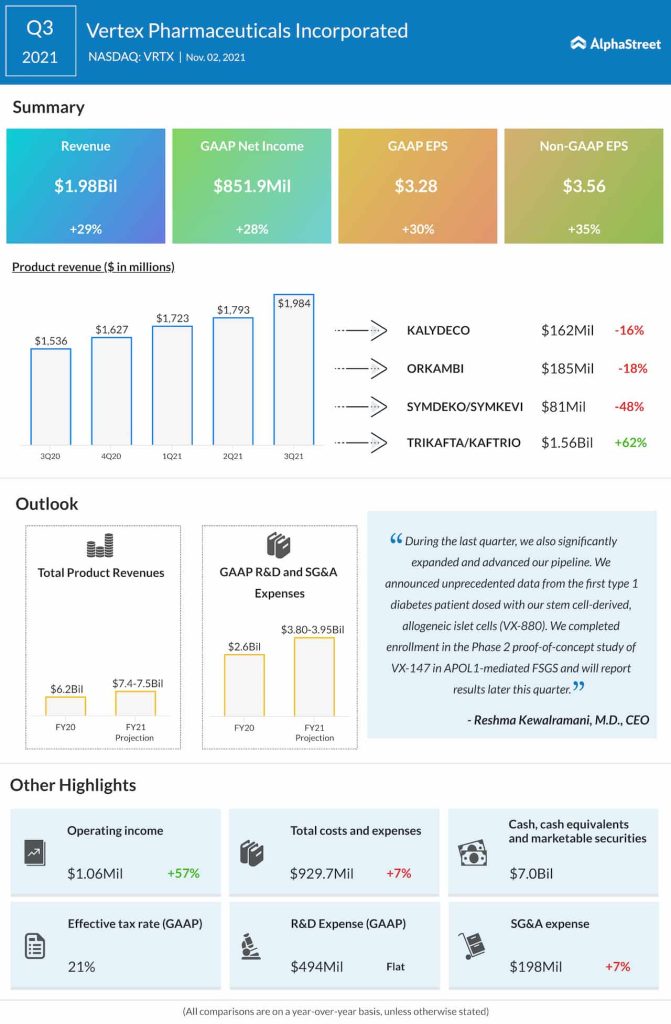

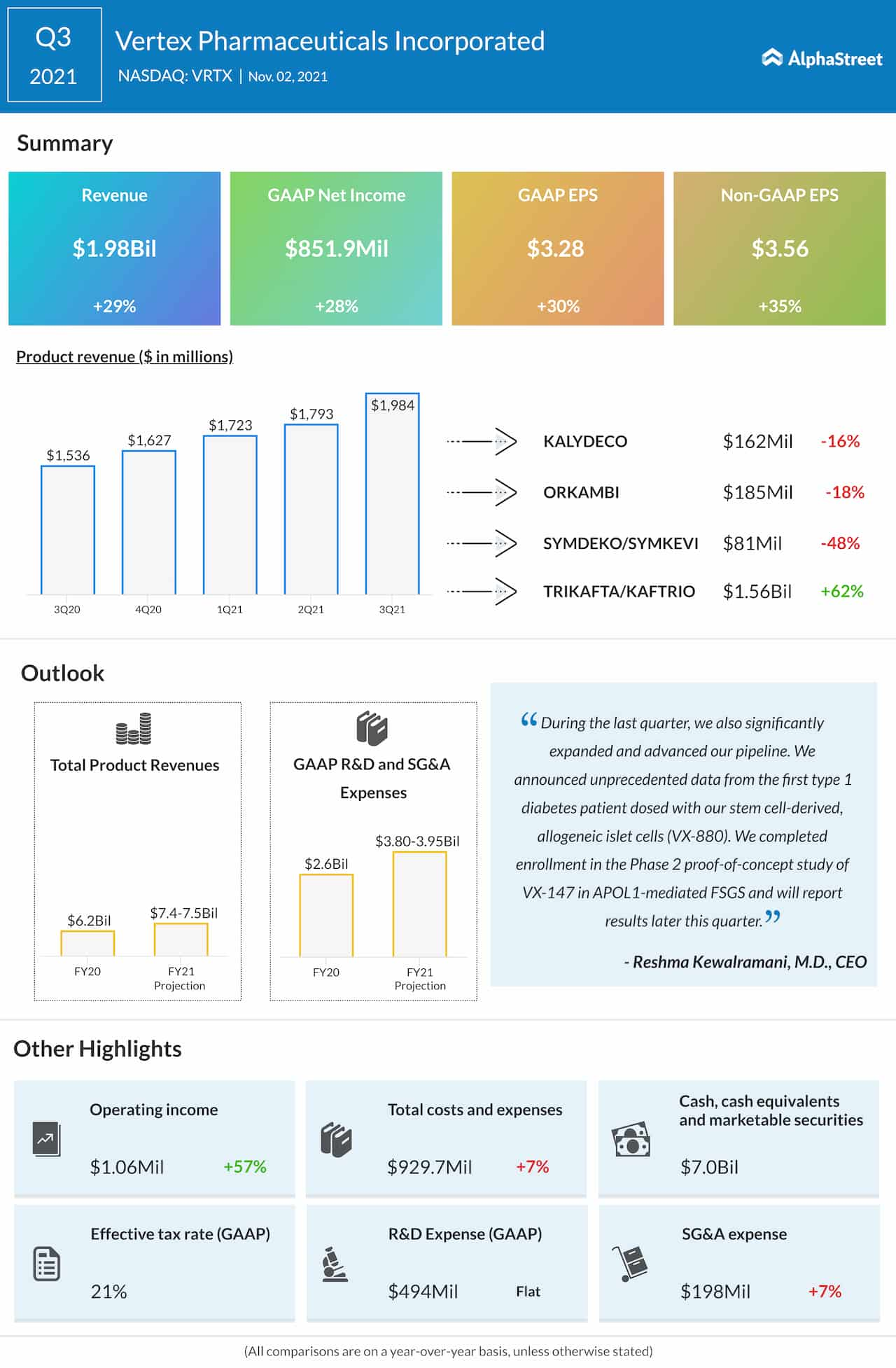

The impressive earnings performance reflects a 29% increase in revenues to $1.98 billion. Market watchers were looking for slower growth. The top-line benefitted from the continued expansion of the company’s pipeline in cystic fibrosis and incremental investment to support the launches of medicines globally.

“Our financial performance in the third quarter was outstanding, marked by the exceptional continued growth of TRIKAFTA/KAFTRIO. Based on these results, we are again raising our 2021 product revenue guidance, and we see significant additional growth ahead as we continue to deliver this transformational medicine to more people with CF,” said Reshma Kewalramani, CEO of Vertex.

Read management/analysts’ comments on quarterly results

VRTX’s shares have made strong gains after the recent earnings announcement but lost momentum since then. In the past twelve months, the stock has lost about 42%.