Nio Inc. (NYSE: NIO) is often referred to as China’s Tesla (NASDAQ: TSLA) but the Chinese company is still far behind its competitor in terms of deliveries. After facing challenges at the beginning of the year due to the coronavirus outbreak, Nio’s deliveries have picked up pace.

Deliveries

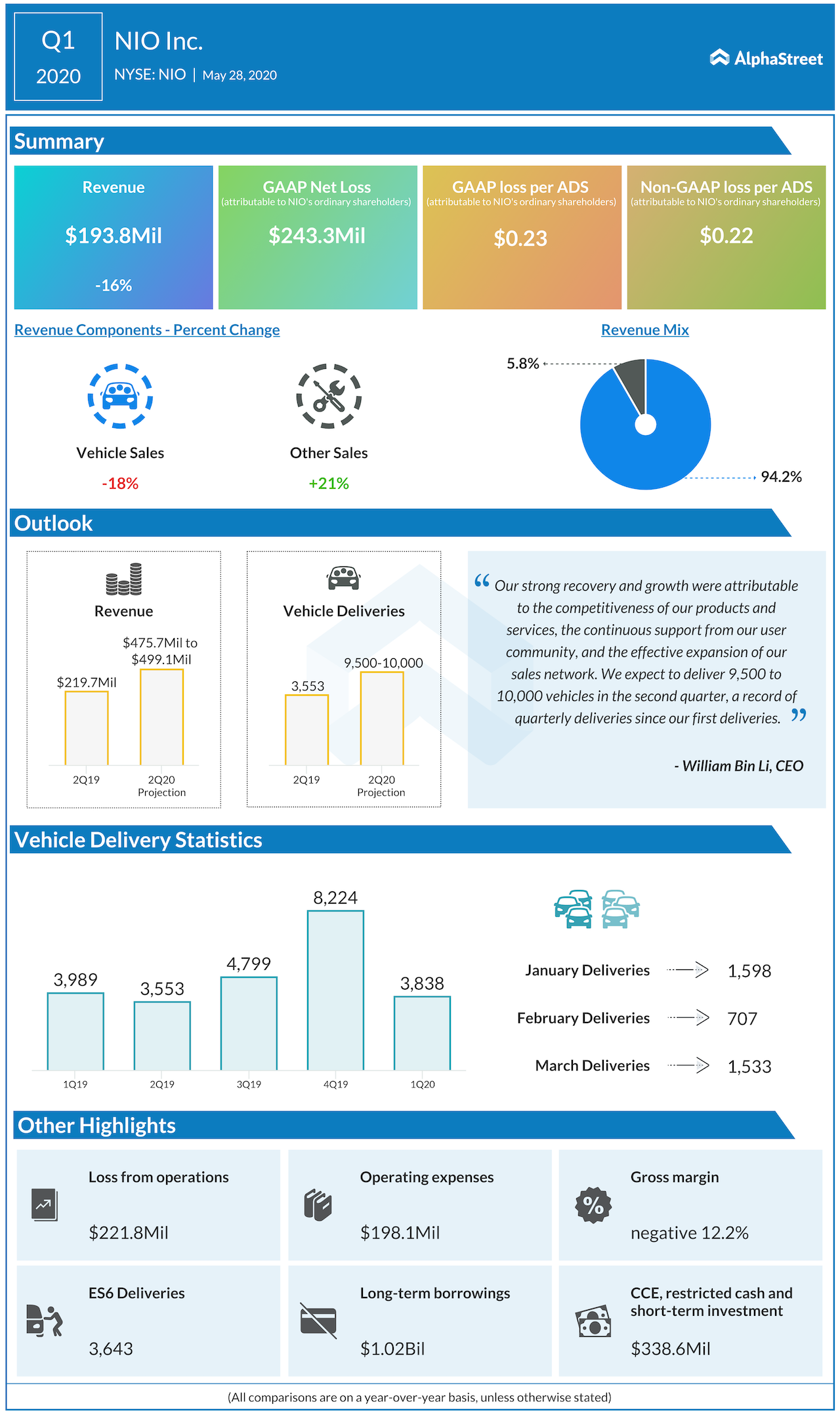

In January, Nio’s deliveries fell 11.5% to 1,598 vehicles due

to the timing of the Chinese New Year holiday and lower business days caused by

the pandemic. In February, as overall passenger vehicle sales in China plunged

78% year-over-year, Nio’s deliveries fell further by 12.8% to 707 vehicles.

However, from mid-February, production started to ramp up and the company saw deliveries increase 116.8% to 1,533 vehicles in March from February. Deliveries amounted to 3,838 in the first quarter of 2020.

In April, this number improved further marking a 180.7%

growth year-over-year to 3,155 vehicles. In May, deliveries rose 215.5% to

3,436 vehicles. This number rose to 3,740 vehicles in June, reflecting a growth

of 179.1% year-over-year. Deliveries for the second quarter of 2020 totaled

10,331 vehicles, up 190.8% year-over-year.

This is nowhere close to Tesla’s number which amounted to

deliveries of approx. 90,650 vehicles in the second quarter of 2020. This

compares to deliveries of 88,496 vehicles in the first quarter of 2020. Tesla is

a major player in the electric vehicles market and its production facility in

China gives it a major advantage. According to a report

by Clean Technica, Tesla held a 29% share of the global electric vehicle market

in the first quarter of 2020.

Outlook

Based on research done by IEA,

electric car sales in 2019 rose 6% from the previous year. The report states

that the COVID-19 pandemic will affect global electric vehicle markets and that

in 2020, electric car sales will account for around 3% of global car sales.

Risks

Nio is yet to achieve profitability and the company has made

significant investments in R&D and marketing which continue to weigh on the

bottom line. The company continues to face tough competition in the EV market

and it has to work on making its products appeal to more customers.

Like every other industry, the COVID-19 pandemic has

affected the automobile industry as well and has disrupted business operations

of most companies. This has led to a slowdown in the production and demand for

electric vehicles and this weakness is likely to continue for the remainder of

this year.

Nio has only a limited number of models and this is another factor that puts the company at risk. Its revenue is dependent on these models alone and there is a need to bring forth more models in order to broaden its sales avenues.

Taking into account all these factors, Nio still lags behind competitors like Tesla and the company faces the risk of being overtaken in its home market by its larger rival. It needs to work on ramping up its production and rolling out more models to broaden its reach and appeal. However, in the current situation, this could prove to be a challenge for the company.

Click here to read the full transcript of Nio Q1 2020 earnings conference call