Processed food companies witnessed a surge in demand for their products during the COVID-19 pandemic as people started buying more snacks and easy-to-prepare meals. This trend is largely expected to slow down once the pandemic subsides and things go back to normal but so far the momentum seems to remain intact. Companies such as Tyson Foods (NYSE: TSN), Hormel Foods Corp. (NYSE: HRL) and Kellogg Co. (NYSE: K) performed well during their most recent quarters.

Retail strength

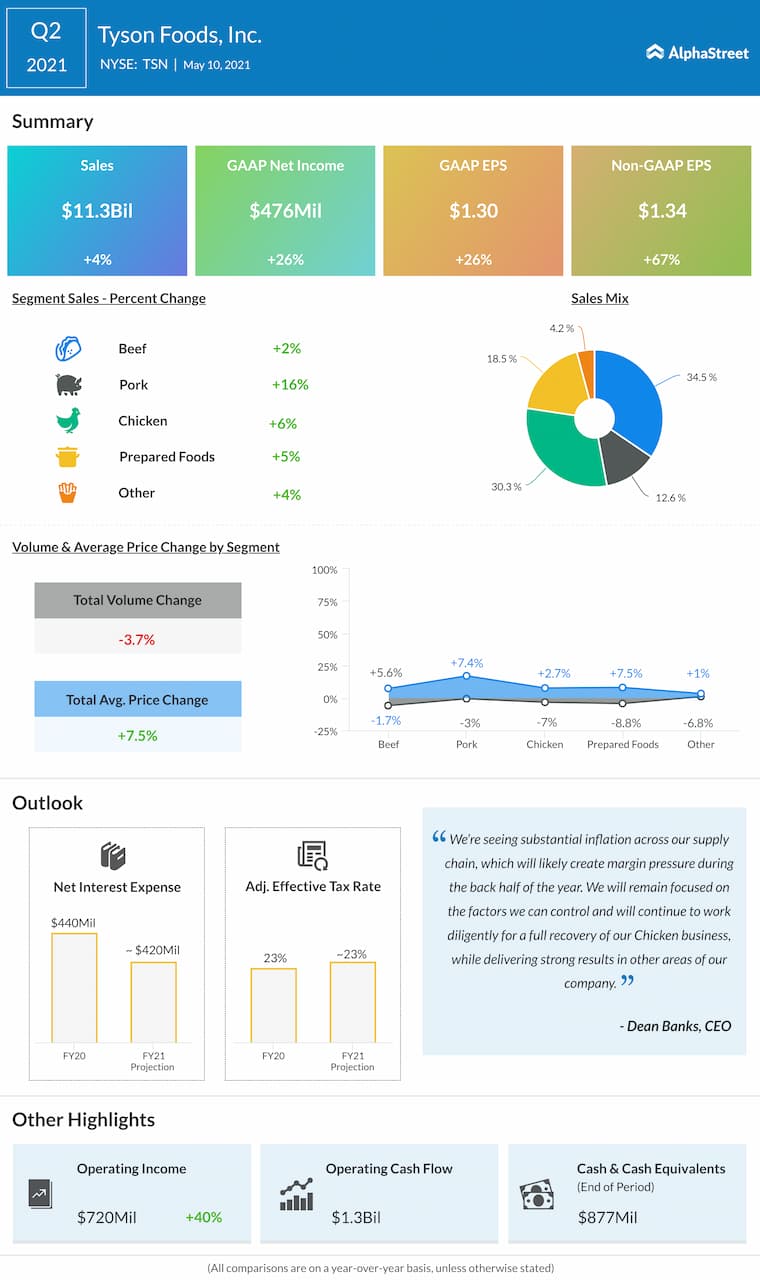

These companies all saw strong performance in their retail channels during the pandemic and this strength continued through their recent quarters as well. Tyson drove retail volume growth across its core businesses during the second quarter of 2021 even as the comparable quarter included benefits from the pandemic-related pantry loading. The company grew share in categories such as breakfast sausage, hot dogs and frozen protein breakfast.

Sales in the Prepared Foods segment rose 4% year-over-year to $2.2 billion. On the whole, Tyson’s retail channel delivered over $260 million in sales growth during the second quarter compared to the year-ago period.

Hormel’s retail and deli businesses delivered a healthy performance with high demand compared to pre-pandemic levels. Total retail sales in Q2 remained flat to last year even as the company lapped the months of pantry overstocking. Sales rose 16% compared to the second quarter of 2019. Hormel saw strong performance in brands such as SPAM, Applegate, Jennie-O and Wholly. Deli channel sales increased 4% in Q2.

Kellogg saw strong growth in categories such as snacks, cereal, frozen foods and noodles during the first quarter of 2021 compared to the same periods in 2020 and 2019. Brands such as Pringles, Cheez-It and Pop Tarts delivered strong growth.

Food companies have also been investing in plant-based offerings and alternative proteins which are delivering good growth. Hormel is seeing growth in its plant-based pepperoni and crumbles products while Tyson launched three new products under its Raised & Rooted brand to meet the rising demand in plant-based protein.

Tyson also expanded its alternative protein offerings in the Europe and Asia-Pacific markets during the second quarter. Kellogg’s plant-based brand Morningstar Farms is seeing good growth with over $400 million in retail sales and this momentum is expected to continue in the coming years.

Foodservice recovery

The recovery in foodservice brought some relief to food companies after a challenging year. Tyson and Hormel both saw improvements in their foodservice channels. Hormel saw a 28% increase in foodservice sales during Q2, which was up 1% over 2019 pre-pandemic levels. Tyson’s foodservice sales improved by $69 million in Q2.

Ecommerce growth

The companies saw strong growth in their digital channels as more customers made their purchases online and believe this is a trend that is likely to continue even after the pandemic subsides. Hormel’s ecommerce sales grew double-digits in Q2. Tyson reported ecommerce sales growth of 105%, which translated to approx. $425 million of sales during the second quarter. In Q1 2021, Kellogg saw ecommerce sales growth of 75%.

Outlook

So will the momentum continue? Hormel remains bullish on the performance of its foodservice, deli and retail channels for the second half of the year. The company continues to see high demand in its retail and deli channels and believes it is well-positioned to gain share as the recovery in foodservice continues. Hormel also expects costs to increase in the coming months.

Tyson too expects to face challenges from higher costs in the second half of the year but remains optimistic about the ongoing strength in the retail channel and the recovery in the foodservice business.

The strong performance in the first quarter gave Kellogg the confidence to increase its full year 2021 outlook. The company now expects full-year organic sales to remain flat year-over-year as opposed to its previous guidance of a decrease of 1%.