Though the stock has snapped the losing streak ahead of next week’s earnings release, the underlying weakness suggests that any recovery would be short-lived.

The stock, which has been in a downward spiral ever since the company went public two years ago, witnessed significant volatility in recent months. However, it shifted to recovery mode this month after staying low in the early weeks of the year.

Call for Caution

In general, analysts’ recommendations suggest that it might not be the right time to invest in Dropbox as the stock tends to stay flat in the near future.

Though it’s been more than a year since Dropbox acquired e-signature company HelloSign, the synergies are yet to play out fully. It needs to be seen if the latter’s contributions would enhance the company’s content collaboration capabilities.

New COO

The post of chief operating officer remained vacant for nearly one-and-half years, at a time when Dropbox has been in the process of adopting a new business model with focus on product revamp. The company recently named former Google Cloud executive Olivia Nottebohm its new chief operating officer.

Also read: Cloudflare Q4 2019 Earnings Snapshot

The new operations head is likely to take up the task of promoting the recently launched ‘Spaces’ app that allows users to add special features to files stored in the cloud. The market is closely following the portfolio revival. The goal is to create a unique smart workspace that can mitigate distractions linked to the use of technology.

Dropbox might benefit from its pioneering products in the long-term, considering the range of the company’s client-base that includes professional teams, enterprises, and individuals.

User Growth

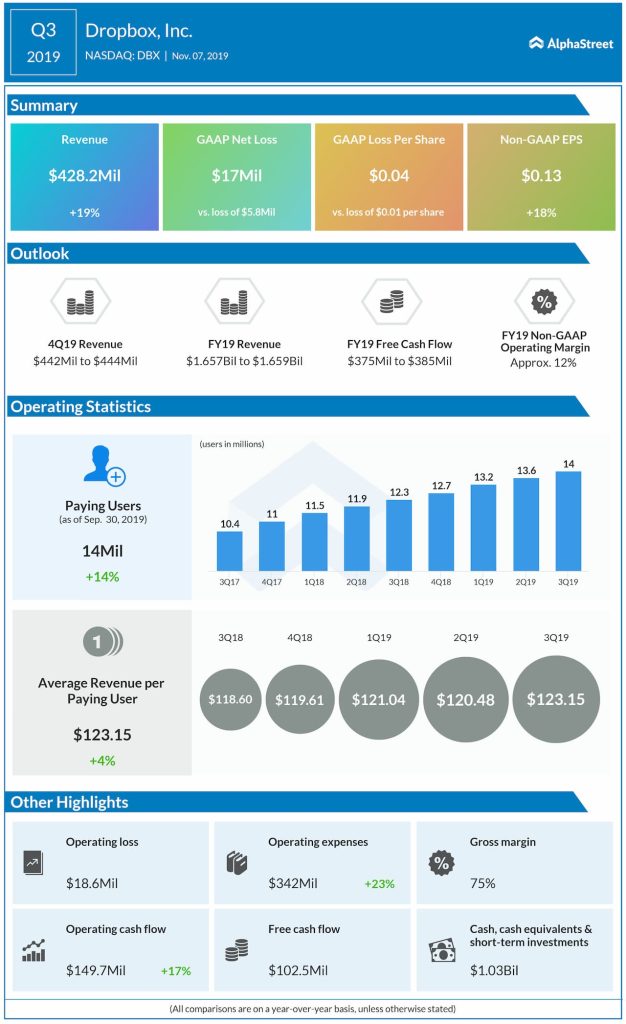

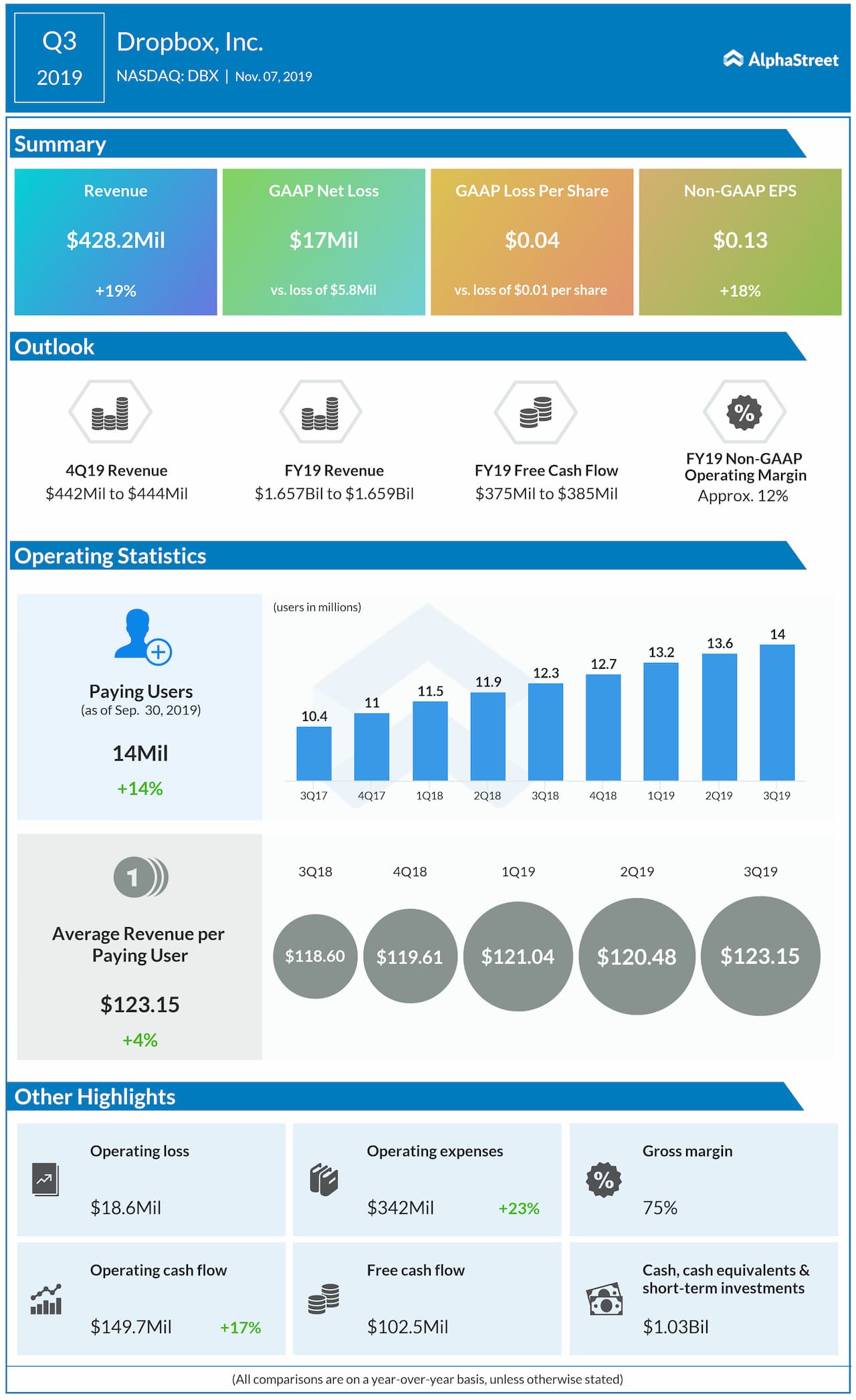

Dropbox has been expanding its user-base consistently over the years and ended the third quarter with more than 14 million paying subscribers. Aided by a double-digit increase in revenues, adjusted earnings rose to $0.13 per share in the quarter. The results also exceeded the market’s prediction.