Revenue

Earnings

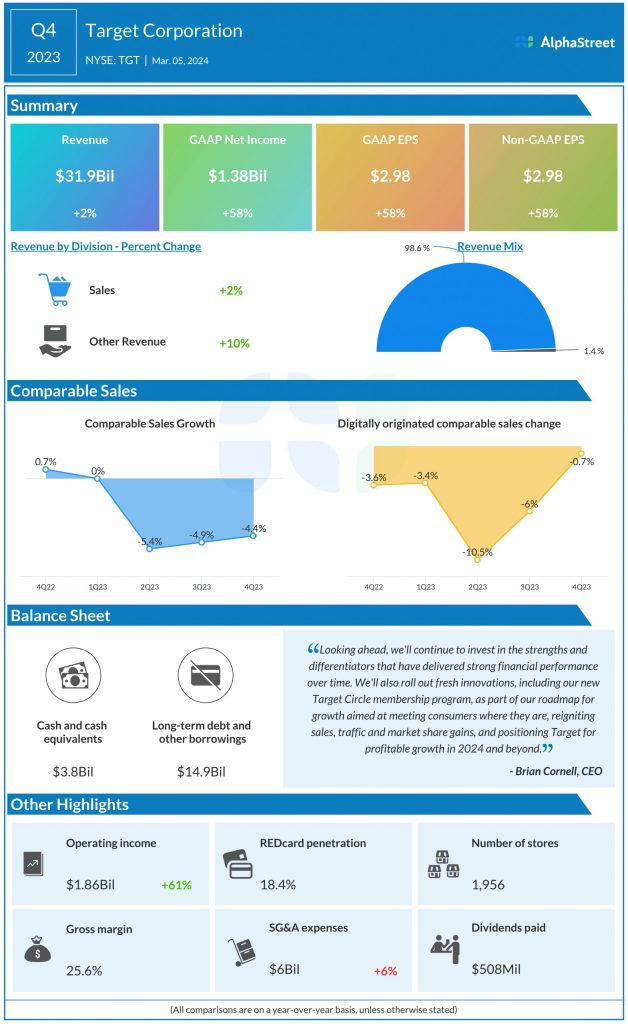

For Q1 2024, Target has guided for both GAAP and adjusted EPS to range between $1.70-2.10. Analysts are predicting EPS of $2.05. This compares to adjusted EPS of $2.05 reported in Q1 2023 and $2.98 reported in Q4 2023.

Points to note

For the first quarter of 2024, Target expects comparable sales to decline 3-5%. In Q4, comparable sales declined 4.4%, reflecting comparable store sales declines of 5.4% and a comparable digital sales decline of 0.7%. The company expects its top line to face the highest hurdle in the first quarter, following which it is expected to see a recovery over the rest of the year.

On its last quarterly call, Target mentioned that it was seeing soft demand in the discretionary category while in the frequency businesses it anticipated a recovery in unit trends in 2024 as inflation moderates.

Target is expected to continue to benefit from its vast store fleet, its multi-category portfolio and its mix of frequency and discretionary categories, as well as its investments in fulfillment options and digital capabilities. These efforts will help it meet the needs of customers who are increasingly seeking value.

Last quarter, Target saw an improvement in its operating margins helped by better inventory management and a reduction in freight and transportation costs. The retailer has also been dealing with inventory shrink, which has been taking a toll on margins. Although the company has seen some encouraging results from the actions it has taken to tackle this issue, it still expects shrink rates to remain approx. flat in 2024 versus 2023. This could impact results in Q1 as well.