Hewlett Packard Enterprises (NYSE: HPE) is slated to report fourth quarter and fiscal year 2019 earnings results on Monday, November 25, after the market closes. Analysts expect the company to report earnings of $0.46 per share on revenue of $7.4 billion. This compares to EPS of $0.45 on revenue of $7.9 billion reported a year earlier.

The company has seen a decline in its topline over the past three quarters and it remains to be seen if this trend will continue in the final quarter of this year. Weakness in segment revenues coupled with negative currency impacts could pull down the overall results.

However, strength in Aruba Services, High Performance

Compute and Composable Cloud provide some optimism that revenues could see a

pickup. Last quarter, Aruba Services, Composable Cloud and HPE Nimble Storage

saw double-digit growth. The company has been focusing on more profitable

products and services and slowly moving away from low-margin businesses.

Last month, HPE stated that its strategy of investing in

high value, software-defined solutions had helped improve profitability across

the company over the past year. The company plans to offer the entire HPE

portfolio as-a-Service by fiscal year 2022 and sees solid market opportunity in

this space.

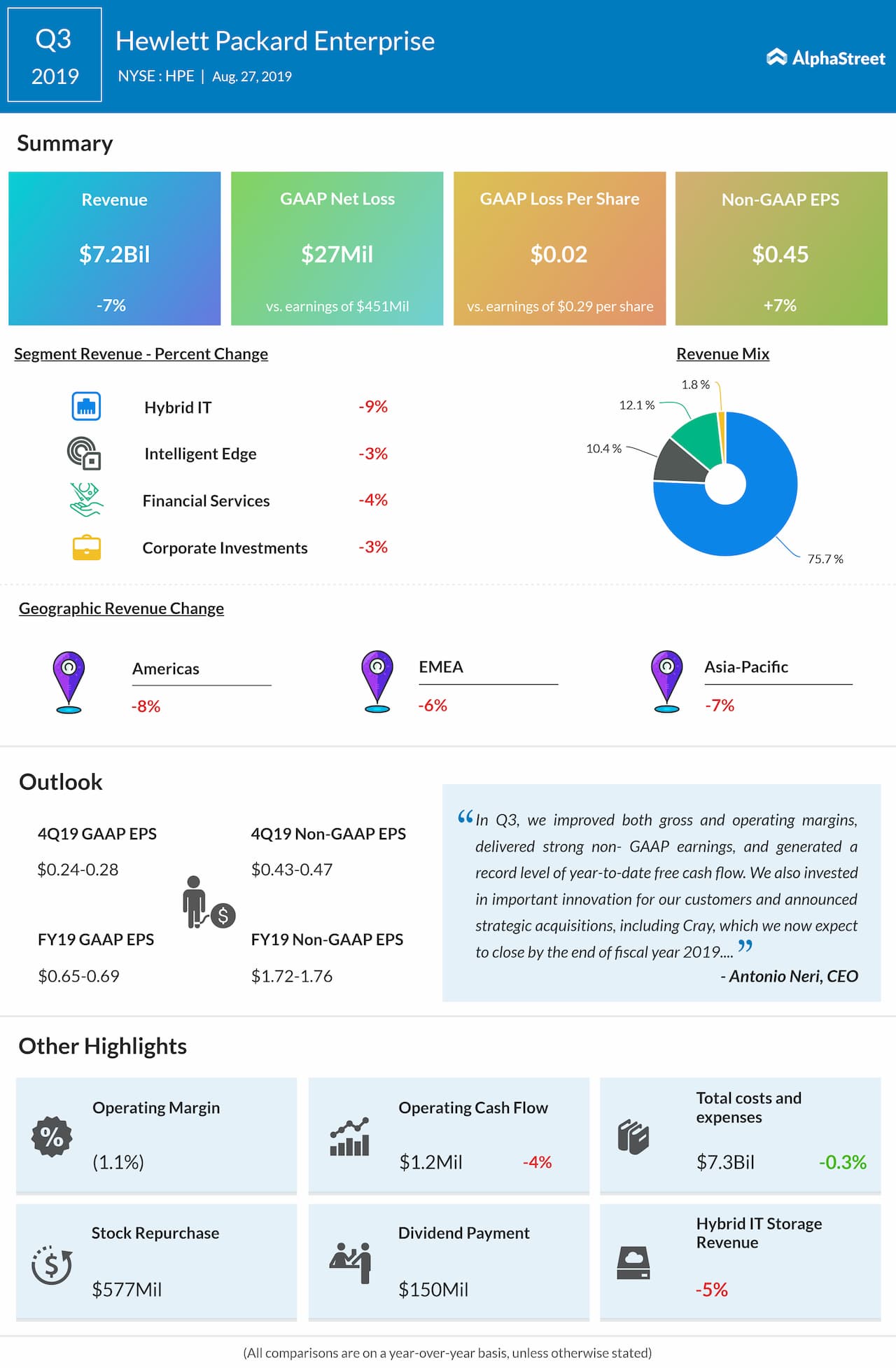

In the third quarter of 2019, HPE beat earnings expectations but missed revenue estimates. Revenues fell 7% to $7.2 billion while adjusted EPS rose 7% to $0.45.

Also read: Hewlett Packard Enterprises Q3 2019 Earnings Call Transcript

For the fourth quarter of 2019, HPE has guided for GAAP EPS

of $0.24-0.28 and adjusted EPS of $0.43-0.47. For the full year of 2019, the

company expects GAAP EPS to be approx. $0.65-0.69 and adjusted EPS to be approx.

$1.72-1.76.

Last month, HPE provided its outlook for fiscal year 2020. The

company expects adjusted EPS to be $1.78-1.94, up 7% year-over-year at the

mid-point and GAAP EPS to be approx. $1.01-1.17, up 63% year-over-year at the

mid-point. HPE

also increased its quarterly dividend to $0.12 per share.

Shares of Hewlett Packard Enterprises have gained 29% year-to-date and 31% over the past three months.