Like all other businesses, the packaged food industry is going through a highly volatile phase, with the coronavirus bringing a paradigm shift in consumer behavior. While store operators, in general, continue to experience reduced traffic, packaged food brands benefitted as people rushed to stock on essential items after the onset of the pandemic.

MamaMancini’s Holdings (OTCQB: MMMB), which has been serving traditional Italian recipes to Americans for more than a decade, registered positive sales and earnings during the early weeks of the crisis. As part of expanding the business, the East Rutherford-based company is exploring new avenues in the food industry, and the recent partnership with Beyond Meat (NASDAQ: BYND) is an important step in that direction.

Unfazed By COVID

In an interview with AlphaStreet, chief executive officer Carl Wolf attributed the record first-quarter results to the shopping spree in the early days of the virus outbreak when people stocked high volumes of food items. That, together with the new products, contributed to sales growth.

According to Wolf, the collaboration with Beyond Meat has been successful so far. Under the partnership, MamaMancini’s launched Beyond Beef Meatballs & Sauce in January through shopping channel QVC, but the response was slightly below expectations. He said:

“Beyond Meat presentation started in January and it was put on hold because of COVID. So we are just restarting them now and we expect some additional business. The first place we did sell the product was on QVC, which has a website where you can order direct to consumer. It has done very well and repeat customers have been high.”

ADVERTISEMENT

Game-changer?

The deal could turn out to be a game-changing initiative if the evaluation of customer feedback being planned by the management – over a period of time – is encouraging. In that case, the market will see more plant-based products from MamaMancini’s.

Though fast-food giant McDonald’s (NYSE: MCD) had conducted trials of plant-based burgers in Canada in partnership with Beyond Meat, the project was discontinued later.

Costs to Drop

Wolf told AlphaStreet that he is optimistic that operating expenses would decline during the remainder of the year – to about 14% of sales – despite the aggressive promotional campaigns for the new product category. Meanwhile, costs related to shipping, trade promotion, and commissions, are expected to remain relatively constant, while sales would continue to grow.

[irp posts=”59606″]

As far as the food services business is concerned, Wolf sees demand picking up once the market fully reopens after the shutdown. According to him, it will take a few months for that to happen, though restrictions are being lifted.

Responding to a question on technology spend, Wolf said MamaMancini’s might not go for full-fledged digitization because it is not a direct-to-customer business. With regard to the global expansion strategy, Wolf said Canada is the current focus area due to the immediate opportunities and ruled out venturing into South America in the near future.

Q1 Sales Up 51%

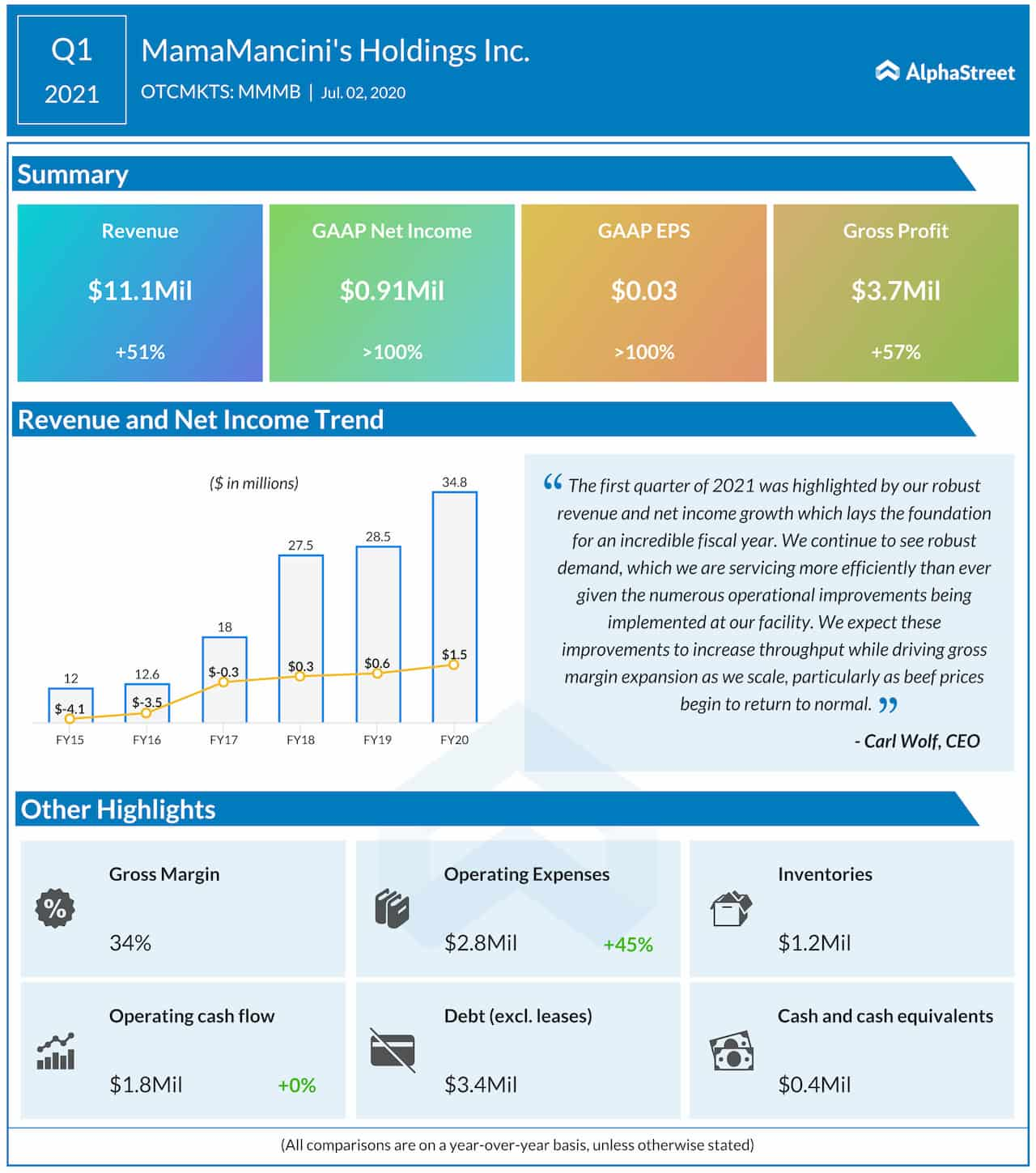

In the first quarter of 2021, revenues surged 51% annually to a record high of $11.1 million, resulting in an increase in profit to $0.03 per share compared to the year-ago quarter. Margins improved to 34% aided by a decrease in operating expenses. The results also topped the Street view.

The traditional Italian recipes being offered by MamaMancini’s came from co-founder Dan Mancini’s grandmother who traveled to America from Italy nearly a century ago. The food items are sold mainly through supermarkets like Walmart (NYSE: WMT), BJ’s Wholesale Club (NYSE: BJ), and Costco (NASDAQ: COST).

Meanwhile, the management is planning up-listing of the stock in the NASDAQ stock exchange after meeting the regulatory requirements, which includes a reverse stock split. The low-priced stock has been quite stable, trading below the $2-mark for the past several years. Interestingly, the stock bounced back from the COVID-driven slump pretty quickly and hovered near the pre-crisis levels in recent weeks even as the market responded positively to the first-quarter outcome.

______

For more insights into MamaMancini’s, read the latest transcript here.

[irp posts=”57773″]