High Sales

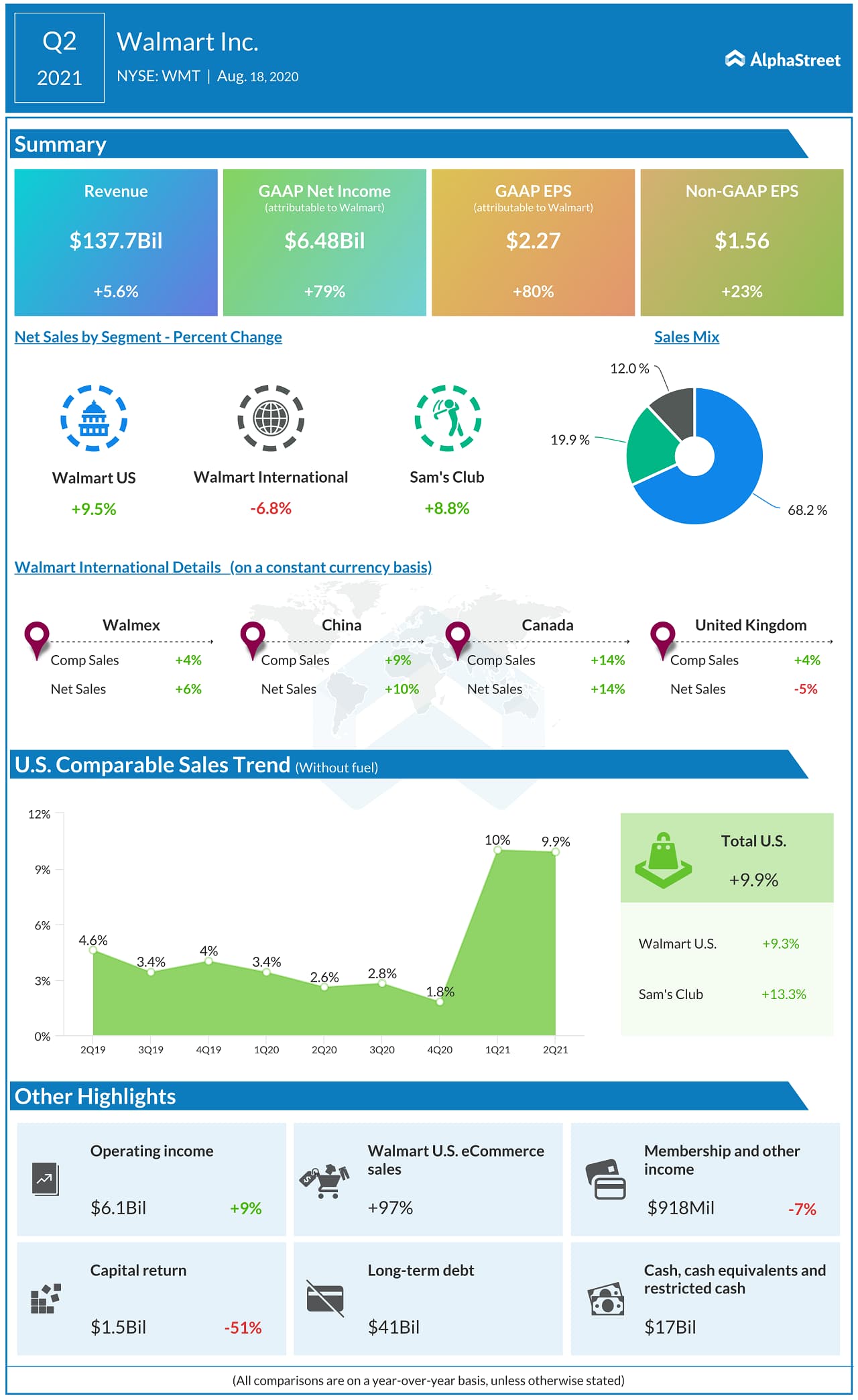

Walmart’s comparable sales growth was near 10% all through the first half, due to the rush to stock on essential items soon after the virus outbreak and later the spike in online sales when the shelter-in-place order came into effect. Comps growth was widespread across geographies, with the main contributors being general merchandise and food. The fact that Walmart hired about 500,000 new associates since the beginning of the year is reflective of the phenomenal sales growth.

Taking a cue from the surge in grocery sales in recent months, the company is all set to expand its automated bulk grocery pickup system called Alert, which was successfully piloted in New Hampshire, to other markets.

Widening Range

There has been a steady rise in the sales of televisions, computers, and communication equipment as people remain confined to their homes due to the lockdown, while those living in hotspots tend to stock up on essentials. The categories that witness unusual demand include food and entertainment items as the majority of restaurants and recreational spaces remain inaccessible to the public. The government’s stimulus is also contributing to the growth.

Continuing its global expansion drive, the retailer launched same-day delivery at about two-thirds of the Sam’s Club stores in Mexico this year and expanded the Flipkart business in India by introducing a B2B wholesale scheme. These efforts are expected to add to the advantages brought about by the broad assortment and Walmart’s effective delivery system. In order to effectively leverage that, the company needs to ensure a balanced inventory, which remains under strain due to the high demand.

Online Prowess

Walmart owes the uninterrupted operations to its state-of-the-art e-commerce platform, which witnessed a major makeover in recent years amid growing competition from online-marketplace Amazon (AMZN). In the most recent quarter, Walmart’s e-commerce sales nearly doubled year-over-year. Encouraged by the uptrend, the company is mulling new brand launches and revamp of the product mix so as to expedite its transformation into an omnichannel platform.

“The tailwinds we’re experiencing are accelerating our progress to build a healthier eCommerce business as we add new brands, improve product mix, grow the marketplace and achieve more fixed cost leverage… Our integrated omnichannel offering continues to resonate with customers around the globe. It’s positioned the Company well during this crisis, and we remain convinced that it will be the winning strategy going forward.”

Doug McMillon, chief executive officer of Walmart

Risks Linger

It is not clear how the change in people’s shopping behavior would play out in the coming weeks. Walmart can still be impacted by the pandemic-linked headwinds during the second half since the crisis is far from over and regional governments tend to impose curbs depending on the severity of the situation. It is almost certain that back-to-school sales – normally a busy period for Walmart – are going to be affected this time. The company did not provide guidance for the remainder of the year.

While the cash position remains healthy, there will be an uptick in costs related to COVID-related safety measures and additional employee benefits in the second half, putting pressure on profitability. The good news is that the company is well-positioned to navigate through the troubled times, thanks to the strength of its online and offline assets.

Read management/analysts’ comments on Walmart’s second-quarter 2021 results

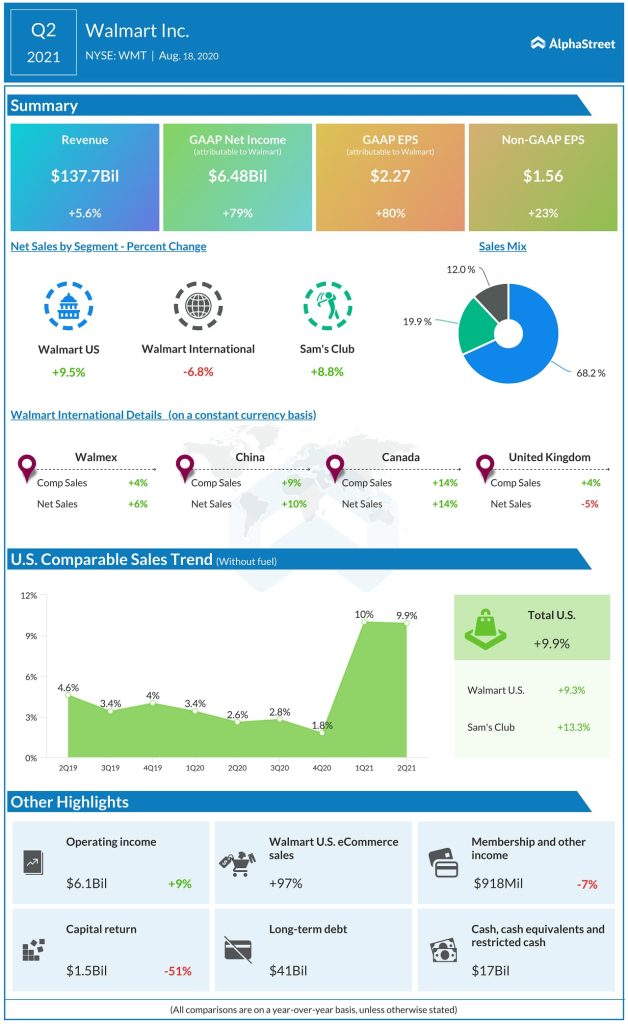

The market’s response to the second-quarter outcome was not very encouraging as the management withheld its guidance for the third quarter and fiscal 2021, which outweighed the impressive quarterly numbers. At $1.56 per share, earnings were up 23% from last year and far exceeded the forecast. Robust US sales for the Walmart brand and Sam’s Club lifted revenues to about $138 billion.