This time, the bottom-line will be affected by an increase in SG&A expenses and investments made in the e-commerce platform to strengthen multi-channel capabilities.

Nevertheless, the direct-to-customer push and the planned launch of new brands including clothing rental service Nuuly will help the company regain momentum in the future. The management needs to focus on streamlining inventory and easing pricing pressures to enhance profitability in the near term.

Related: Macy’s misses Q2 earnings estimates and lowers guidance

ADVERTISEMENT

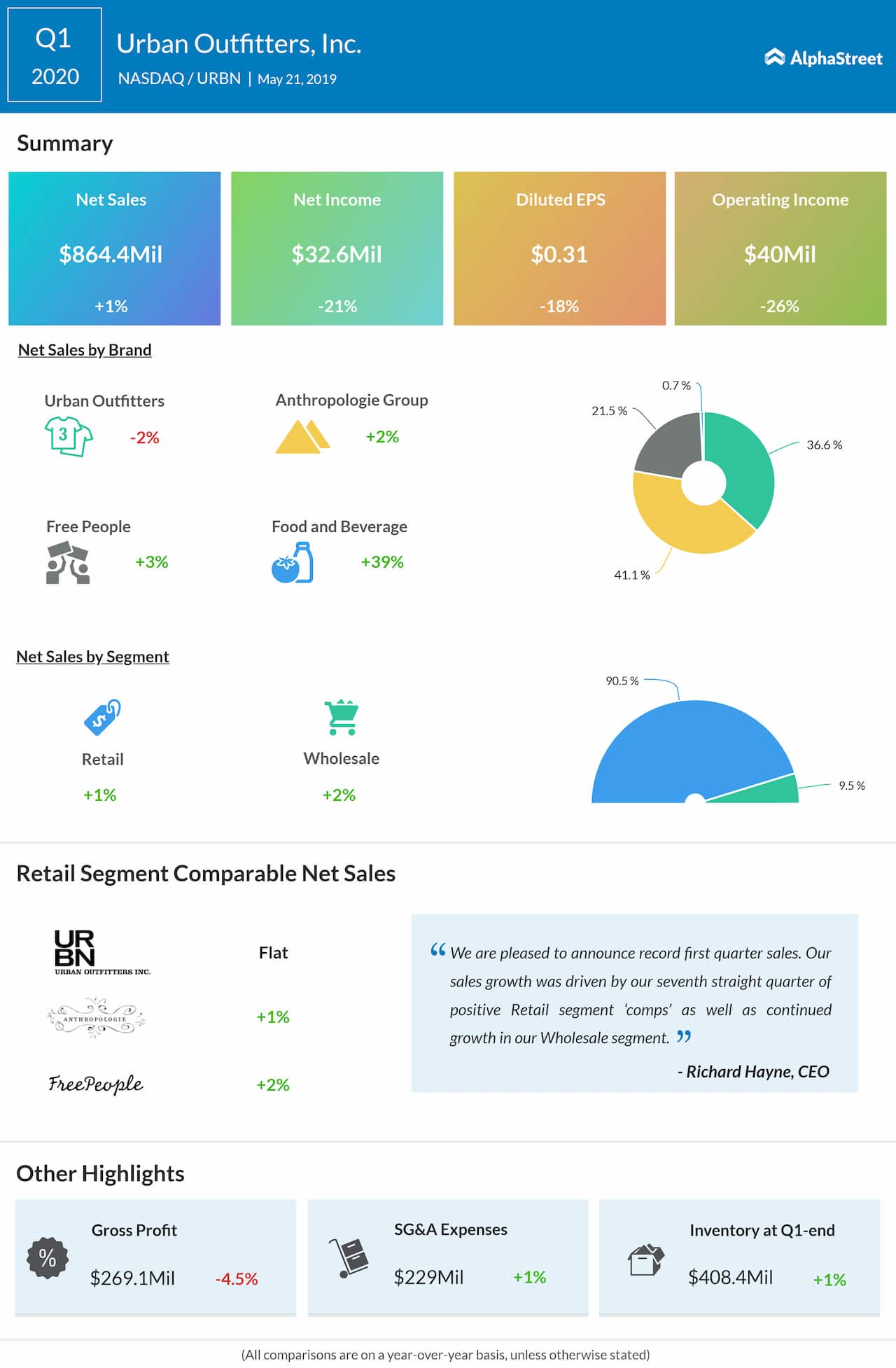

In the March quarter, earnings declined in double digits to $0.31 per share, despite revenues growing modestly to $864.4 million. The results came in above the estimates. The impact of muted comparable store performance was partially offset by relatively strong online sales.

Among others in the sector, American Eagle Outfitters (AEO) is scheduled to release its second-quarter earnings on September 4 before the opening bell. Analysts expect earnings to slip to $0.32 per share on revenues of around $1 billion.

Also read: Nvidia Q2 earnings, revenue drop but beat estimates

Earlier this week, Urban Outfitters’ stock suffered after brokerage B. Riley FBR downgraded it to neutral from buy, citing continued weakness in sales despite the management forecasting an improvement from last year’s lows. The analyst is of the view that the downtrend in profitability might persist through 2022.

A potential rebound in the stock’s performance will depend on the company’s ability to revive the sales momentum. The shares lost consistently in the past twelve months and traded at a two-year low in mid-August. They dropped around 41% since the beginning of the year.