Shares of Target Corporation (NYSE: TGT) stayed green on Thursday. The stock has dropped 7% over the past three months. The leading retailer is scheduled to report its first quarter 2023 earnings results on Wednesday, May 17, before market open. Here’s a look at what to expect from the earnings announcement:

Revenue

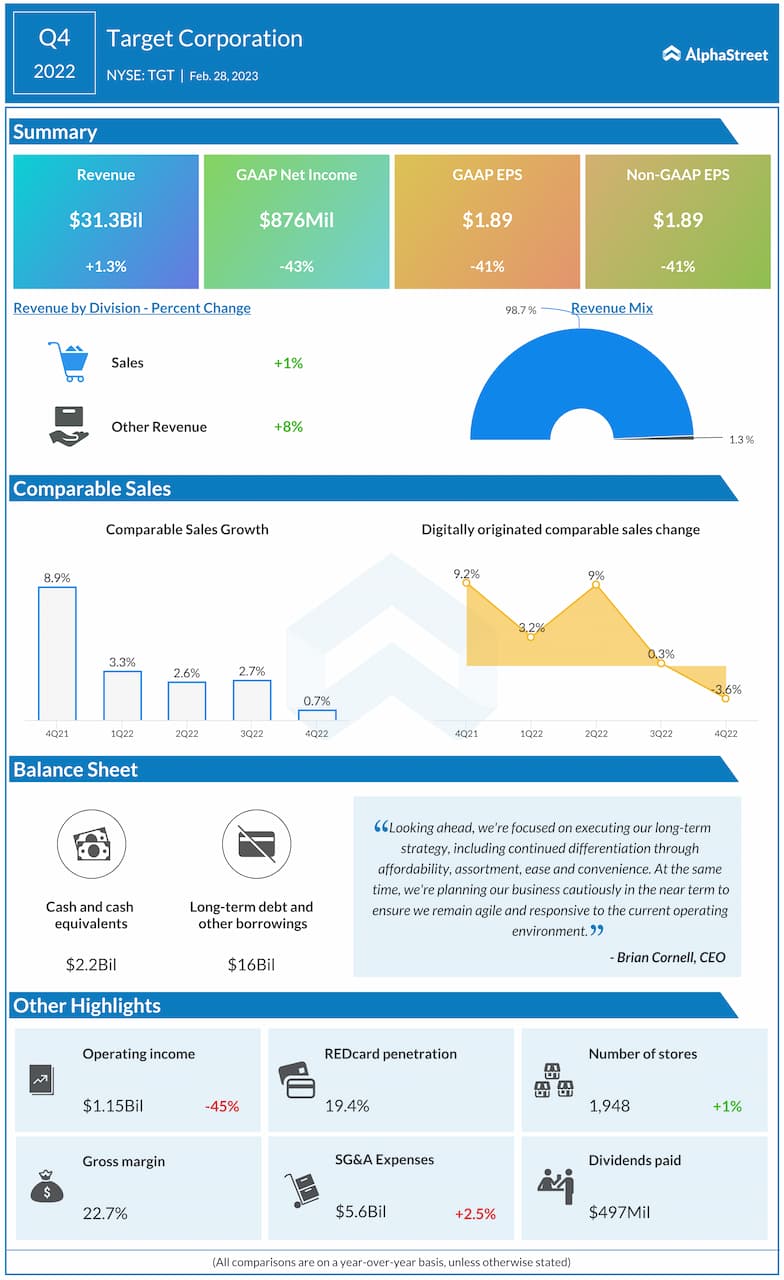

Analysts are projecting revenue of $25.3 billion for Target in Q1 2023 which compares to $25.2 billion reported in Q1 2022. In the fourth quarter of 2022, revenue grew 1.3% year-over-year to $31.4 billion.

Earnings

Target has guided for adjusted EPS of $1.50-1.90 for the first quarter of 2023. The consensus estimate for EPS is $1.77. This compares to adjusted EPS of $2.19 reported in Q1 2022 and $1.89 reported in Q4 2022.

Points to note

Target expects comparable sales in a wide range, from a low single-digit decline to a low single-digit increase for the first quarter of 2023. In the first quarter of 2022, comparable sales grew 3.3% while in Q4 2022, comparable sales grew only 0.7%.

During the fourth quarter, like most of its peers in retail, Target felt the pressures of inflation as rising prices drove consumers into spending more on necessities and putting discretionary purchases on hold. The company saw softer sales in its discretionary categories which took a toll on its margins as well. These pressures are likely to have continued in the first quarter as well.

Target’s multi-category portfolio provides it with an advantage as it focuses on driving growth from essential categories during these challenging times. The company’s efforts in building its omnichannel capabilities have also paid off. Its fulfillment options such as Drive-Up and Pick-Up have grown to form a meaningful part of its digital sales and have yielded benefits for the company.

A diverse assortment which provides flexibility, a vast store network and efficient same-day fulfillment services are likely to have benefited Target in the first quarter. However, softness in discretionary and a higher portion of sales coming from essentials are likely to have weighed on margins.