Hold It?

While the company has what it takes to reignite growth, the stock looks a slightly risky bet in the absence of clear signs of a recovery in the near term. Right now, the best way to deal with Walgreens’ stock is to just keep it on the watchlist so that investors can buy it and take advantage of the low valuation when the time is ripe. Existing shareholders need not have to worry about the slowdown – which will not last forever – and should resist the urge to sell.

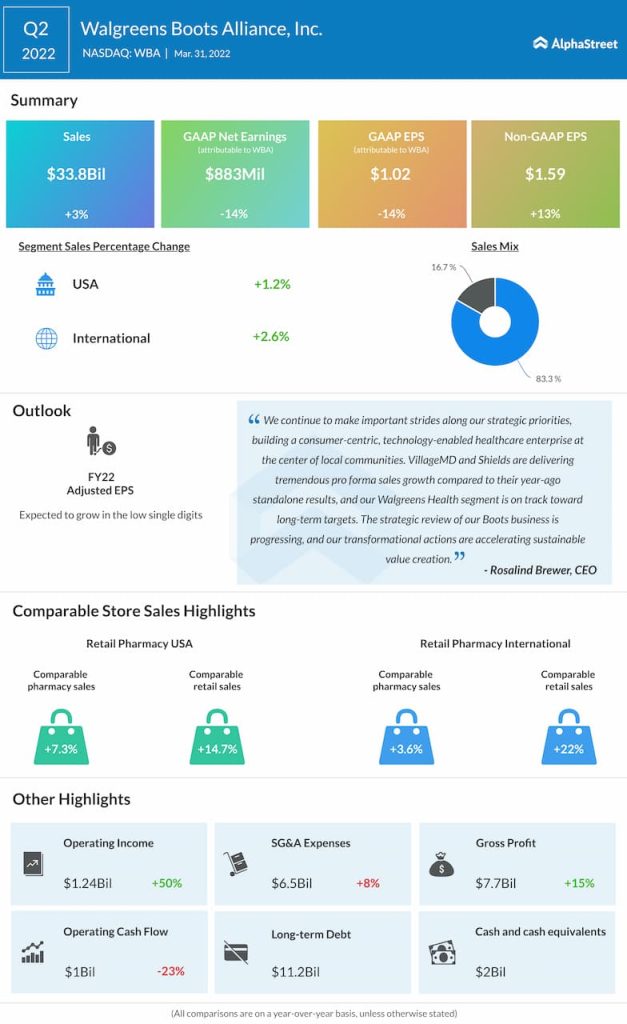

Walgreens Boots Alliance Inc. Q2 2022 Earnings Call Transcript

With a dividend yield of around 4.4%, Walgreens is a promising option for income investors. The payout is among the best in the healthcare sector. Last year, the company raised the dividend by more than 2% to $0.4775, adding to the stock’s prospects as a long-term investment.

Fundamentals

The Illinois-based retail pharmacy company has been around for more than a century. The well-established business is capable of weathering adversities effectively, supported by its 13,000-odd drug stores operating in nine countries. The business model has evolved over the years and Walgreens has transitioned from a traditional drug store chain into a full-fledged healthcare service company offering specialty pharmacy management solutions and patient care through on-site clinics.

The nature of the healthcare business is such that external factors usually have a limited impact on them. In the case of Walgreens, the company has strived to enhance its offerings and expand the business beyond its physical stores – which were affected by the COIVD shutdown initially — by adopting technology. Also, it is a mature firm with strong fundamentals, capable of recovering from the slowdown once normalcy returns to the market.

“We will improve health outcomes and lower costs for payers and providers by delivering care through owned and partnered assets. The goal is to support the patient journey across the entire care continuum through omnichannel solutions. This is why you see these complementary assets spanning primary care through VillageMD, specialty pharmacy through Shield, and post-acute care through our pending CareCentrix investment,” said Walgreens’ CEO Rosalind Brewer a few weeks ago.

Broad-based Growth

In the second quarter of 2022, both U.S. and international sales increased, though modestly, resulting in a 3% growth in net sales to $34 billion. At $1.59 per share, adjusted earnings were up 13% year-over-year. The company is scheduled to publish third-quarter results on June 30 before regular trading starts.

Why it’s a good idea to buy UnitedHealth stock and hold it forever

Like all retail businesses, meanwhile, high inflation will likely be a drag on Walgreens’ sales, which is already under pressure due to the fall in COVID vaccinations compared to last year. WBA traded slightly higher on Monday afternoon and hovered around the $40-mark. In the past six months alone, the stock lost about 6%.