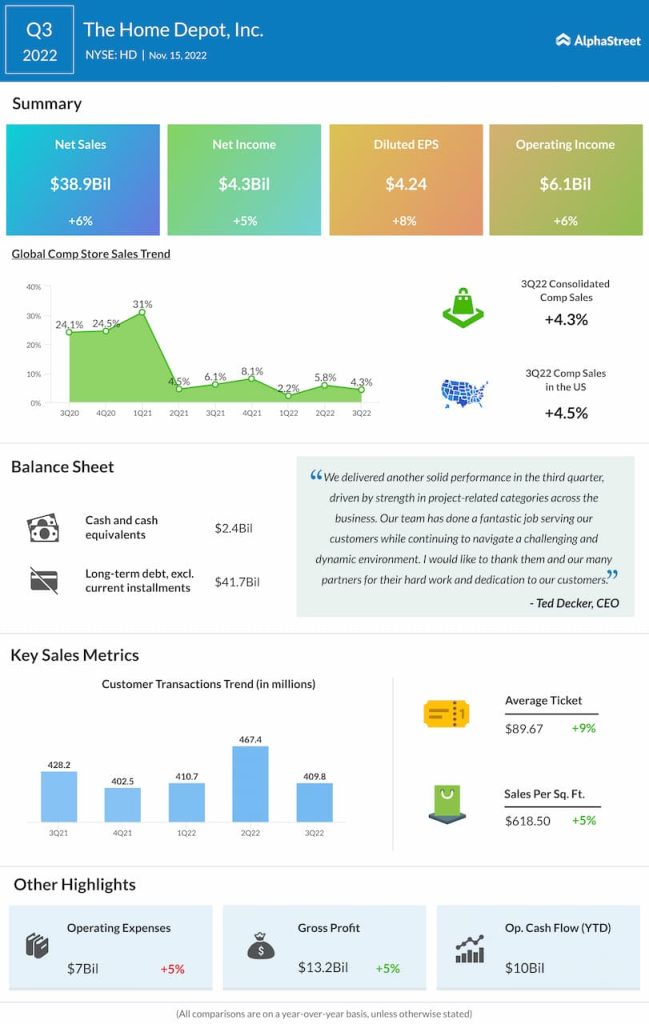

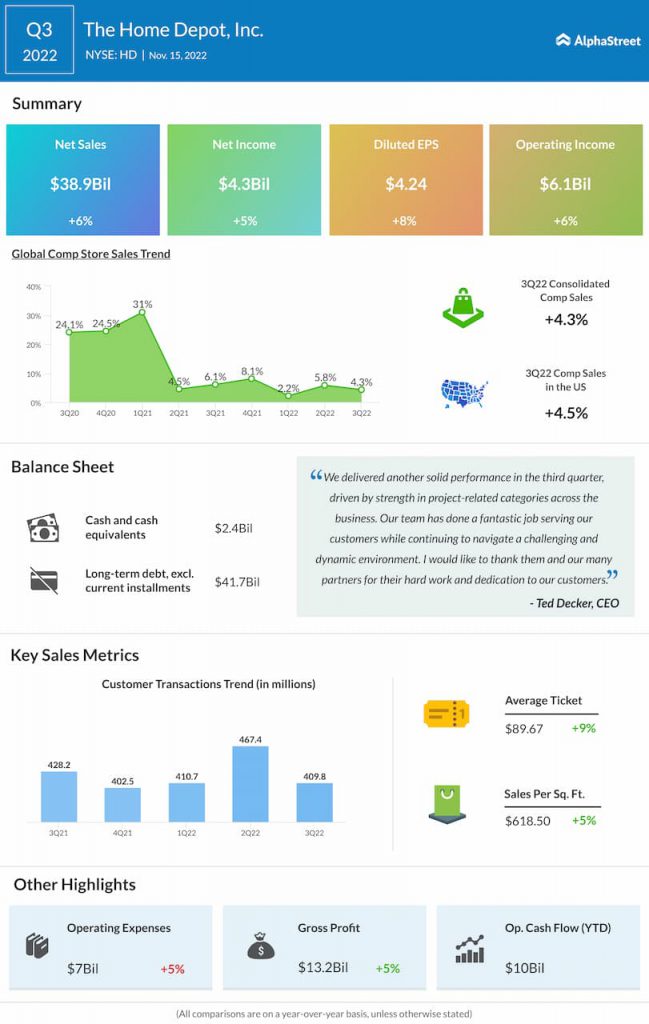

Revenue

Earnings

Analysts are projecting EPS of $3.27 for Home Depot in Q4. This compares to EPS of $3.21 in the year-ago period. In Q3 2022, EPS increased 8% YoY to $4.24.

Points to note

In the third quarter of 2022, Home Depot’s comparable sales increased 4.3% while comparable sales in the US grew 4.5%. The company benefited from solid demand for home improvement projects and saw growth from both its Pro and DIY customers. Despite some softness in certain products and categories, the project business remained strong across most departments.

In Q3, inflation across product categories and demand for new products helped drive an 8.8% increase in comp average ticket. However, comp transactions dropped 4.4%.

The company delivered positive comps across most of its merchandising departments and with the momentum in the project business, it recorded double-digit comps in areas like building materials, plumbing and lumber. Sales growth in the Pro segment outpaced the DIY segment in Q3. Home Depot has seen encouraging trends from its larger Pro customers who posted double-digit comps in Q3. This momentum is likely to have continued through the fourth quarter. In its last quarterly call, the company said its Pro customers have solid backlogs. Home Depot believes there will continue to be strong demand for home improvement over the long term.