Revenue

Earnings

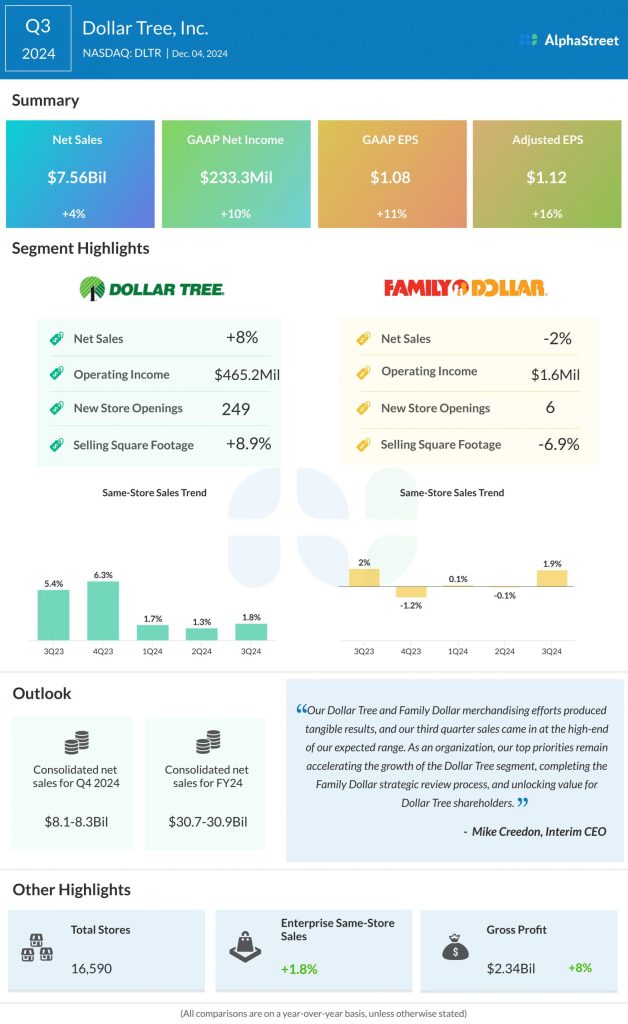

DLTR has guided for adjusted earnings per share to range between $2.10-2.30 for Q4 2024. Analysts are predicting EPS of $2.20 for the quarter. This is lower than the adjusted EPS of $2.55 reported in Q4 2023. In Q3 2024, adjusted EPS increased nearly 16% YoY to $1.12.

Points to note

Dollar Tree expects comparable store sales to grow in the low-single-digits for the enterprise as well as the Dollar Tree and Family Dollar segments in Q4 2024. In Q3 2024, enterprise same-store sales increased 1.8%, while the Dollar Tree and Family Dollar segments saw same-store sales increase 1.8% and 1.9%, respectively.

In the third quarter, Dollar Tree’s same-store sales benefited from growth in traffic and average ticket. The discount retailer continues to be the preferred destination for consumers who seek value. Its product assortment and affordable price points are likely to have helped drive sales in Q4, especially in the consumables category. Despite a soft start, Dollar Tree is likely to have benefited from holiday season sales with the advantage of its multi-price assortment and its store improvement efforts.

Under its namesake banner, Dollar Tree has been converting stores to its in-line multi-price 3.0 format, opening new stores, and bettering the shopping experience through renovations and improvements in customer service. In Q3, DLTR converted 720 stores to the 3.0 format, bringing the total number of these converted stores to around 2,300. These stores have contributed meaningfully to the top line and delivered strong comps. These benefits are likely to be reflected in the fourth quarter performance as well.

The company’s expansion of its store footprint through the addition of the former 99 Cents Only stores can also be expected to yield benefits in the fourth quarter.