Bullish View

The projection is in line with the guidance issued by AMD executives, who seem to be highly encouraged by the solid demand for the company’s products and positive shipment trend – especially the EPYC server processors, Ryzen and Radeon. The server processors are being adopted by some of the leading firms including cloud service providers and PC vendors. It is estimated to have boosted revenue growth in the fourth quarter.

Meanwhile, AMD’s innovation prowess is giving a tough time to Intel Corporation (INTC), which struggles to maintain the sales momentum amid the continuing slowdown in the PC market.

Looking Back

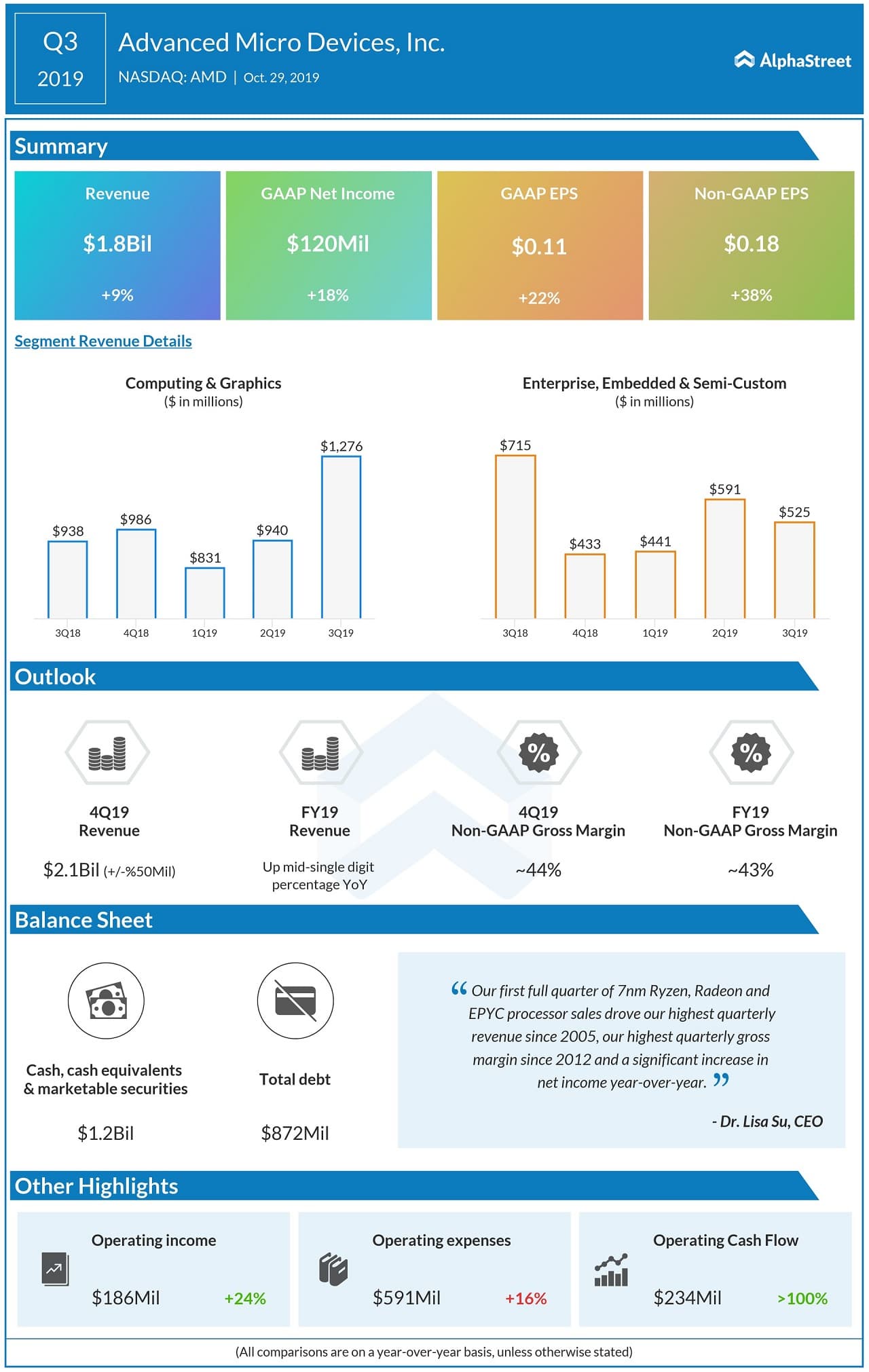

AMD’s revenue climbed 9% to $1.8 billion in the third quarter as a strong performance by the Computing and Graphics division more than offset weakness in the Enterprise segment. As a result, earnings rose in double digits to $0.18 per share and topped the Street view.

Also see: What 2020 has in store for Advanced Micro Devices?

Earlier this week, Intel reported better-than-expected revenue and earnings for its fourth quarter, spurring a stock rally. Last month, Micron (MU) posted an 85% fall in its first-quarter earnings, reflecting the slump in microprocessor demand. The results, however. exceeded analysts’ expectations.

Is AMD a Buy?

Most investors would find AMD’s stock affordable at the current prices, but market watchers are of the view that it might not be the right time to buy. The consensus rating is hold, with a price target of around $44 that represents a 15% drop from the last closing price.

Related: Advanced Micro Devices Q3 2019 Earnings Call Transcript

AMD’s market value more than doubled in the past twelve months as the shares made steady gains, beating all odds. After making an upbeat start to 2020, last week the stock crossed the $50-mark for the first time and set a fresh record.