GameStop Corp. (NYSE: GME) is the talk of the town right now. Is it for the right reasons? Can’t tell. The stock skyrocketed in an unprecedented manner over the past week sending Wall Street into a tizzy. There was a lot of chatter and a lot of opinions were thrown around but the general sentiment over the stock remained the same – nobody on Wall Street expected this to end well.

Stock movement

GameStop’s shares dropped 31% in morning trade on Thursday after rallying heavily all through this week. The stock has gained over 1,000% in the past one month and nearly 2,000% in the past three months. In the last 12 months, the gain is over 5,000%. The company’s market cap now stands at $24.2 billion. Just a week ago, the stock’s price was $40. It went up as much as $490 this week.

What’s going on?

GameStop had been rallying ever since a group of retail investors came together on Reddit to push shares higher and squeeze out short-sellers. Short-sellers are traders who borrow stock betting that the price will fall and when it does, they buy back the shares at a lower cost and pocket the difference.

This changed in GameStop’s case when retail investors online pushed the stock to heights never seen before and caused massive losses to hedge funds. This risky behavior, based purely on unproven theories, raised concerns over the damage it could cause to market stability.

Many short-sellers backed down from voicing their opinions on the stock due to severe online trolling and threats which is another disturbing matter. GameStop meanwhile continued to rally and this trend spilled on to other heavily shorted stocks such as AMC Entertainment (NYSE: AMC) and Bed Bath and Beyond (NASDAQ: BBBY).

How is GameStop doing?

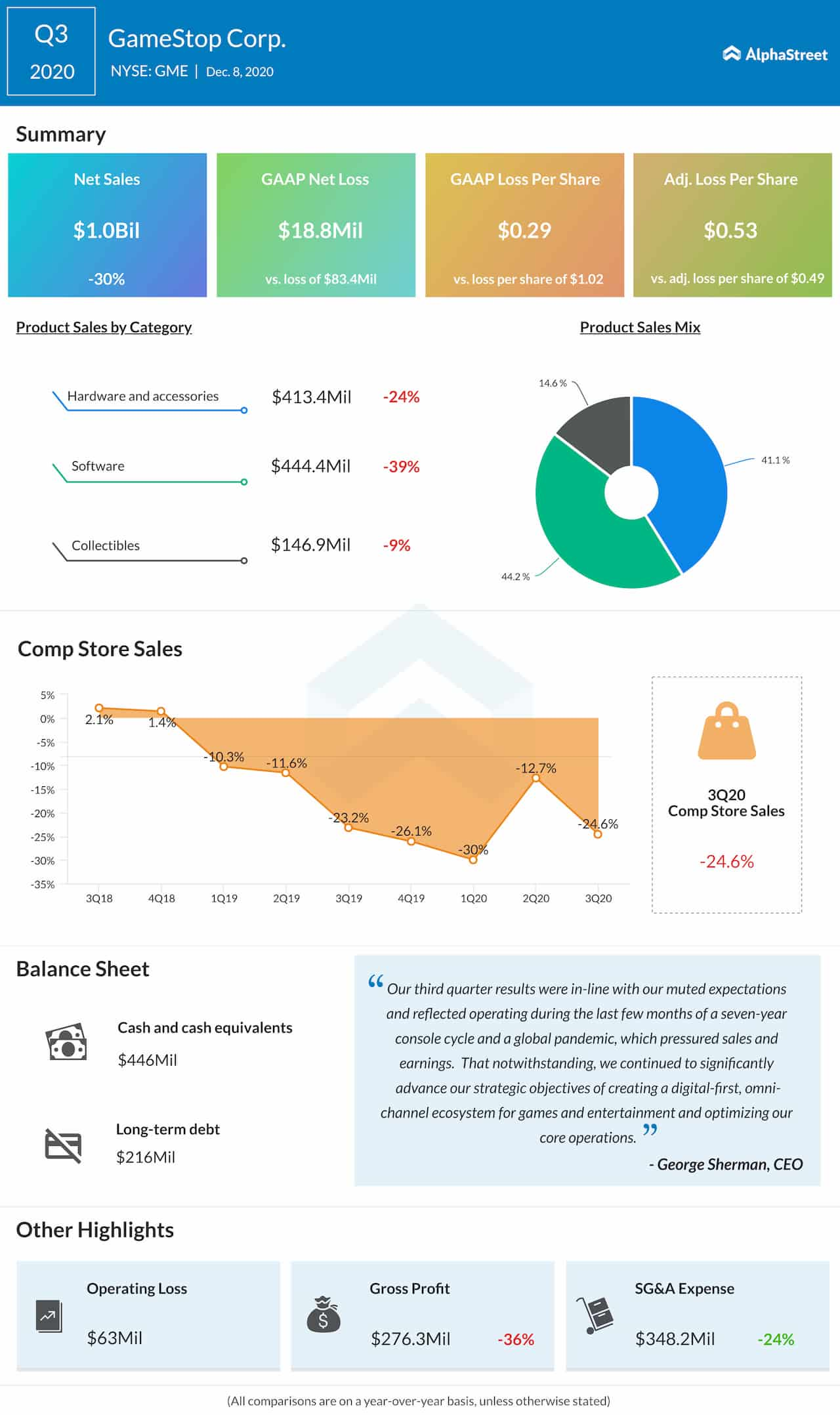

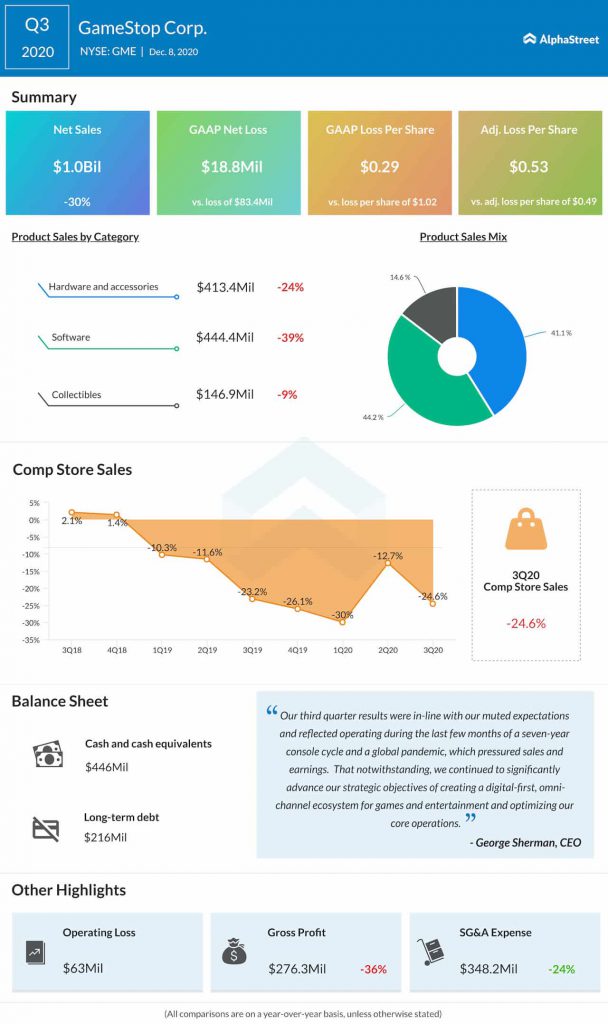

GameStop has seen its revenues and profits decline through the first three quarters of 2020. The company reported holiday sales a week ago and despite strong growth in ecommerce and demand for new consoles, overall sales fell 3%. GameStop has been facing headwinds from the shift to online within the gaming industry and these changes in customer behavior are expected to continue to hurt the struggling retailer.

How does this end?

Almost all analysts share the opinion that it is better to stay away from GameStop’s stock right now because of the extreme volatility. GameStop’s weak fundamentals cannot justify its stock price and the whole drama unfolding on Reddit is not based on strong research or data, it is just personal.

Many analysts predicted that the GameStop bubble would burst soon and it appears it has. Some believed that short-sellers were simply waiting for this to happen, quietly watching from the sidelines.

Experts had opined that no matter how high GameStop went this week or the next, it was bound to come crashing back down. When that happens, they said, it would not be pretty. It appears they have the last word.

Click here to read more on gaming stocks