Q2 results miss

Streaming business

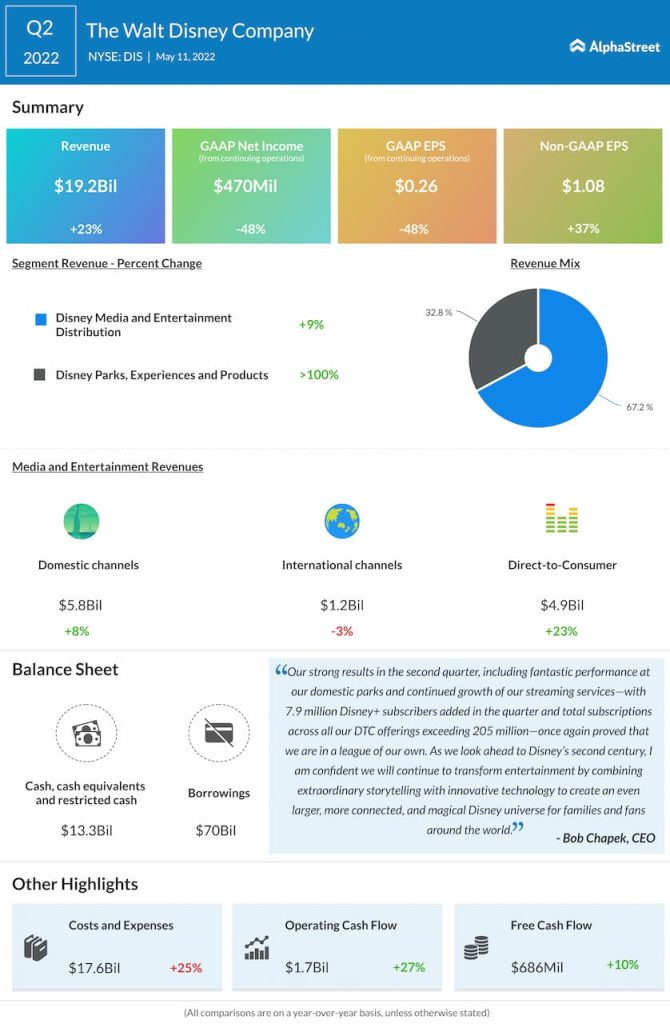

In Q2, direct-to-consumer (DTC) revenues increased 23% YoY to $4.9 billion. Total paid subscribers across the DTC offerings stood at 205 million at the end of the quarter, reflecting 9.2 million additions. This includes nearly 138 million subscribers for Disney+, reflecting close to 8 million net additions from the first quarter. On its quarterly conference call, the company stated that a little over half of these net adds came from Disney+ Hotstar, which benefited from the new IPL season.

Domestic net adds for Disney+ were approx. 1.5 million, driven by the strength of bundled and multi-product offerings. Excluding Disney+ Hotstar, international net additions were 2 million versus Q1. ESPN+ had 22.3 million paid subscribers at the end of the quarter, reflecting an increase of about 1 million from Q1. Hulu ended the quarter with 45.6 million paid subscribers.

Disney is excited about its growth potential in international markets. The company plans to roll out Disney+ to 53 new markets across Europe, Africa and West Asia, starting with South Africa next week.

It goes without saying that content is Disney’s biggest strength. The company currently has over 500 local original titles in various stages of development and production as part of its international expansion efforts. 180 of these titles are set to premiere this fiscal year and the company plans to steadily increase this number to over 300 international originals per year. These local originals along with branded content are expected to help drive subscriber growth and engagement.

Disney’s portfolio of popular franchises gives it a key advantage. Franchises like Toy Story are part of various attractions across the business and forms a key part of Disney+ with four feature films and a short series. Even after 30 years of its release, it continues to generate over $1 billion in annual retail sales. Disney has significant opportunity to both build on existing IP as well as create new franchises.

Operating losses

Higher operating losses in the streaming division are a concern. In Q2, operating loss for the DTC segment rose to $0.9 billion due to higher losses at Disney+ and ESPN+ and lower operating income at Hulu. Lower results at Disney+ and Hulu were due to higher programming and production, marketing and technology costs which were partly offset by higher subscription and advertising revenues. ESPN+ was impacted by higher sports programming costs.

Outlook

On its call, Disney said it expects DTC programming and productions costs to increase by more than $900 million YoY in the third quarter of 2022, reflecting higher original content expense at Disney+ and Hulu, increased sports rights costs and higher programming fees at Hulu Live.

The company also hinted that the second half of the year may not be as strong as the first half for Disney+ even though it expects to see higher net adds in the second half versus the first half. Disney still expects to reach 230-260 million Disney+ subscribers by FY2024 and it expects Disney+ to be profitable in FY2024.