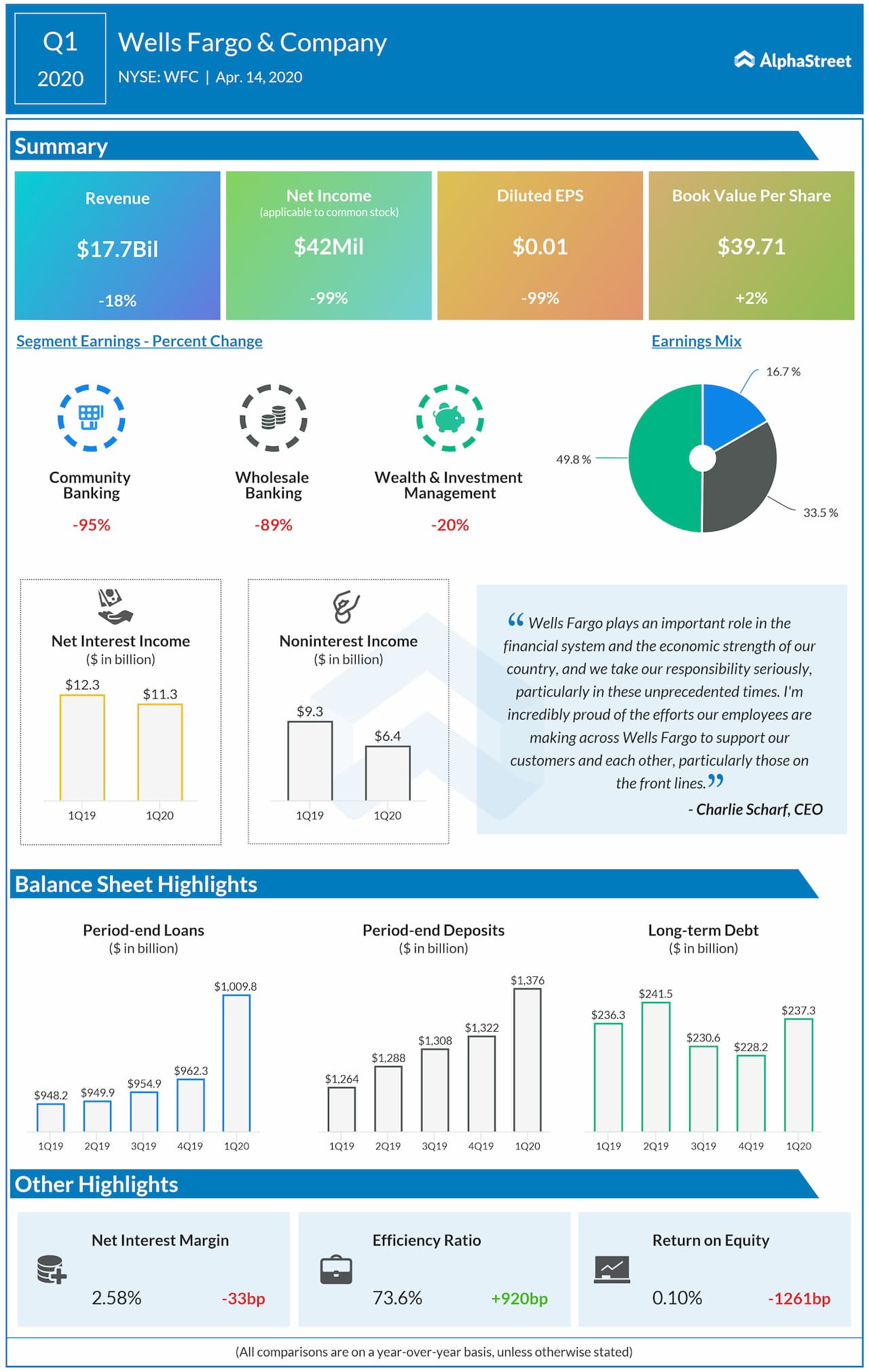

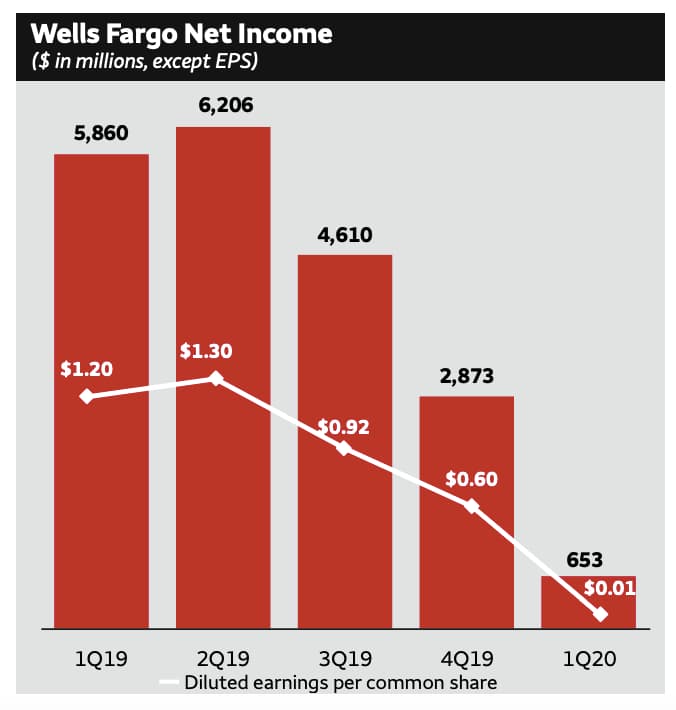

Wells Fargo (NYSE: WFC) reported an 89% dip in earnings for the first quarter of 2020 due to lower revenue as well as higher costs and expenses. The results included the impact of reserve build and impairment of securities driven by economic and market conditions. The results missed analysts’ expectations.

The top line was hurt by net losses from equity securities reflecting lower deferred compensation plan investment results as well as lower mortgage banking income, card fees, and net interest income. The provision for credit losses increased $1 billion, predominantly due to reserve build reflecting forecasted credit deterioration due to the COVID-19 pandemic.

Past Performance

-

4Q19 -

3Q19 -

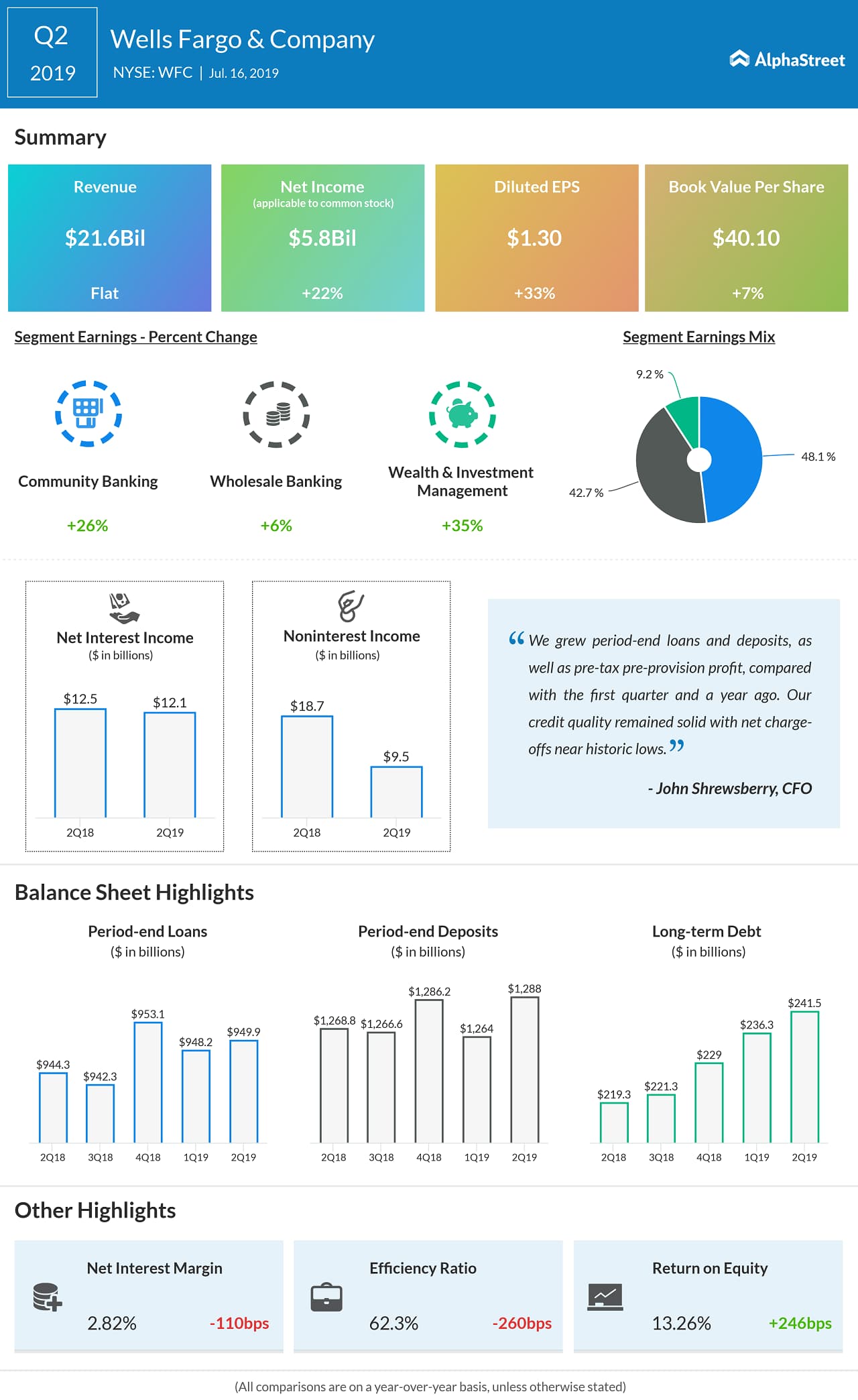

2Q19