Facebook does not give out the numbers for WhatsApp and Instagram but based on data from BusinessofApps, WhatsApp had 2 billion monthly active users (MAUs) as of October 2020, making it the leader in Messenger apps. WhatsApp stands close to its parent in MAUs. As of October 2020, Facebook had 2.7 billion MAUs.

According to the report, WhatsApp gets a large chunk of its users from India. As of September 2019, WhatsApp had 340 million MAUs in the country. Compared to this, the number in the US stood at 68 million. In Q3 2020, WhatsApp downloads totaled around 140 million.

During its most recent quarterly conference call, Facebook said that private messaging is a rapidly growing form of communication, and that roughly 100 billion messages are exchanged every day on WhatsApp alone.

Also read: Facebook (FB): Small businesses turn to social media to drive revenue amid the pandemic

WhatsApp Business and WhatsApp Payments are two areas that are expected to drive significant growth going forward. As of July 2020, 50 million users had signed up for WhatsApp Business. Currently there are over 40 million people viewing a Business Catalog every month on WhatsApp.

Facebook is working on integrating WhatsApp business features with Facebook Shops, its new service that allows a user to create an online store on Facebook and Instagram for free. This is expected to help businesses simultaneously expand their presence across Facebook, WhatsApp and Instagram. This shows how WhatsApp forms an integral part of Facebook’s growth strategy.

Facebook’s photo and video-sharing platform, Instagram, currently has over one billion users and contributes over $20 billion to Facebook’s annual revenue, according to this article by Business Standard.

Based on a report from BusinessofApps, Instagram is popular in the US with 110 million users and a penetration of 37%. Instagram remains a favorite among youngsters with 67% of users in the 18-24 age group and 60% in the 25-34 age group. Even among people aged above 55, 31% used Instagram.

In terms of interests, the top categories were travel and music at 45% and 44% respectively followed by food and drink at 43% and fashion at 42%. Not surprisingly, news came last at 28%.

Features like Stories which Facebook reportedly copied from rival Snapchat, helped drive Instagram’s popularity significantly. On its recent quarterly conference call, Facebook mentioned how Instagram is also helping businesses connect with users through features like Instagram Shops and Instagram Checkout. These numbers indicate that Instagram is a significant growth driver for Facebook.

User base

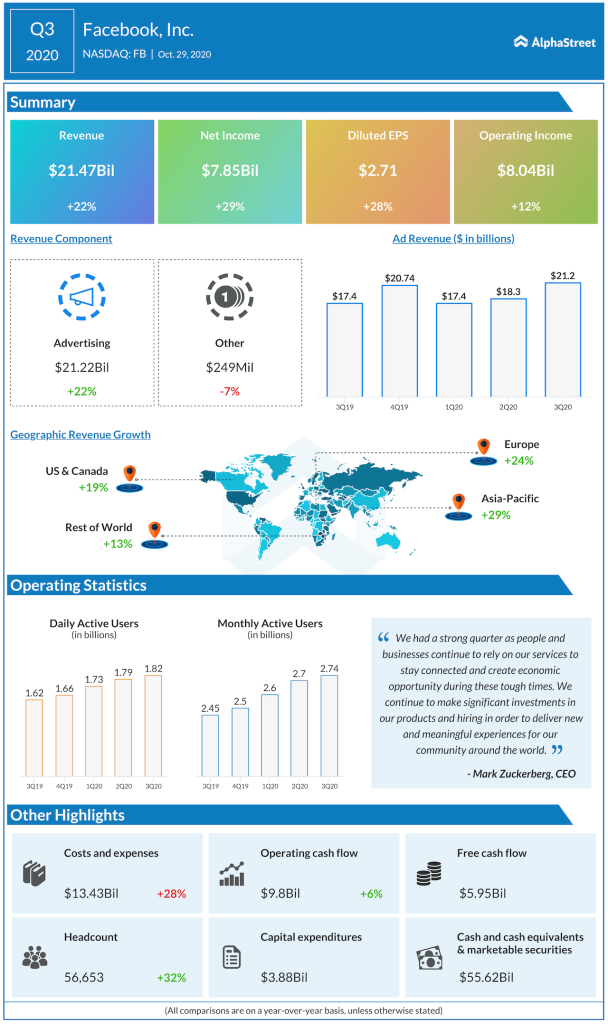

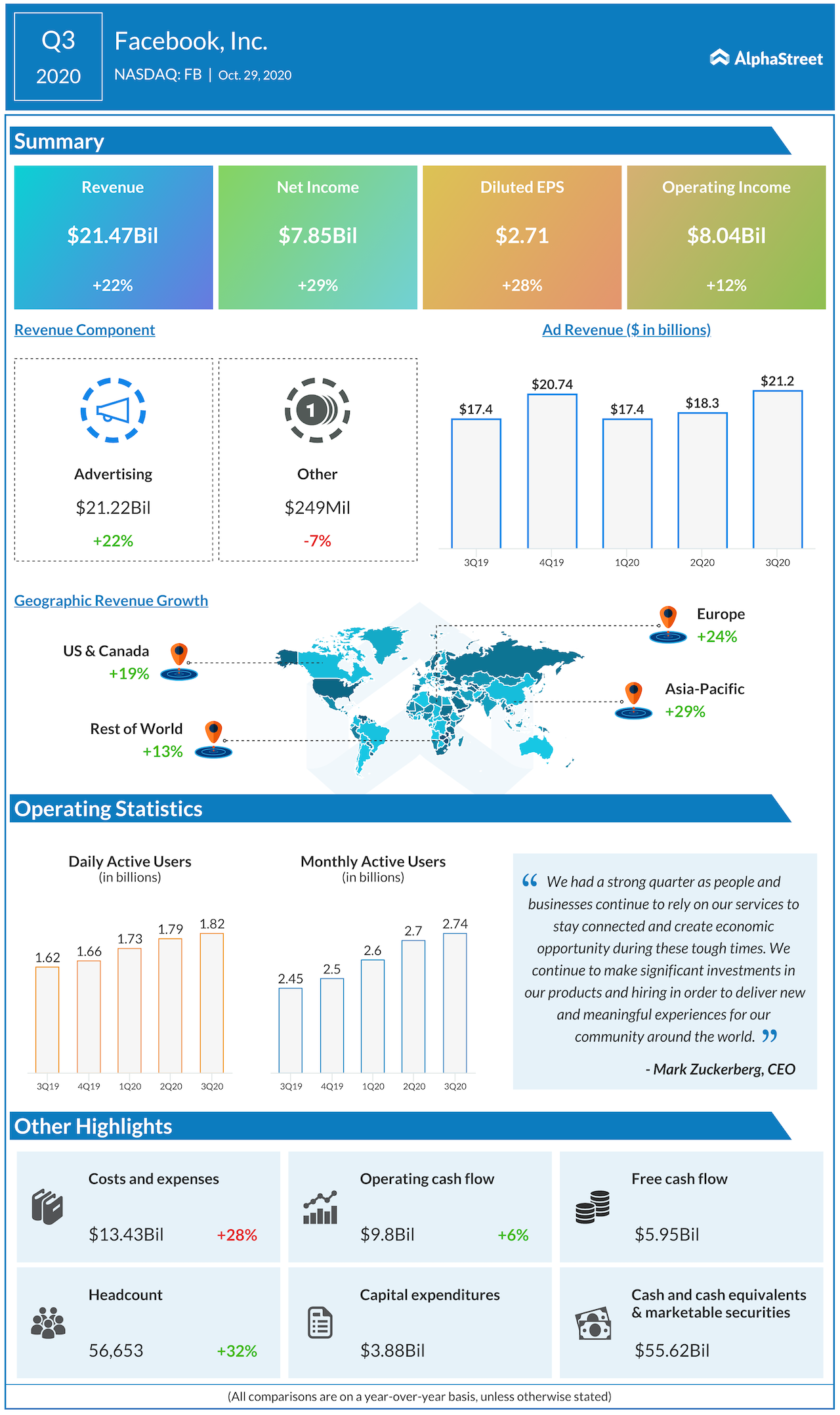

As of the end of its third quarter of 2020, Facebook had 2.7 billion monthly active users in total. MAUs in the US & Canada region amounted to 255 million, down slightly from the second quarter. The largest number of MAUs came from the Asia-Pacific and Rest of World regions at 1.1 billion and 906 million respectively.

Facebook gets to reach a massive user base in countries like India through WhatsApp while Instagram’s popularity benefits it in the US. So these divisions play a key role in giving Facebook a vast reach globally.

Advertising

Facebook generates the majority of its revenue from advertising. During the third quarter, advertising revenues grew 22% year-over-year to $21.2 billion. Instagram helps generate ad revenue for Facebook meaningfully. Facebook says 68% of people view photos from brands they like or follow on Instagram while 66% view videos from brands they like or follow. According to BusinessofApps, Instagram ad revenue as a share of Facebook ad revenue is estimated to rise from 9% in 2017 to 30% by 2020.

Also read: Facebook (FB): The ad boycott hasn’t left any scratches on the social media giant

These numbers show how important these two divisions are to Facebook which is precisely why the company will do everything it can to not lose them. Facebook is also working on integrating its features across all its platforms which will make it very difficult for the company if it were to split up thereby leading to the need for a whole new strategy.

Market experts believe these lawsuits are likely to take a long time to get resolved and at the end of it all, there may not even be a split. So it looks like Facebook might have hope after all.

Facebook’s shares were down 1.2% in afternoon hours on Friday.

Click here to read Facebook’s Q3 2020 earnings conference call transcript