, pharmaceutical products, compounding products in certain regions of the world. CEO mentioned in the call that Tilray is having a lot of conversations and the focus is on international markets, not domestic markets. He further said,

“Fortune 500 companies that are looking to enter the industry are taking a much more methodical approach. I think that a year and a half ago, the valuations of companies in this industry and the volatility scared off a lot of those Fortune 500 companies. And the more realistic valuations today have peaked their interest more.”

Outlook

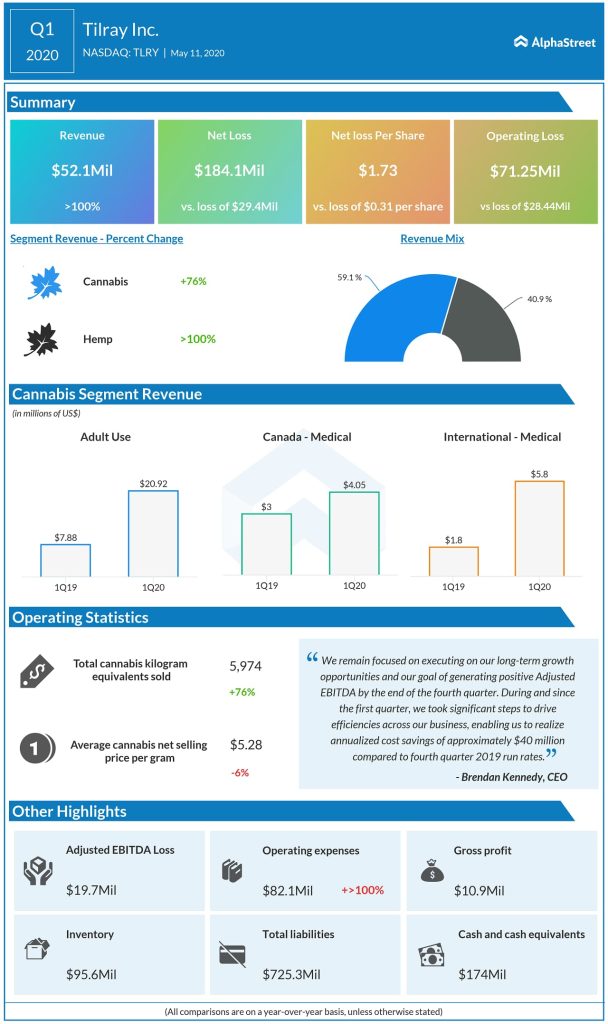

As stated in the fourth quarter earnings call, Tilray began restructuring the organization in February by reviewing each of the businesses to reduce duplication and costs. The company estimate to achieve approximately $40 million in annualized cost savings, relative to the fourth quarter 2019 run rate. The cost savings components include corporate headcount reduction, operational efficiencies at the cultivation sites in Canada and Portugal, and transitioning Canadian adult-use sales to Kindred, a special cannabis brokerage.

[irp posts=”61037″]

For the first quarter, cost savings totaled $2.5 million. Tilray expects that the financial impact of these improvements will be realized starting in the second quarter, before ramping up the full benefits in the third quarter. The company targets to generate positive adjusted EBITDA by the end of the fourth quarter.

When discussing medical cannabis revenue, CEO Brendan Kennedy stated that international medical cannabis revenues exceeded Canadian medical cannabis revenues in the first quarter. He added,

“And that will never — it will never go back, right. International medical will always be in excess of our Canadian medical cannabis revenue, and we expect that growth to continue on a quarter-over-quarter basis throughout the rest of this year until next year”.

It will be interesting to see how Presidential candidates address CBD legalization, medical cannabis legalization and legalization for adult-use in the U.S. between now and November.

Read the entire Tilray Q1 2020 earnings transcript