Alibaba has been investing heavily in its business and the

higher costs related to these initiatives are likely to weigh on the bottom

line numbers. The company also faces stiff competition from ecommerce giants like

Amazon (NYSE: AMZN) as well as from local players.

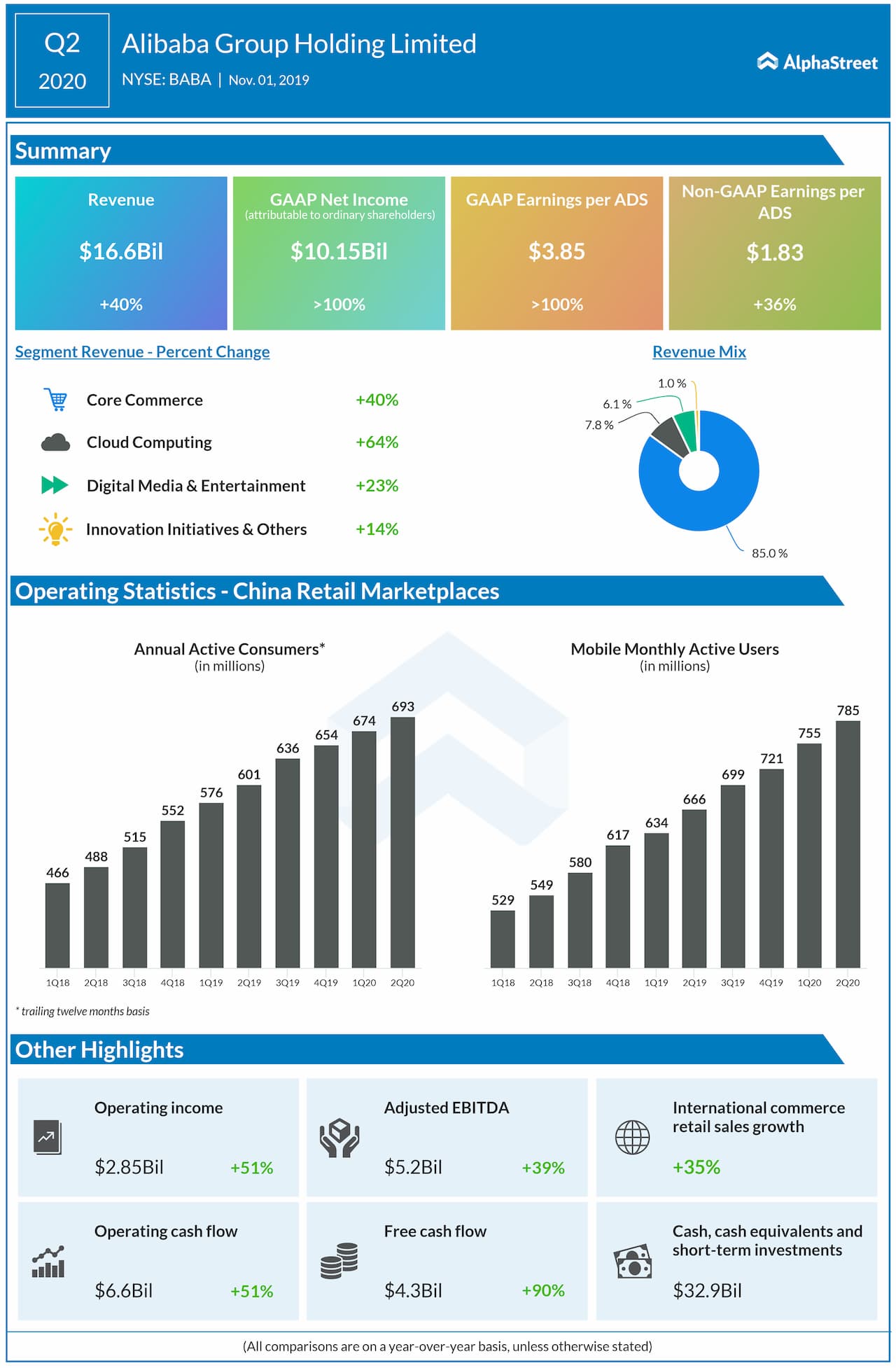

In the second quarter of 2020, Alibaba beat revenue and profit estimates. Revenues increased 40% to $16.6 billion while adjusted earnings per ADS rose 36% to $1.83.

Annual active customers on the company’s China retail marketplaces reached 693 million, up 19 million from the 12-month period ended June 30, 2019. Mobile MAUs on the China retail marketplaces reached 785 million in September 2019, up 30 million over June 2019.

Also read: Shopify Q4 2019 Earnings Preview

Alibaba’s shares have gained 28% over the past one year. The

stock reached a new high of $231.14 last month. The stock has held its ground

despite tough conditions in China including a weak economy, trade tensions and

violence in Hong Kong. The general sentiment on the stock remains bullish.

The majority of analysts have rated the stock as Buy and it has an average price target of $251.00, which represents an upside of 16% from the current level.