Revenue

Earnings

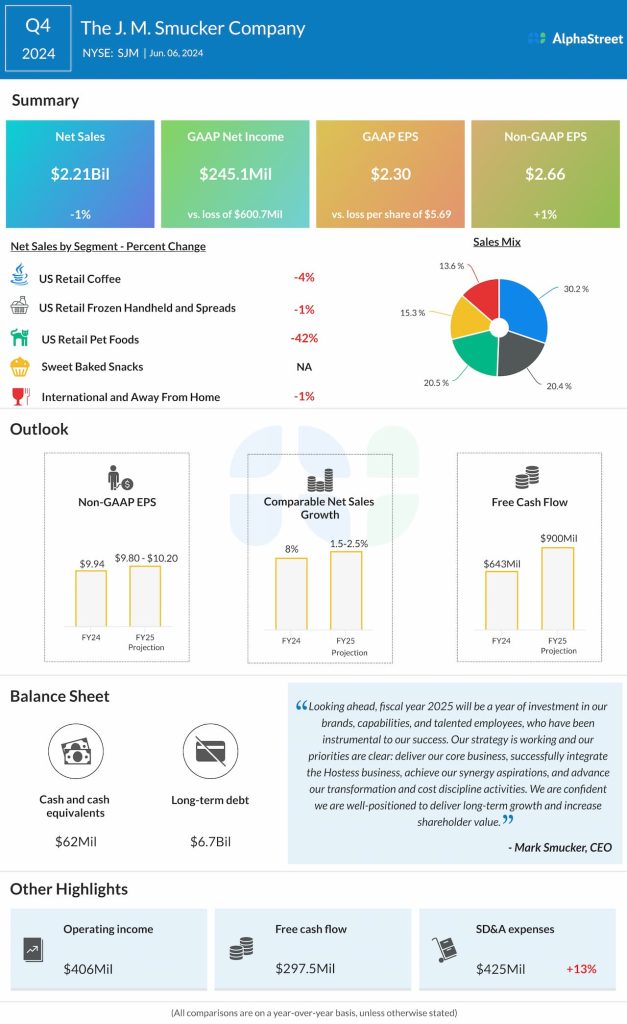

SJM expects its Q1 2025 adjusted EPS to decline low-single digits, mainly driven by higher selling, distribution & administrative expenses, and interest expense. Analysts are predicting EPS of $2.17 for Q1 2025. This compares to adjusted EPS of $2.21 reported in Q1 2024. In Q4 2024, adjusted EPS rose 1% YoY to $2.66.

Points to note

JM Smucker is expected to continue to benefit from the strength and demand of its brands in the first quarter. The expansion of its portfolio through the acquisition of Hostess Brands, which has allowed it to move into the sweet baked snacks category, is expected to add further momentum to its business.

In Q4, SJM saw sales in the Coffee segment decrease due to a list price decline as it passed the benefit of lower coffee costs to customers. In the first quarter, the company expects to see a spike in green coffee costs which it plans to tackle through an increase in list price. The coffee category is expected to stay resilient, helped by strength in at-home coffee consumption. This trend, along with gains in its Café Bustelo and Dunkin brands, is expected be beneficial to SJM.

JM Smucker continues to see strength in its Uncrustables brand, which recorded a 17% growth in total company net sales last quarter. It continues to invest in expanding capacity for this brand and anticipates continued growth for the same. Meanwhile, its Jif peanut butter brand is facing tough competition from private label.

In Pet Foods, the company continues to gain from momentum in the Meow Mix and Milk-Bone brands. Its reshaped portfolio has been driving yields in sales and margins for the segment. SJM’s top line will also see further contributions from the Sweet Baked Snacks segment in Q1.

Last quarter, gross profit increased 15% YoY, driven by lower costs, higher net price realization, and favorable volume/mix. These benefits are anticipated to continue in the upcoming fiscal year as well, which bodes well for the first quarter.