Call for Caution

The shutdown and delay in the federal aid plan have affected thousands of American Airlines employees, in the form of wage-cuts and furloughs. The company is also planning to advance the retirement of about 150 aircraft. Though the lawmakers this week made some progress in reaching a consensus on the stimulus bill, it might not help the cash-guzzling airline companies much. Naturally, American Airlines’ management has turned to the next best option and is set to raise about $2 million through stock and note offerings.

Focus on Cash

Considering the scale of the slowdown, the modest improvement in the latest quarterly numbers, compared to the prior periods, and a stronger balance sheet should be a morale booster for the stakeholders. American Airlines’ ability to sail through the crisis would depend on preserving liquidity by reducing the cash-burn rate and adopting effective cost-cutting measures. Encouragingly, the company had about $15.6 billion of cash balance at the end of the September-quarter, more than what it had in any of the recent quarters.

As to conserving cash, in this environment, we’re focusing on what we can control. To that end, we’ve been — we worked relentlessly to right-size all aspects of the airline. This has been done primarily through cost savings resulting from reduced flying and long-term structural changes to our fleet and our infrastructure. We continue to realize the benefits, both financially and operationally of accelerating the retirement of more than 150 aircraft from our fleet.

ADVERTISEMENTDoug Parker, chief executive officer of American Airlines

Meanwhile, the sector is witnessing a modest but steady uptick in travel demand, compared to the initial months of the pandemic. American Airlines looks to base its recovery on the improving passenger traffic, by ensuring safety and eliminating change fees.

Losing Streak

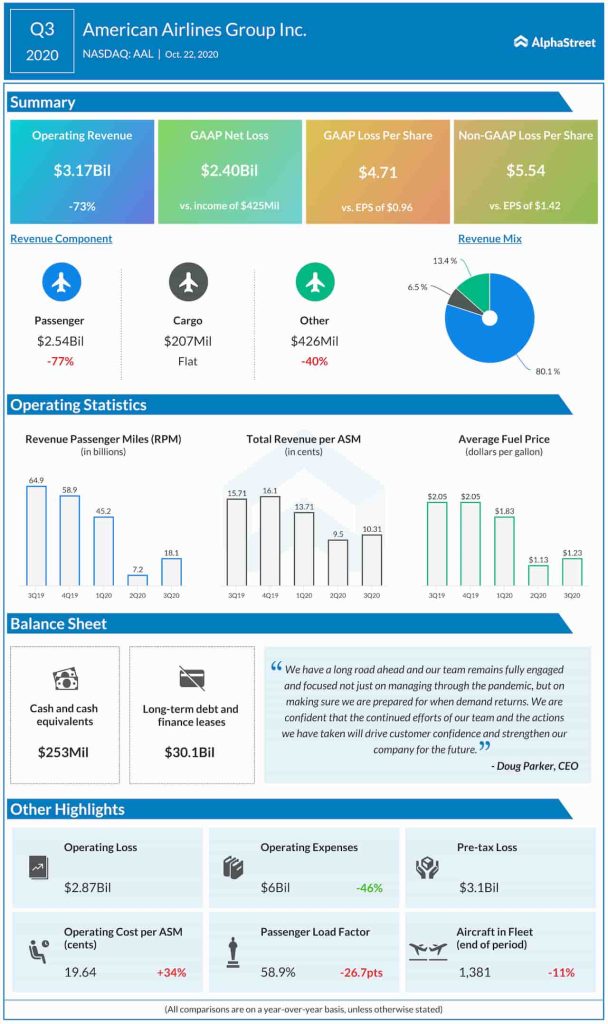

Like in the previous periods, operations were hit by widespread flight cancellations in the third quarter, resulting in a record fall in passenger traffic. Consequently, revenues plunged 73% year-over-year to $3.17 billion. The company incurred a loss of $5.54 per share in the third quarter, marking a sharp deterioration from the year-ago period when it recorded earnings of $1.42 per share. To the management’s relief, the numbers came in above the consensus forecast.

Peer Performance

It was almost the same story with rivals United Airlines Holdings, Inc. (UAL) and Southwest Airlines Co. (LUV), which published earnings earlier this month. Passenger traffic plunged to dismal lows and the bottom-line remained in the negative territory.

Read management/analysts’ comments on American Airlines’ Q3 2020 Earnings

American Airlines’ stock, which has been in a perpetual downward spiral for more than two years, suffered a further jolt after demand plunged to historic lows following the virus outbreak. The stock declined by about 60% since the beginning of the year and all along underperformed the market.