5G Push

An encouraging factor, in terms of top-line performance, has been the progress Verizon is making in the roll-out of 5G service, the next-generation wireless technology that offers ultra-high network speed. For the company, 5G was the main focus area last year, expanding deployments across all the major US cities. Verizon’s recently launched streaming service, which is offered on the 5G network, is expected to drive subscription growth.

Also read: Telecom stocks inch higher after AT&T fake 5G icon

The effective use of new offerings to enhance customer experience might translate into revenue growth this time. The uniqueness of the cloud-based mobile applications for 5G, being offered in partnership with Amazon Web Services, should attract customers. Unlike some of its peers, Verizon is following a broad-based expansion strategy, which includes the development of fiber optics networks to support both the existing and new-gen services.

Wireline Slump

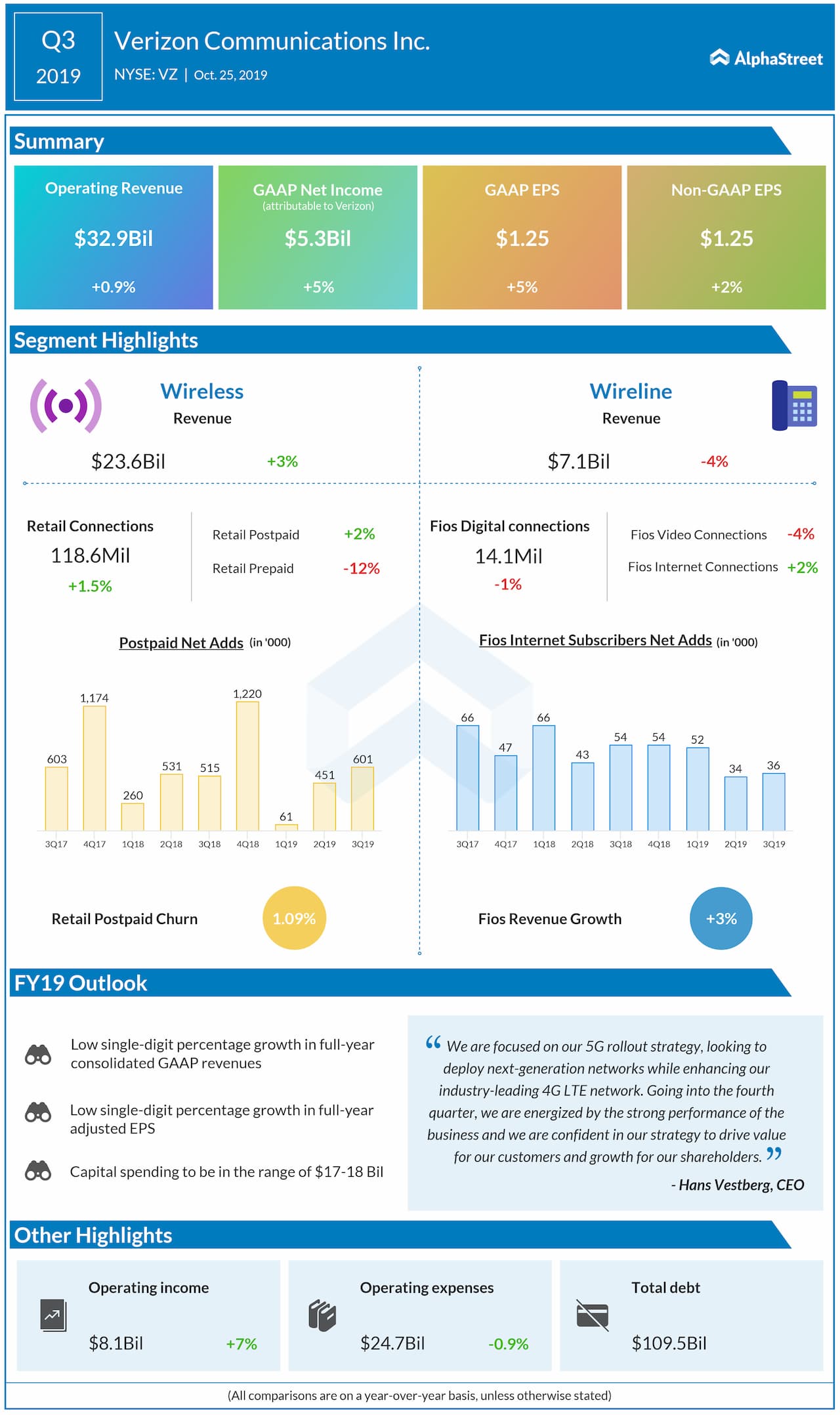

Meanwhile, the continuing weakness in the traditional wireline business including fiber optic, mainly due to competition from internet-based communication platforms and customers’ drift from pay-TV service to streaming platforms, has been a drag on profitability. Earnings growth could also be restricted by higher costs, mainly those related to investments in network development.

Q3 Outcome

In the third quarter, operating revenues were broadly flat at $33 billion as an increase in wireless revenues was offset by weakness in the wireline segment. Earnings moved up 2% annually to $1.25 per share and topped the Street view.

Sprint Posts Loss

Earlier this week, telecom firm Sprint Corporation (S) said third-quarter loss narrowed even as the fate of its merger with T-Mobile (TMUS) remained uncertain. The continuing weakness in the wireless business took a toll on revenues. The bottom-line came in above the market’s prediction.

Related: Verizon Q3 2019 Earnings Conference Call Transcript

Verizon shares surged to a record high towards the end of last year but retreated in the following weeks. The stock, which gained 11% in the past twelve months, lost momentum in the early days of 2020.