It is estimated that the healthcare insurance market would grow at a compound annual rate of around 10% in the next five years. UnitedHealth Group, Inc. (NYSE: UNH), a market leader in healthcare insurance, is well-positioned to tap into that opportunity. The company seems to be on track to achieve its long-term earnings per share growth target of 13-16%, supported by various initiatives focused on the key growth areas.

UNH is one of the few stocks that remained unaffected by the macro headwinds and recent market selloff. It reached a new high last week ahead of the earnings release, shrugging off the weakness experienced in the early weeks of the year. Despite a 37% rally over the past year, it looks like the stock is still trading at a reasonable discount to fair value.

Valuation

However, some observers believe the valuation is too high, and there are concerns that there is not much room for further growth in the neat future. While those fears are justifiable to some extent, the Minnetonka-based healthcare service provider has what it takes to hit the high-growth path. That makes the stock a compelling buy for the long term. Also, the steady uptick in payout ratio is good news for income investors, which also signals continued dividend growth. The 1.2% yield almost matches the market’s average.

Key highlights from Walgreens Boots Alliance Q2 2022 earnings results

UnitedHealth ended fiscal 2021 with a cash balance of about $21 billion, which is a testament to the strength of its business model. The company has expanded the customer base constantly over the years, bringing it to more than 50 million at the end of 2021.

During his post-earnings interaction with analysts, UnitedHealth’s CEO Andrew Witty on Thursday said, “In Medicare Advantage, our strategic balance of benefit stability and enhancements once again helped to deliver strong growth. We remain well on track to serve an additional 800,000 people in 2022, consistent with the expectations we set last November. In the commercial benefits market, our innovative offerings such as physician-led and virtual-first plans have grown to serve 350,000 more people over the past year.”

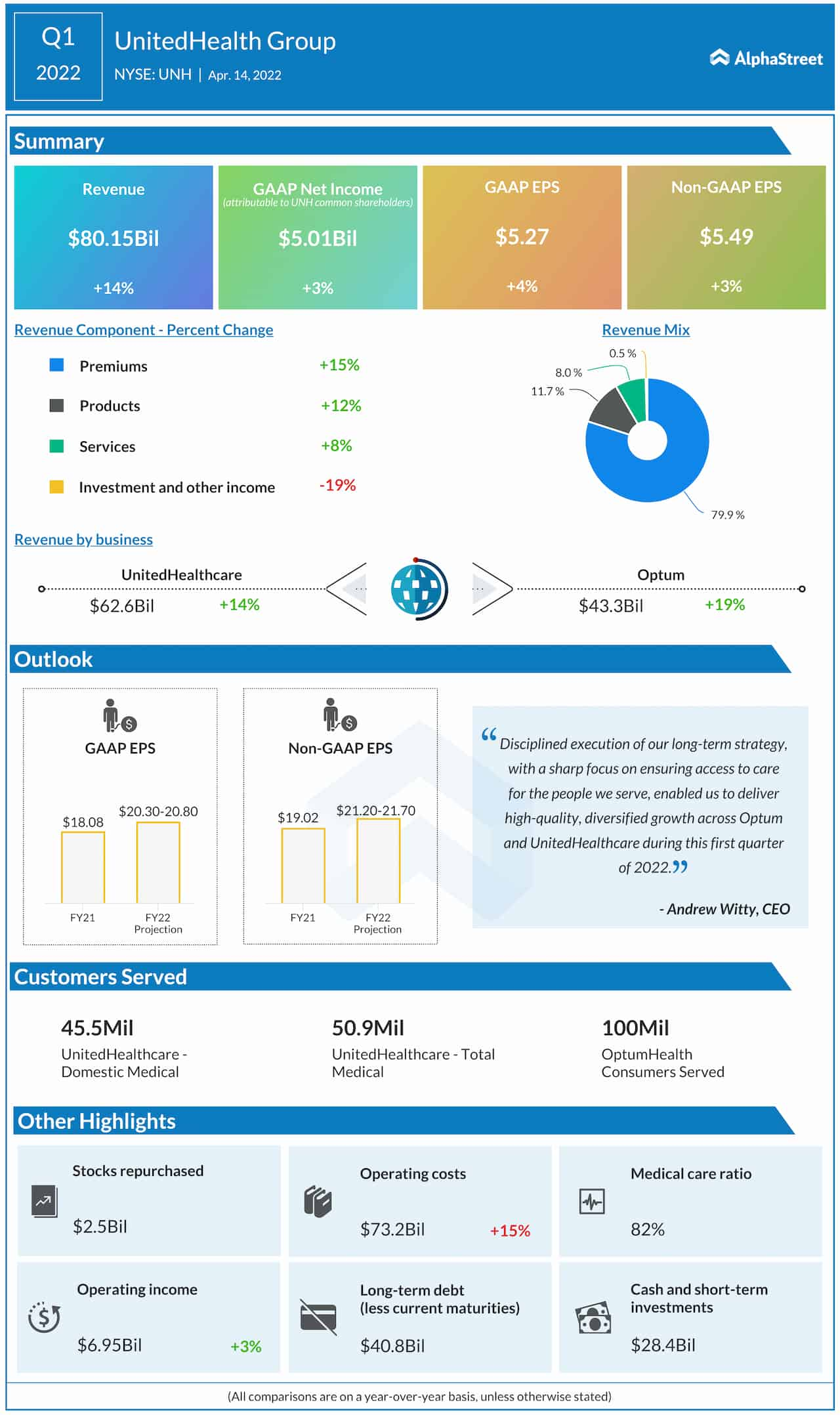

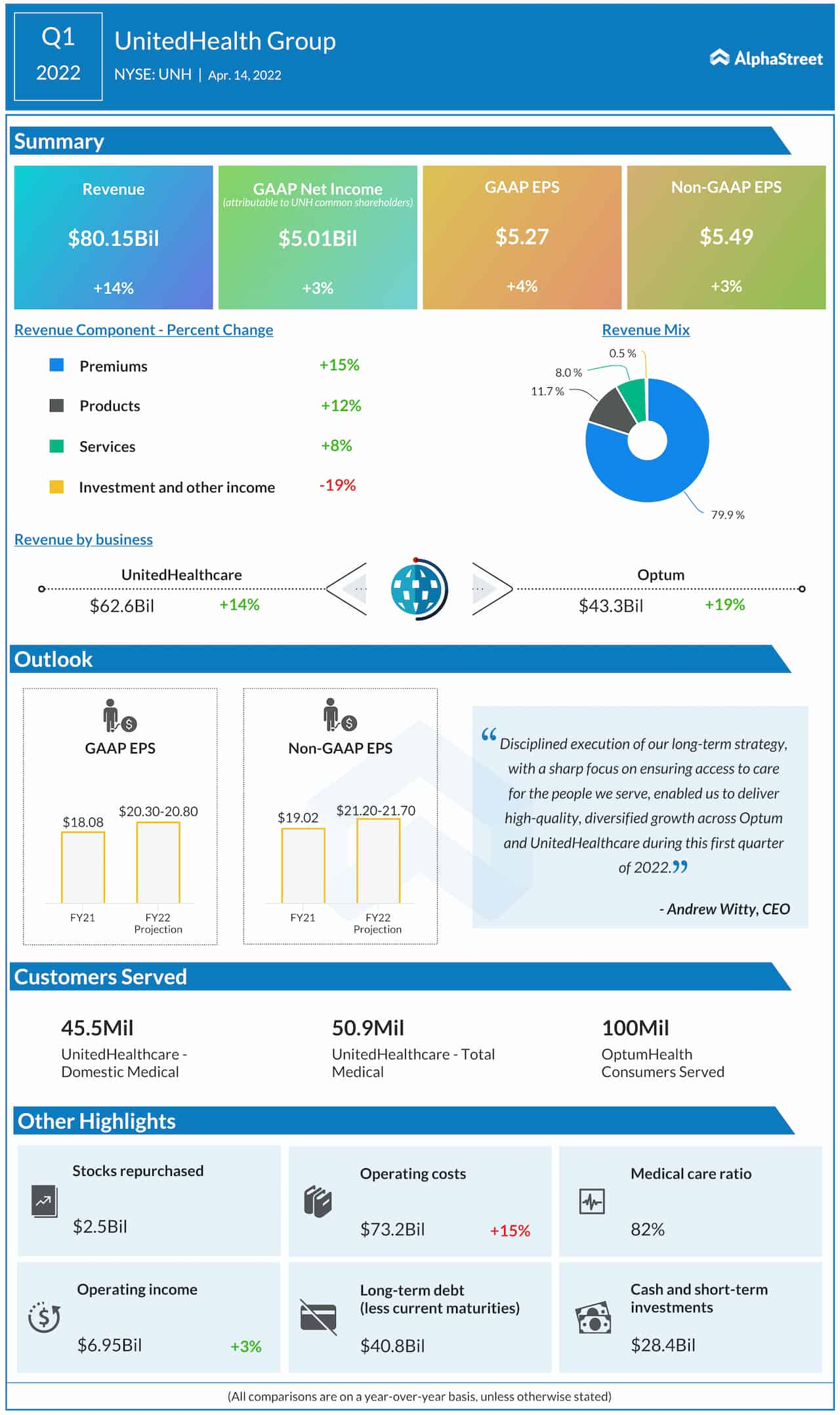

Underscoring the sustainability of the business and strong fundamentals, UnitedHealth’s quarterly earnings either beat or matched consensus estimates consistently over the past several years. In the first three months of fiscal 2022, revenues and net profit increased year-over-year and topped expectations even as all the main operating segments registered strong growth.

Good Start to FY22

First-quarter net income, excluding one-off items, rose to $5.49 per share from $5.31 per share last year. Earnings benefitted from a 14% increase in revenues to $80.15 billion, which also exceeded the market’s projection. Buoyed by the upbeat results, the management raised its earnings guidance for fiscal 2022.

Read management/analysts’ comments on quarterly results

While the company’s growth prospects are quite encouraging, the management needs to take special care to maintain a balanced medical care ratio and ensure that the pricing is favorable.

Shares of UnitedHealth traded higher throughout Thursday’s regular session, hovering near last week’s peak. They have gained about 28% in the past six months, mostly outperforming the market.