Tesla Inc. (NASDAQ: TSLA) is preparing to report third-quarter earnings on October 18, after the closing bell. The market will be closely following the event for updates on the future plans of the EV giant that achieved record production and deliveries in the most recent quarter, defying macro headwinds and muted consumer confidence.

So far, 2023 has been a good year for Tesla’s stock as it regained strength after hitting a two-year low last year. It experienced a series of ups and downs in recent sessions and is trading well above the 52-week average; that is, the stock has become more expensive and the valuation looks high. Market watchers, in general, are bullish on Tesla — the optimism is mainly associated with the prospects of the core EV business and scaling it. Also, the company enjoys the first-mover advantage in robo-taxi, with a substantially bigger database than others.

On Track

According to the management, Tesla is on track to grow production and achieve the 50% CAGR target being guided since a few years ago. On the positive side, the cash flow is strong enough to enable the company to invest in growth initiatives like capacity expansion, both in vehicle plants and the supercharging network. Besides core technologies, it is also spending on AI-related technologies like full self-driving. Another priority is maximizing volumes for the vehicle and energy businesses.

On the flip side, elevated costs are taking a toll on the company’s gross margin, making it necessary to streamline costs and improve working capital. When it comes to future demand, there is uncertainty because people usually tend to cut back or postpone big-ticket purchases when the economy is weak and interest rates are high. Also, the EV market is getting highly competitive and that would weigh on Tesla’s pricing power to some extent – the company recently cut prices of its top models to boost sales.

Mixed Q3 Estimates

When the company releases September-quarter numbers, the market will be looking for earnings of $0.74 per share, which represents a 30% year-over-year decrease. The consensus revenue estimate is $24.16 billion, compared to $21.96 billion a year earlier.

Commenting on the demand scenario, Tesla’s chief Elon Musk said recently, “We continue to target 1.8 million vehicle deliveries this year. Although we expect that Q3 production will be a little bit down because we’ve got summer shutdowns to — for a lot of factory upgrades. So just probably a slight decrease in production in Q3 for sort of global battery upgrades. In the long-term, autonomy, we think is going to just drive volume through the ceiling next level.”

Record Production

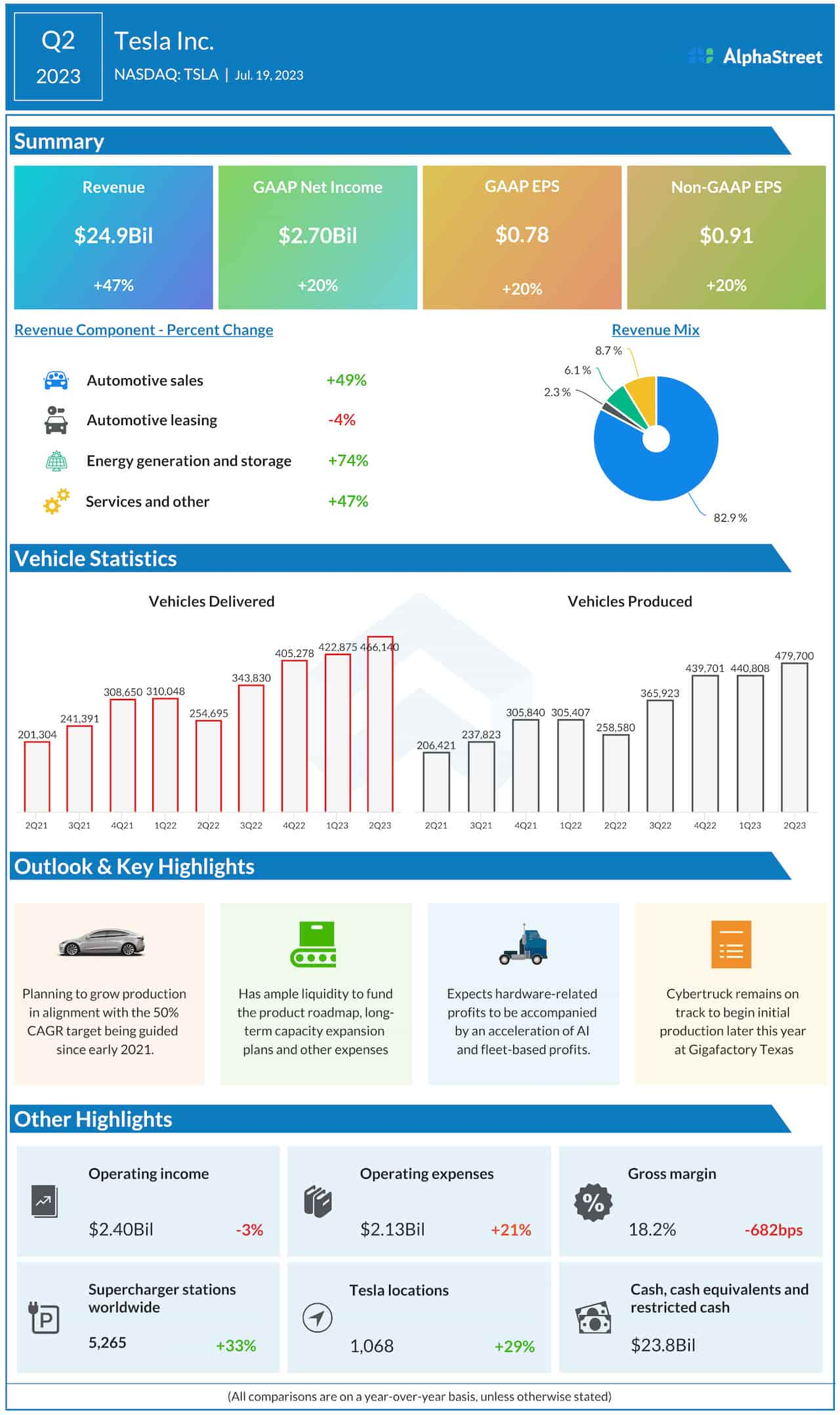

In the second quarter, Automotive sales, which account for more than 80% of the company’s revenues, increased around 50%. The other key business segments – Energy Generation & Storage and Services & Other – also registered strong growth, resulting in a 47% surge in total revenues. Analysts were looking for a slightly smaller amount. Net profit, excluding special items, increased by a fifth to $0.91 per share in Q2. The bottom line beat estimates after missing in the previous quarter. Production and deliveries hit a new high during the three-month period.

Shares of Tesla had a good start to the week but traded lower on Wednesday morning. The value has more than doubled since the beginning of 2023.