After ending fiscal 2020 on a mixed note, the business software giant expects to tackle the slump with its revamped pipeline and improvements in the cloud segment, which is gathering prominence aided by remote working that has become the new normal. Also, efforts are on to maintain margin growth through cost-reduction, which is already showing results.

“COVID-19 created challenges that forced companies to reconsider how they work in the cloud, including looking to us as an alternative to AWS and Azure. As we engaged with these customers they found OCI was more performant than our competitors, more secure, less expensive, and easy to use, making OCI now a serious part of the infrastructure discussions.”

Safra Catz, chief executive officer of Oracle

ADVERTISEMENT

In 2020, the tech firm recorded double-digit earnings growth, though the final months of the year witnessed a downturn in terms of bookings and profitability. The setback might not last long if it is due to the postponement of purchases by customers, like retailers and healthcare service providers who have been hit hard by the pandemic. It is also possible that a part of the business has gone to competitors like Amazon (AMZN) and Microsoft (MSFT).

Cloud Push

The prevailing market trend shows that Oracle might need to go a long way before catching up with the current market leaders in cloud, though the strong customer base and the move to link its on-premises applications with the cloud platform can catalyze the transformation.

Anticipating only a modest impact from coronavirus in the current quarter, the management predicts stable revenue performance, but it depends on how long it takes the market to regain normalcy and enterprise software spending to return to the pre-crisis levels. That assumes significance for Oracle considering the need to tweak its business model to focus more on cloud-based solutions. The combination of a competent cloud infrastructure and the company’s prowess in the SaaS segment should give it an edge over rivals.

Bullish View

While interacting with analysts at the post-earnings conference call, chief technology officer Lawrence Ellison was quite bullish on Oracle’s autonomous system. “Eliminating human labor dramatically lowers the cost of running an autonomous system. Eliminating human error dramatically increases data security and system reliability. All of the big data losses at Amazon were caused by human error. There is no opportunity for any human error if your data is stored in an Oracle autonomous system. This is a very big deal,” he said.

Stock Performance

Oracle can be the perfect investment opportunity in the present situation, except for the valuation that is deemed slightly on the higher side. Naturally, market watchers are divided in their recommendations for the stock, which has been assigned a target price that suggests modest growth. Still, the strong fundamentals and healthy cash position make it a wise bet. Having said that, the cash flow might be impacted temporarily by the deferment of client payments.

Q4 Revenue Dips

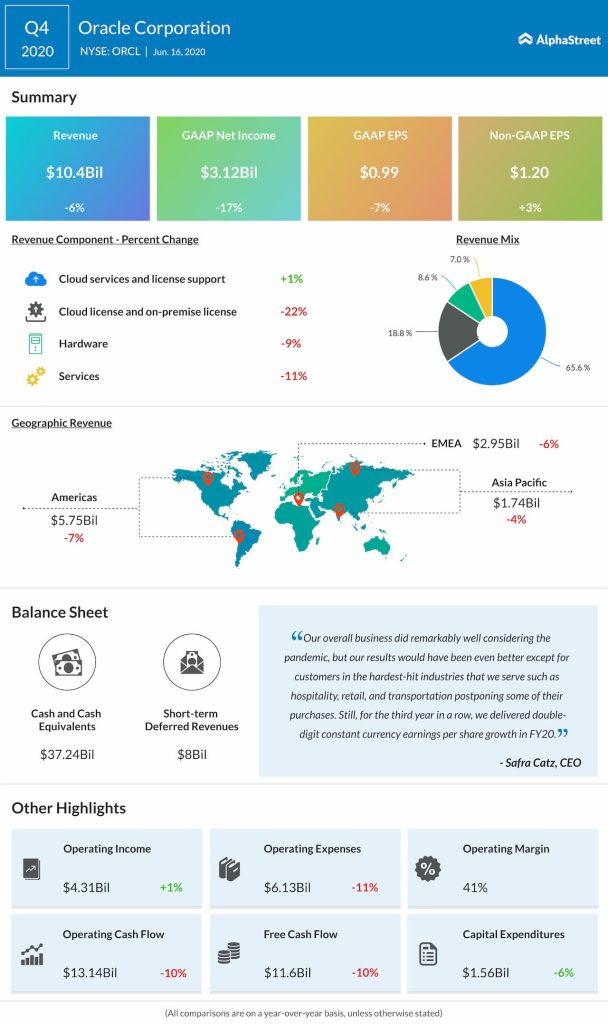

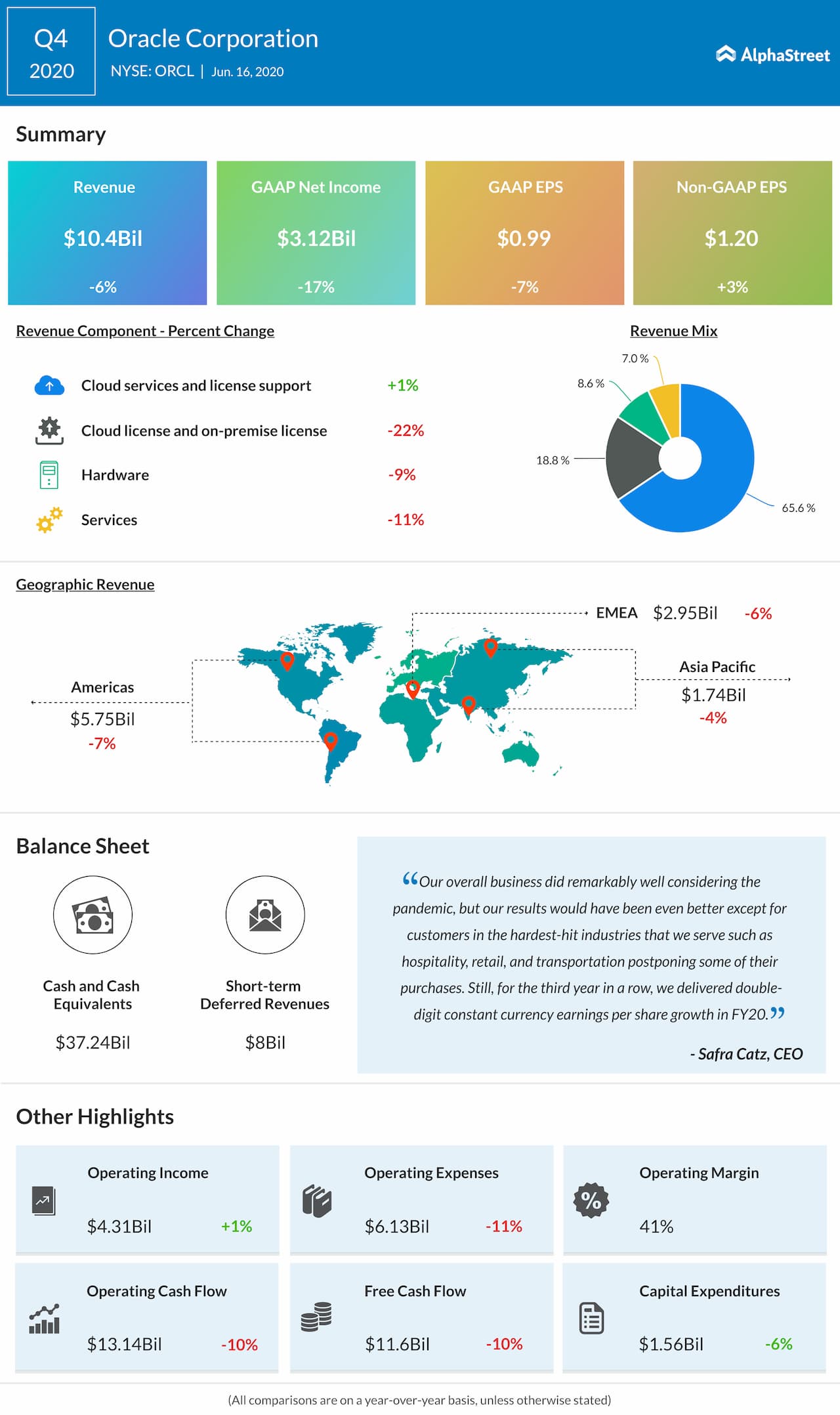

In the fourth quarter, an increase in revenue in the core Cloud Services and License Support was more than offset by a contraction in the other operating segments. At $10.4 billion, net revenues were down 6% year-over-year. On the other hand, adjusted earnings moved up 3% to $1.20 per share. Earnings exceeded the consensus forecast, while revenues missed.

It is expected that there would be a general spike in the demand for advanced technologies in the coming months when companies that are yet to take the digital plunge will be forced to do so – a trend that perfectly aligns with Oracle’s business strategy.

[irp posts=”57542″]

The market reacted negatively to the unimpressive revenue performance in the fourth quarter and the stock dropped sharply during the after-hours session on Tuesday. Still, the shares are hovering near the recent peak, after recovering from the coronavirus-induced loss they suffered in March. Except for the recent selloff, the stock has been pretty stable since reaching a record high last year.