Fastenal Company (NASDAQ: FAST), a leading industrial supplier focused on fasteners, has stayed broadly unaffected by the manufacturing slowdown caused by economic uncertainties. The company, which operates through its extensive store network and onsite locations, has a good track record of effectively navigating economic cycles.

Fastenal’s stock has grown 23% since the beginning of the year, and the uptrend gathered steam in recent weeks. But FAST seems to have peaked and there are no clear signs of it making meaningful gains in the near future. After the recent gains, the stock has moved closer to the record highs seen at 2021-end, assuming a valuation that looks high. On the positive side, the company has raised its dividend consistently and offers a decent yield.

Road Ahead

Fastenal looks to counter the impact of muted industrial lending trends and economic uncertainties through continued business expansion, especially in the on-premise and e-commerce segments. Meanwhile, the management recently warned of some weakness in the company’s end markets but exuded optimism about its future prospects. Currently, the focus is on investing in long-term expansion plans and returning value to shareholders. The company’s healthy balance sheet should allow it to pursue acquisitions and capital investment initiatives.

Q2 Report Due

When Fastenal reports second-quarter 2023 results on July 13, at 6:50 am ET, the market will be looking for earnings of $0.53 per share, which is up by three cents from the prior-year number. June quarter revenue is estimated to have increased about 6% from last year to $1.89 billion.

From Fastenal’s Q1 2023 earnings conference call:

“If you look at customers 50 through 100, they were growing nicely, because we’re picking-up market share. And that makes me more enthused because long-term our success is from taking market share every day. The economy is going to do in the short-term what the economy is going to do. We have a healthy business, we generate more cash flow in a year like this, and we’d rather be deploying the cash flow into the business. But in a year like this, maybe we return more to shareholders, but it’s a case of focusing on the long-term opportunity of business, and I’m as excited as ever.”

Stable Performance

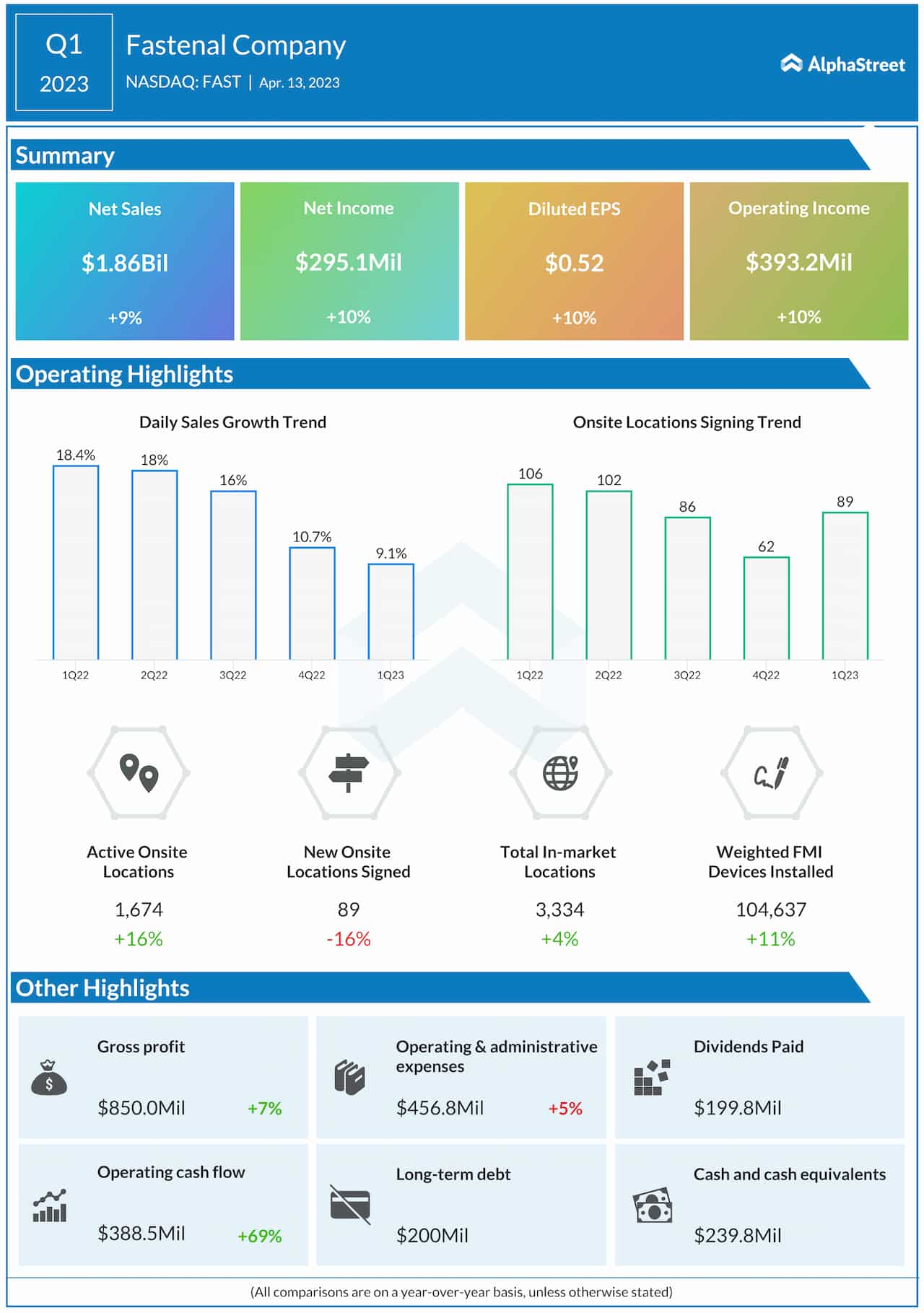

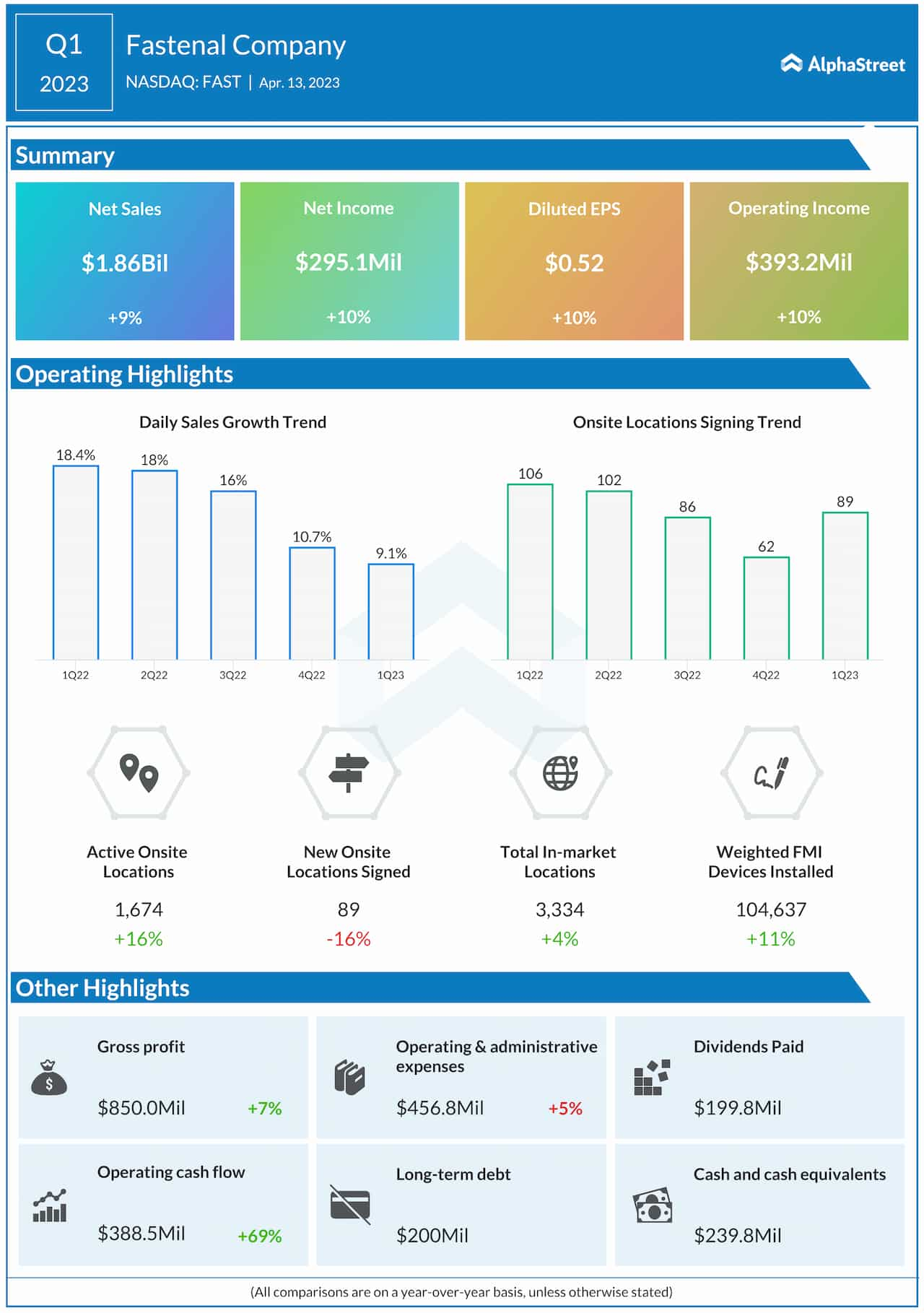

In recent years, the company’s quarterly earnings either topped expectations or matched the Street view. In the first three months of fiscal 2023, net profit rose 10% to $0.52 per share. At $1.86 billion, net sales were up 9% year-over-year. Of late, there has been a slowdown in the daily sales growth. The top line matched estimates in Q1, after beating in the trailing two quarters.

FAST traded higher on Friday afternoon, recovering from the weakness experienced in the previous sessions. It has been trading above the 52-week average in recent weeks.