Despite the stock’s incredible run, the general sentiment surrounding its future trajectory and the company’s prospects is pessimistic. GameStop might have benefited from people staying at home and playing video games more during the COVID-19 pandemic period but its overall sales have continued to decline.

Recent performance

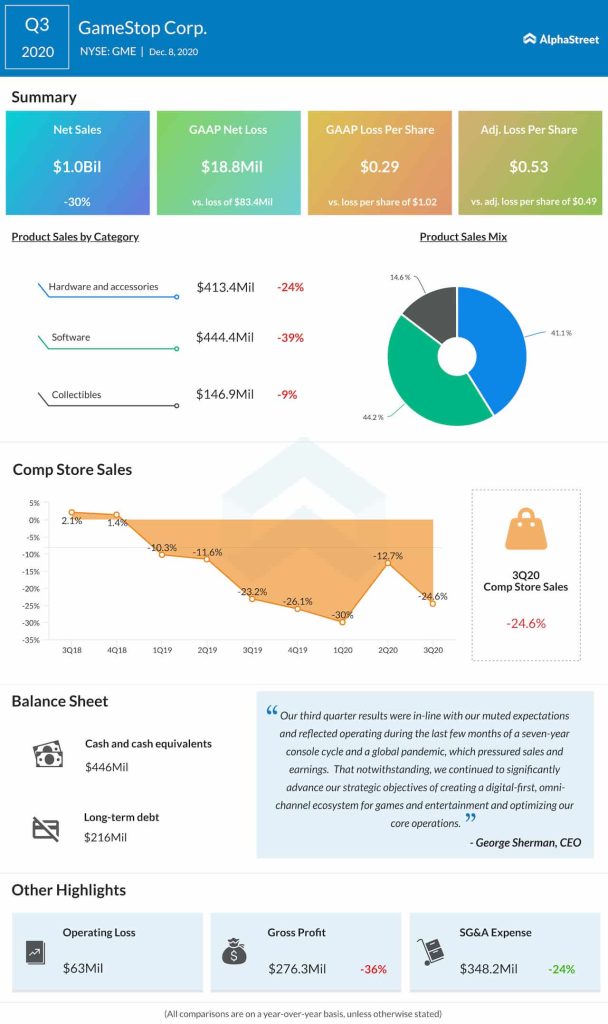

In the third quarter of 2020, GameStop’s net sales fell 30% to $1 billion, hurt by lower traffic and store closures amid the pandemic as well as a reduction in the store base due to its de-densification strategy. Comparable sales declined nearly 25%. Ecommerce sales increased 257% worldwide representing over 18% of total sales.

For the nine-week holiday period which ended on January 2, GameStop reported net sales of $1.7 billion, which was down 3.1% compared to the same period last year. Sales were impacted by store closures due to both the pandemic and its de-densification strategy. Comp sales rose 4.8% while ecommerce sales rose 309%. Ecommerce sales represented approx. 34% of total sales.

Outlook

GameStop expects to benefit from strong demand for the new consoles through 2021. The company is also confident in its strategy to add new product revenue streams across games and entertainment.

Consensus

Most analysts, however, feel differently. Despite the idea of GameStop turning into some kind of hub for gaming doing the rounds on Reddit, many analysts believe that the company is operating in a very tough competitive environment with relatively nothing new to offer and therefore find this scenario unlikely to unfold.

Those in support of the stock are holding on to the sharp rise in ecommerce sales and the strong demand for new consoles but some analysts counter this with the fact that despite these two factors, overall sales still dropped during the holiday period.

Unless GameStop undertakes a major change in strategy and revamps its entire way of doing things, chances for a turnaround are quite bleak. In general, analysts believe it is better to exercise caution and not get carried away with this stock right now.