$800-bln Valuation

Read management/analysts’ comments on quarterly results

However, there are multiple catalysts that can justify the high valuation, like the company’s growing foothold in new technologies like AI-powered chips and its recent efforts to lead the metaverse movement. Having maintained dominance in gaming processors for many years, the company currently enjoys a clear advantage over rivals, thanks to its GeForce graphics card that is touted as the ultimate in computer gaming. Though slightly expensive, NVDA is a reliable and safe investment that can create decent long-term shareholder value.

<img loading=”lazy” class=”aligncenter wp-image-138821 size-full” src=”https://cdn.news.alphastreet.com/wp-content/uploads/2021/11/Nvidia-Q3-2022-earnings-infographic.jpg” alt=”Nvidia Q3 2022 earnings infographic” width=”1278″ height=”1749″ srcset=”https://cdn.news.alphastreet.com/wp-content/uploads/2021/11/Nvidia-Q3-2022-earnings-infographic.jpg 1278w, https://cdn.news.alphastreet.com/wp-content/uploads/2021/11/Nvidia-Q3-2022-earnings-infographic-219×300.jpg 219w, https://cdn.news.alphastreet.com/wp-content/uploads/2021/11/Nvidia-Q3-2022-earnings-infographic-748×1024.jpg 748w, https://cdn.news.alphastreet.com/wp-content/uploads/2021/11/Nvidia-Q3-2022-earnings-infographic-768×1051.jpg 768w, https://cdn.news.alphastreet.com/wp-content/uploads/2021/11/Nvidia-Q3-2022-earnings-infographic-1122×1536.jpg 1122w” sizes=”(max-width: 1278px) 100vw, 1278px” pagespeed_url_hash=”209776449″/>

<img loading=”lazy” class=”aligncenter wp-image-138821 size-full” src=”https://cdn.news.alphastreet.com/wp-content/uploads/2021/11/Nvidia-Q3-2022-earnings-infographic.jpg” alt=”Nvidia Q3 2022 earnings infographic” width=”1278″ height=”1749″ srcset=”https://cdn.news.alphastreet.com/wp-content/uploads/2021/11/Nvidia-Q3-2022-earnings-infographic.jpg 1278w, https://cdn.news.alphastreet.com/wp-content/uploads/2021/11/Nvidia-Q3-2022-earnings-infographic-219×300.jpg 219w, https://cdn.news.alphastreet.com/wp-content/uploads/2021/11/Nvidia-Q3-2022-earnings-infographic-748×1024.jpg 748w, https://cdn.news.alphastreet.com/wp-content/uploads/2021/11/Nvidia-Q3-2022-earnings-infographic-768×1051.jpg 768w, https://cdn.news.alphastreet.com/wp-content/uploads/2021/11/Nvidia-Q3-2022-earnings-infographic-1122×1536.jpg 1122w” sizes=”(max-width: 1278px) 100vw, 1278px” pagespeed_url_hash=”209776449″/>

From Nvidia’s third-quarter 2021 earnings transcript:

“Some 25,000 companies are now using NVIDIA AI and recently at GTC, we announced two very, very big things. One, we remind everybody that we — just this month before we have tried to support now just in every generation of NVIDIA GPUs, of which there are so many versions to be managing without trying how would you possibly deploy AI across the entire fleet of NVIDIA servers, NVIDIA GPU servers that are all over the world and so it’s almost an essential tool just to operate and take advantage of all of NVIDIA’s GPU that are in the datacenter.”

Chip Shortage

Meanwhile, like most semiconductor firms, the persistent chip shortage has put Nvidia in a difficult situation in terms of striking the right balance between demand and supply. And, there seems to be no end in sight for the short supply of semiconductor products. Also, rival chipmaker Advanced Micro Devices (NASDAQ: AMD) is making large inroads into the GPU realm, with offerings like dual-wielding graphics cards, signaling tight competition among the two companies in the future.

Applied Materials Earnings: AMAT Q4 sales rise but miss estimates

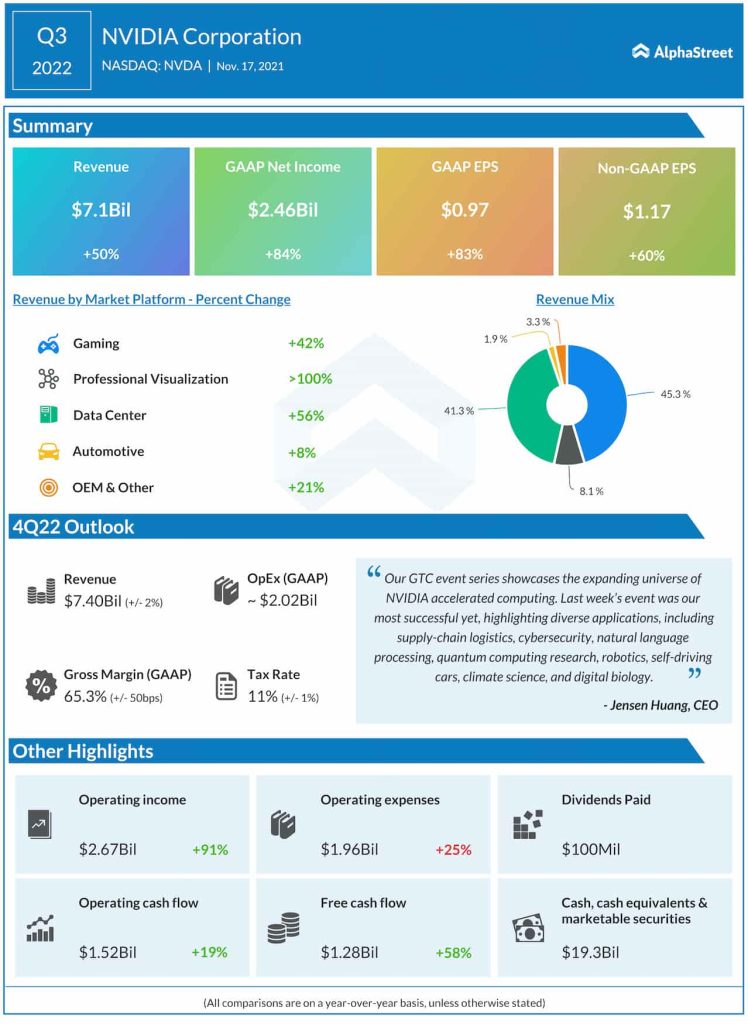

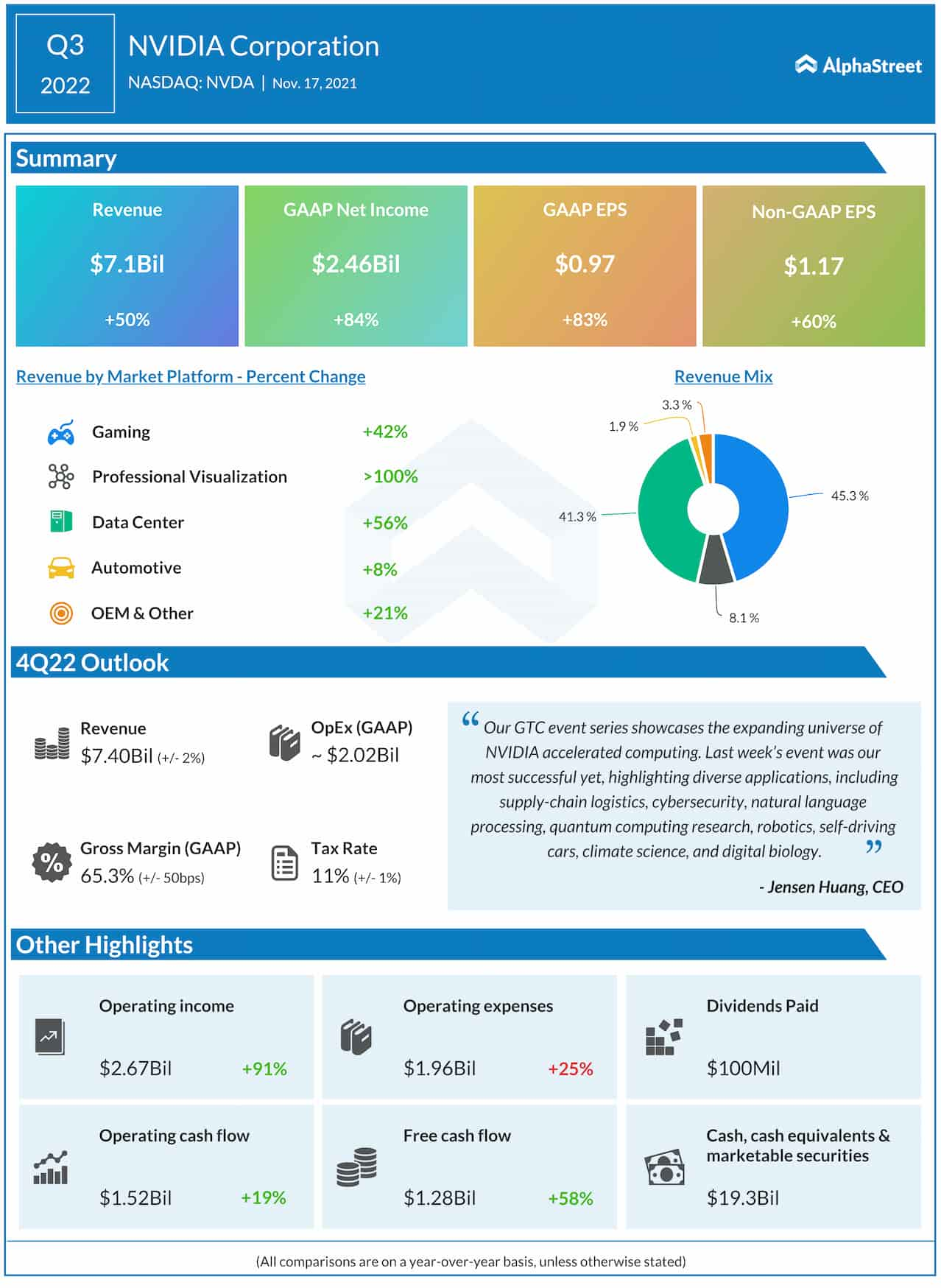

Nvidia enjoys the rare distinction of beating quarterly earnings estimates consistently for more than a decade. The trend continued in the third quarter when adjusted profit climbed 60% to $1.17 per share. All the operating segments, led by Gaming and Data Center, delivered solid growth and total revenues reached $7.1 billion, up 50% year-over-year. For the current quarter, the management expects revenues of approximately $7.4 billion, which is well above the consensus forecast.

At the Bourses

Nvidia’s market value more than doubled since the beginning of the year and the stock hit an all-time high this week, all along outperforming the industry. Extending the post-earnings rally, the stock traded sharply higher on Friday afternoon.