Revenue

Earnings

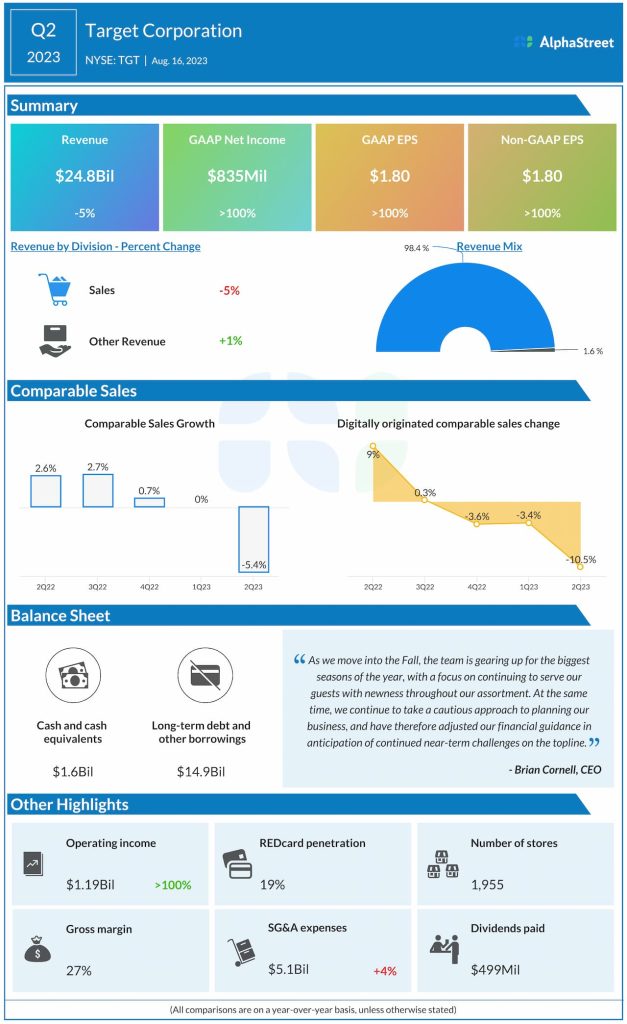

Target has guided for GAAP and adjusted EPS to be in the range of $1.20-1.60 in Q3 2023. Analysts are looking for earnings of $1.48 per share in Q3 2023. This compares to adjusted EPS of $1.54 reported in Q3 2022 and $1.80 reported in Q2 2023.

Points to note

Target expects comparable sales in a wide range around a mid-single-digit decline in Q3 2023. In the second quarter, comparable sales decreased 5.4%, reflecting a 4.8% decline in traffic. It is worth watching if traffic trends improved during the third quarter.

The company also saw lower demand across discretionary categories as consumers opted to spend more on food and essentials amid tight budgets. The retailer’s multi-category assortment, which gives it the flexibility to adapt to such changes in shopping behaviors, is an advantage.

Another challenge Target continues to deal with is inventory shrink. For the third quarter, the company expects the dollar and rate pressure from shrink to remain consistent with the levels seen in the first half of the year.

Target’s investments in its stores and same-day services, along with its efforts in managing inventory and offering affordable options could prove beneficial. At the end of Q2, inventory was down 17% YoY. Inventory in the discretionary category was also down by 25%.

Even in a tough environment, the company managed to achieve margin growth. In Q2, its gross margin rose to 27% from 21.5% last year, benefiting from lower markdowns, lower freight, supply chain and fulfillment costs, and retail price increases. This is a plus point for the retailer.