The Organization

• Trxade Inc. (Web-based Market Platform)

• Bonum Health (Telehealth/telemedicine App)

• Community Specialty Pharmacy (Pharmacy)

• DelivMeds (Rx Delivery App)

• Integra Pharma Solutions (Virtual Wholesaler)

Other products and Services

• Trxade Marketplace (Rx Marketplace)

• Trxade Medical (Rx Marketplace)

• Trxade HSO (Health Services Org)

• TRx Savings Card (Prescription Discount Card)

Read management/analysts’ comments on Trxade’s Q4 2021 earnings

The Market

It is estimated that the pharmaceutical industry in the U.S. would reach $685 billion by next year. More than 90% of the pharmaceutical market, which comprises around 65,000 pharmacy facilities, is controlled by a few large wholesalers, resulting in a dearth of transparency in pricing and delivery. Trxade needs to compete with big distributors like McKesson, Cardinal Health, and AmerisourceBergen to grow the business as it seeks to solve the transparency and pricing issues.

The company serves nearly half of all the independent pharmacies in the country, leveraging its technological prowess and disruptive business model. It looks to scale internationally by partnering with global distribution channels.

Other players in the market offering services similar to that of Trxade include PharmaBid, RxCherrypick, PharmSaver, and MatchRxand. However, the company differentiates itself from others by providing pharmacy partners with both brand and generic products. It also faces competition from legacy healthcare players like Rite Aid Corporation, Walgreens Boots Alliance, and e-commerce platform Amazon.com (NASDAQ: AMZN), which owns digital pharmacy PillPack.

Updates

In February 2022, Trxade entered into a partnership with Exchange Health, LLC, a technology company providing an online platform for manufacturers and suppliers to sell and purchase pharmaceuticals. Under the deal, a limited liability company called SOSRx LLC was formed, which is owned 51% by Trxade and 49% by Exchange Health.

Key Numbers

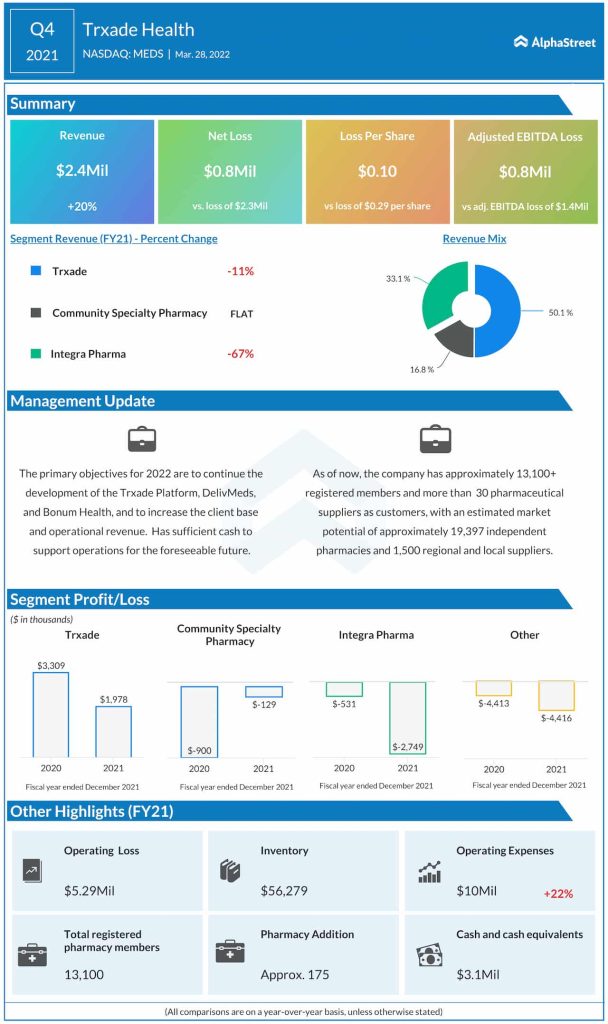

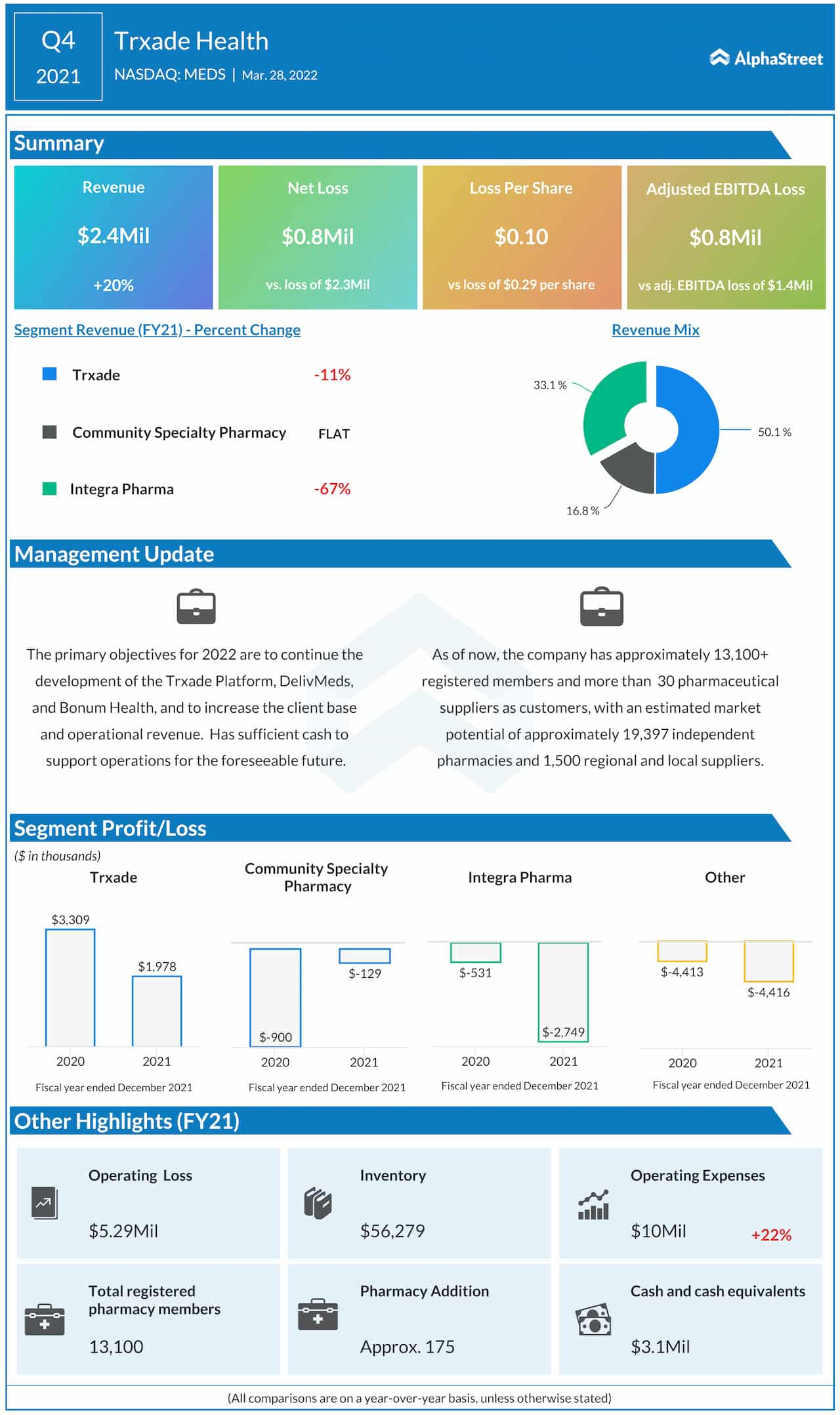

Trxade ended fiscal 2021 on a positive note, with fourth-quarter net loss narrowing sharply amid double-digit revenue growth. The management’s main objectives for the new fiscal year are continued development of the Trxade platform, DelivMeds and Bonum Health. Capital spending will be focused on expanding the client base and boosting revenues.

Net loss narrowed to $0.10 per share in the fourth quarter from $0.29 per share in the corresponding period of 2020. The improvement reflects a 20% increase in operating revenues to $2.4 million. Adjusted EBITDA was a loss of $0.8 million, compared to a loss of $1.4 million in the prior-year quarter. The revenue base has returned to the core TRxADE pharmaceutical exchange platform because the one-time increase in personal protective equipment sales — due to a spike in demand after the onset of the pandemic – cooled off. At the end of the quarter, the company had more than 13,100 registered members and 30 pharmaceutical suppliers as customers. Currently, there are 47 full-time employees.

Outlook

The management expects SOSRx LLC, which was created jointly with Exchange Health to provide a single platform for drugmakers to optimize their sales directly to large buyers, would witness meaningful growth in the current fiscal year. The focus is on new strategies to take forward the core business while pursuing the goal of creating a compelling healthcare ecosystem and building a strong value proposition for stakeholders.

It is expected that supply chain issues would persist in the near term, with the Russia-Ukraine war aggravating the situation. However, things are seen improving as the year progresses despite the lingering COVID-19 uncertainties.

Key highlights from Walgreens Boots Alliance Q2 2022 earnings results

Risks

The primary risk facing Trxade is the pandemic-related disruption and supply chain issues, affecting the growth prospects of the company that is yet to become consistently profitable. Also, the ongoing consolidation in the healthcare industry can have a negative impact on its operating results.

Lack of transparency in drug pricing and inadequate coordination among the different sections of the prescription drug market remains a challenge for both customers and companies. Monopolistic pharmacy benefit managers and retail chains add to the concerns of pharmacy technology companies. Though Trxade’s business is not directly impacted by seasonal variations it might get indirectly affected by the fall/winter flu season.

Stock Performance

Trxade’s stock experienced volatility over the past several weeks, with the market selloff adding to the weakness. Though MEDS made impressive gains following the recent earnings report, it pared most of that in the following sessions. As a result, the shares continue to languish in the single-digit territory. As of April 30, the market capitalization was slightly above $14 million. Experts are of the view that the stock would bounce back in the coming months and go beyond the long-term average.

Conclusion

Trxade’s growing user base underscores the relevance of its unique business model. Recent initiatives like the JV partnership indicate the company is on track to resolve the key issues facing independent pharmacies, such as lack of transparency in drug procurement and delays in delivery. The widespread adoption of technology in the healthcare market and the mass shift to digital services bode well for the company.