Quarterly numbers

Business performance

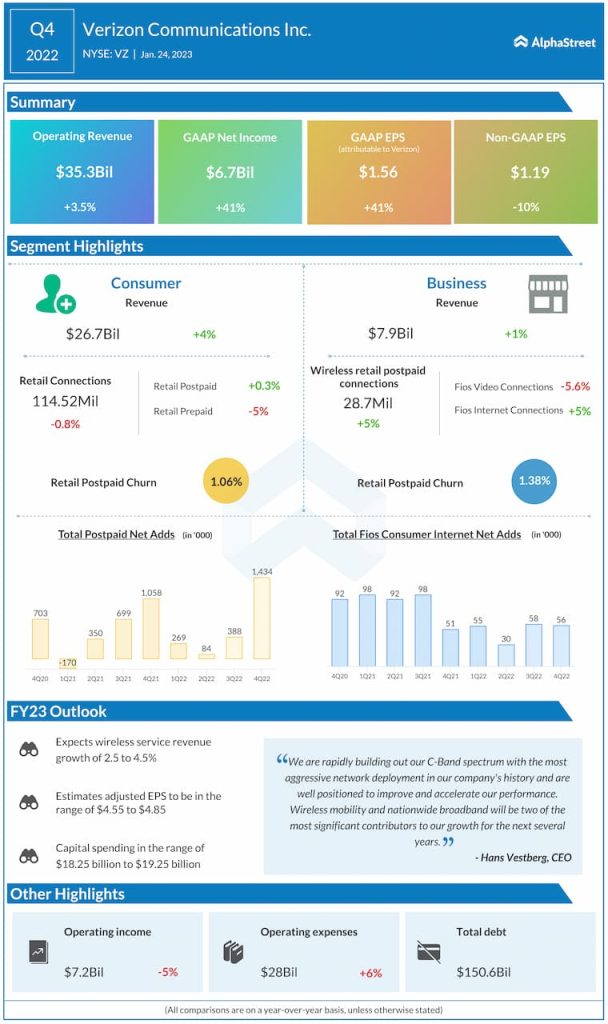

On its quarterly conference call, Verizon said the industry continues to face macroeconomic uncertainty as inflation and high interest rates impact the broader economy. Even so, the company sees strong demand for its services due to the rising importance of mobility and broadband for both consumers and businesses.

During the fourth quarter, wireless service revenue increased 5.9% from the year-ago period, driven by unlimited plan migrations, the highest number of retail postpaid net additions in seven years, and pricing actions. It also included a full quarter contribution from TracFone.

In 2023, Verizon will focus on generating additional synergies from the TracFone integration by shifting TracFone customers on other carriers’ networks onto its network. As of the end of 2022, 81% of TracFone customers were on Verizon’s network, up from 68% as of the end of 2021.

Verizon’s Consumer segment generated revenue of $26.8 billion for the fourth quarter, which was up 4.2% YoY. Revenue growth was driven by a 6.1% increase in wireless service revenue. During the quarter, this segment reported 41,000 wireless retail postpaid phone net additions.

Revenue in the Business segment inched up 1.2% to $7.9 billion in Q4, driven mainly by small and medium business mobility. Wireless service revenue rose 4.7% YoY within this segment. The Business segment reported 455,000 wireless retail postpaid net additions in the fourth quarter.

Verizon expects wireless mobility and nationwide broadband to be the most significant contributors to its growth for the next several years.

Outlook

Verizon’s outlook for fiscal year 2023 was not encouraging. The company has guided for adjusted EPS of $4.55-4.85 for the year. This compares to adjusted EPS of $5.18 for FY2022 and $5.50 for FY2021. Analysts were projecting EPS of $4.97.

In addition, total wireless service revenue growth is expected to be 2.5-4.5% in FY2023, which compares to a growth of 8.6% achieved in FY2022.

Click here to read the full transcript of Verizon’s Q4 2022 earnings conference call