Cloudy Second Half

Being unable to assess the emerging situation, the Sunnyvale, California-based medical device maker withheld its outlook for the remainder of the year while reporting weak earnings for the June quarter. But the market responded positively to the better-than-expected results and the stock moved up, continuing the uptrend that started several months ago. Hovering slightly below the $700-mark, the stock traded at a record high this week.

“We have observed that outreach, education and diagnostic business and procedures come back. The surge of COVID in communities that represent our core markets, either from initial spread or secondary growth, is occurring now. Add to the significant anecdotal evidence of delayed diagnostic visits for non-COVID illness, and we expect that the recovery tail of surgery will be a long one, likely to last many quarters. The ultimate timing and shape of recovery remains uncertain,” CEO Gary Guthart said during the post-earnings discussion with analysts more than a month ago.

A Long-term Bet

The stock bears moderate buy rating, which reflects the relatively high valuation and modest target price. Before investing in Intuitive, it would make sense to wait until a clear picture emerges. But those willing to take risk might find the stock attractive at the current levels. It has an impressive track record — gained 37% in the past twelve months alone.

With a total of more than 5,000 da Vinci installations and having trained thousands of doctors to use the system, Intuitive has a secured revenue source. Competitors will find it difficult to promote their products, because adopting a different system would be a costly affair for Intuitive’s existing customers.

Basics Intact

Moreover, the fundamentals of the company are very strong and the robust balance sheet gives it an edge over rivals like Medtronic (MDT), which reported negative earnings and revenue growth for two consecutive quarters. The impressive return on capital justifies Intuitive’s aggressive spending on growth initiatives, and that will help it continue to dominate the sector that has immense growth potential. In that respect, the strong cash position and low debt bodes well for the company.

Da Vinci, the robotic surgical system that is claimed to have assisted in about seven million surgeries, is the main revenue driver, with a growing number of healthcare facilities adopting it every year. It is widely expected that the market for assisted surgery would double in the next five years, which underscores Intutive’s strong growth prospects for the long term. Of late, there has been an increase in the use of robotic assistance in new surgical procedures.

Weak Q2

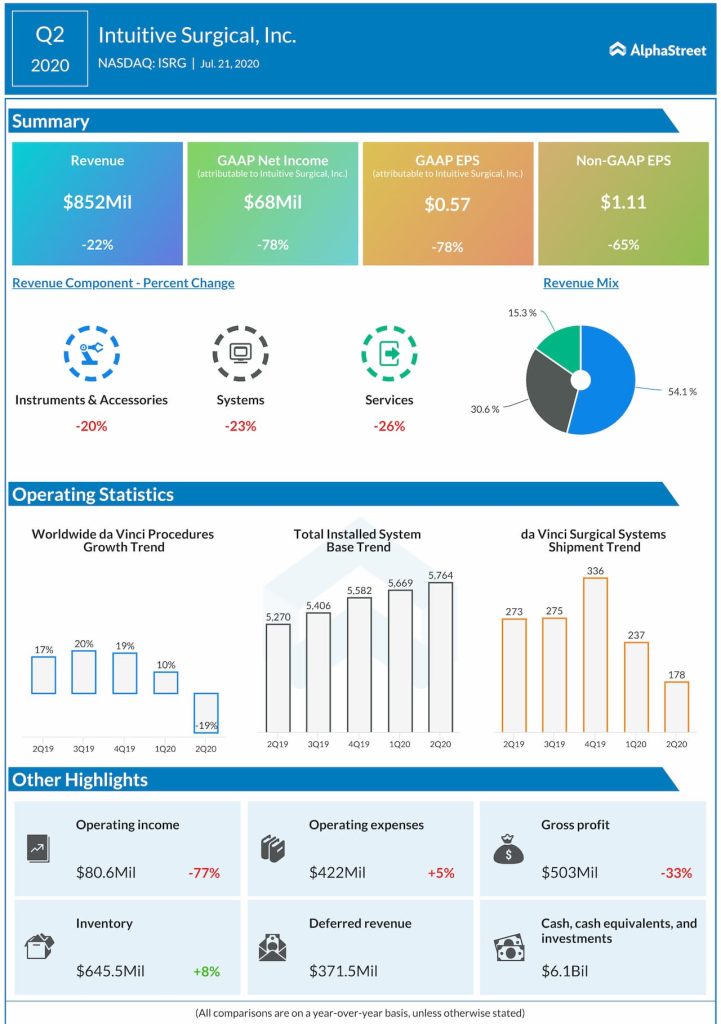

The performance of da Vinci systems was disappointing in the June quarter, with both the number of procedures and shipments declining compared to the preceding quarters. Consequently, there was a double-digit fall in second-quarter revenues and earnings to $852 million and $1.11 per share respectively. Worldwide da Vinci procedures were down 19%.

Read management/analysts’ comments on Intuitive Surgical’s Q1 2020 earnings

Intuitive Surgical is a leading medical technology company engaged in the development and sale of surgical robots. The equipment, including da Vinci system, help surgeons perform procedures with extra control, supported by 3D and 4D vision. The company also generates revenue by selling accessories and consumables for its surgical robots, besides providing maintenance service.