When Amazon (NASDAQ: AMZN) went public in 1997, it had a market of just over $400 million, thereby falling into the small-cap segment. Two decades since, the e-commerce major is sitting on a gigantic valuation of $1.6 trillion!

Of course, not every small-cap stock turns into a global brand; in fact, some of them even go bust. Stock prices also tend to be highly volatile, but if you have an eye for finding great opportunities, it could be a gold mine. To help you out, here are a few stocks that are relatively under the radar, but offer great potential. You can keep an eye on these, but invest at your own risk!

Niu Technologies

It might come as a surprise that an automobile firm has made it to this list, despite the COVID-19 disruptions. The China-based manufacturer of battery-powered scooters has seen its stock soar 140% since the beginning of this year, reminding a similar kind of growth achieved by EV pioneer Tesla (NASDAQ: TSLA) back home.

Niu (NASDAQ: NIU) had earlier said that it was targeting the major domestic regions facing traffic snarls for the time being, in order to tackle the slowdown in international markets. Solid online presence is likely to have helped the company maintain strong volumes during the last few months.

Niu has already established a market in Europe and South America, and plans to expand to other budding EV markets in Southeast Asia once the dust settles. We will have more details about the firm’s sales trends when it reports quarterly results on August 17.

[irp posts=”62453″]

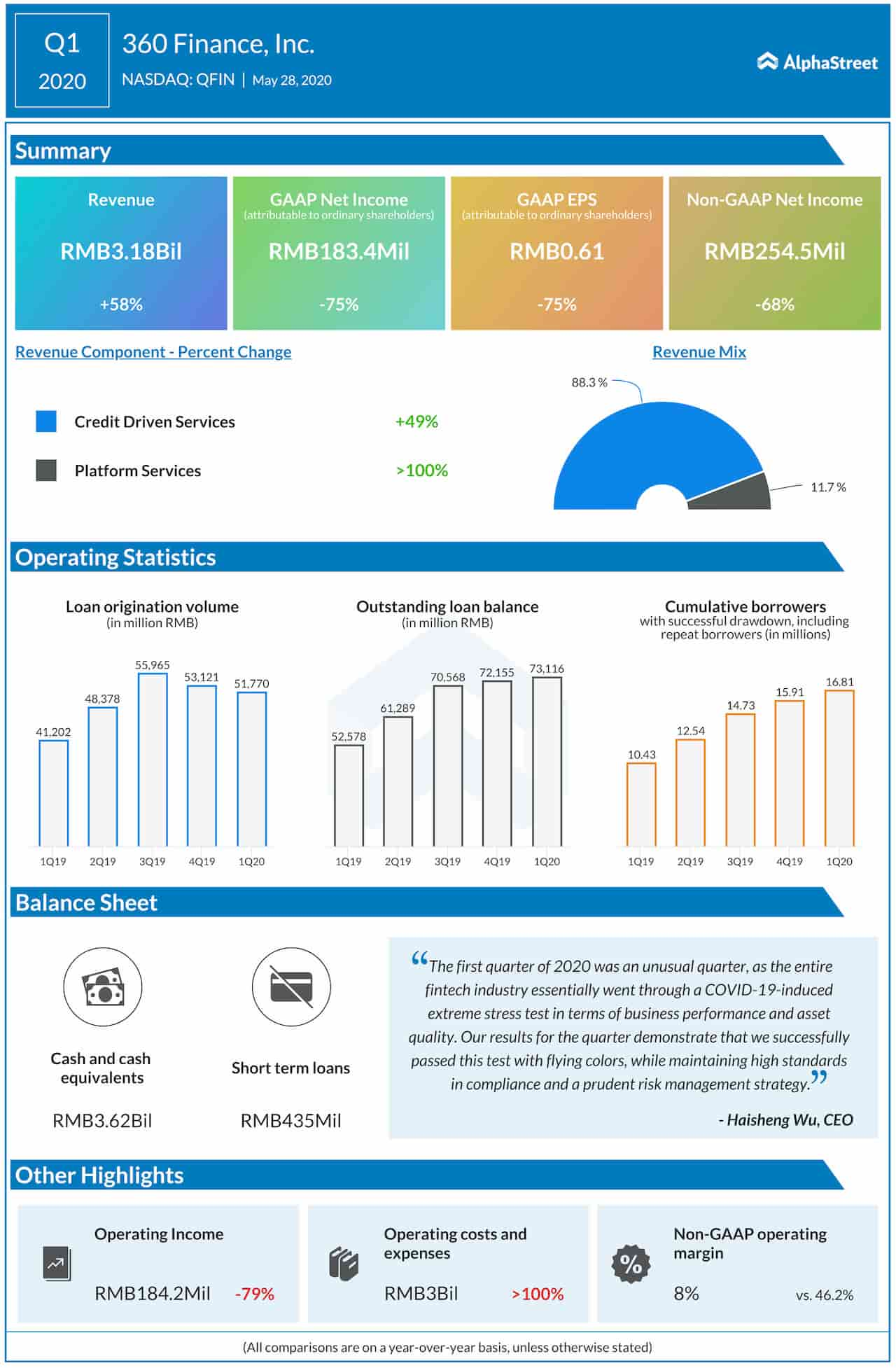

360 Finance

China-headquartered 360 Finance (NASDAQ: QFIN) is the right mix of finance and technology. The firm’s core product is mostly used as a supplement to credit card debt, which makes it unique in the category. The simple and transparent lending process makes the products attractive to borrowers, mostly youngsters.

Currently, the company is following a technology-centric strategy, while also diversifying its funding sources to banks, consumer finance companies, and peer-to-peer lending platforms. The management is also exploring alternative funding initiatives and aims to enhance the loan origination volume of Platform Services to 35-40% from the current 20%, taking advantage of the low-risk factor.

The Chinese consumer finance market is on the threshold of a major transformation, partly driven by the shift in the government’s economic policies that puts additional stress on household consumption. The rapid adoption of internet-based banking services bodes well for online consumer finance companies. This highly regulated segment of the banking sector is going to witness major changes in the future.

Materialise

The significance of 3D printing in future manufacturing processes cannot be stressed enough. And Belgium-based Materialise (NASDAQ: MTLS) plays a key role in the whole process by delivering the software and hardware required to make additive printing easy and precise. Founded in 1990, Materialise is one of the pioneers of the technology.

Even when other 3D printing stocks such as 3D Systems (NYSE: DDD) and Stratasys (NASDAQ: SSYS) have generated negative returns in the past five years, Materialise has gained 230%, suggesting it is among the best stocks in this space.

Materialise also has a strong cash coffer, a part of which is set aside to acquire promising firms. The company makes roughly one acquisition per year, which includes Engimplan in 2019 and ACTech in 2017.

[irp posts=”47414″]

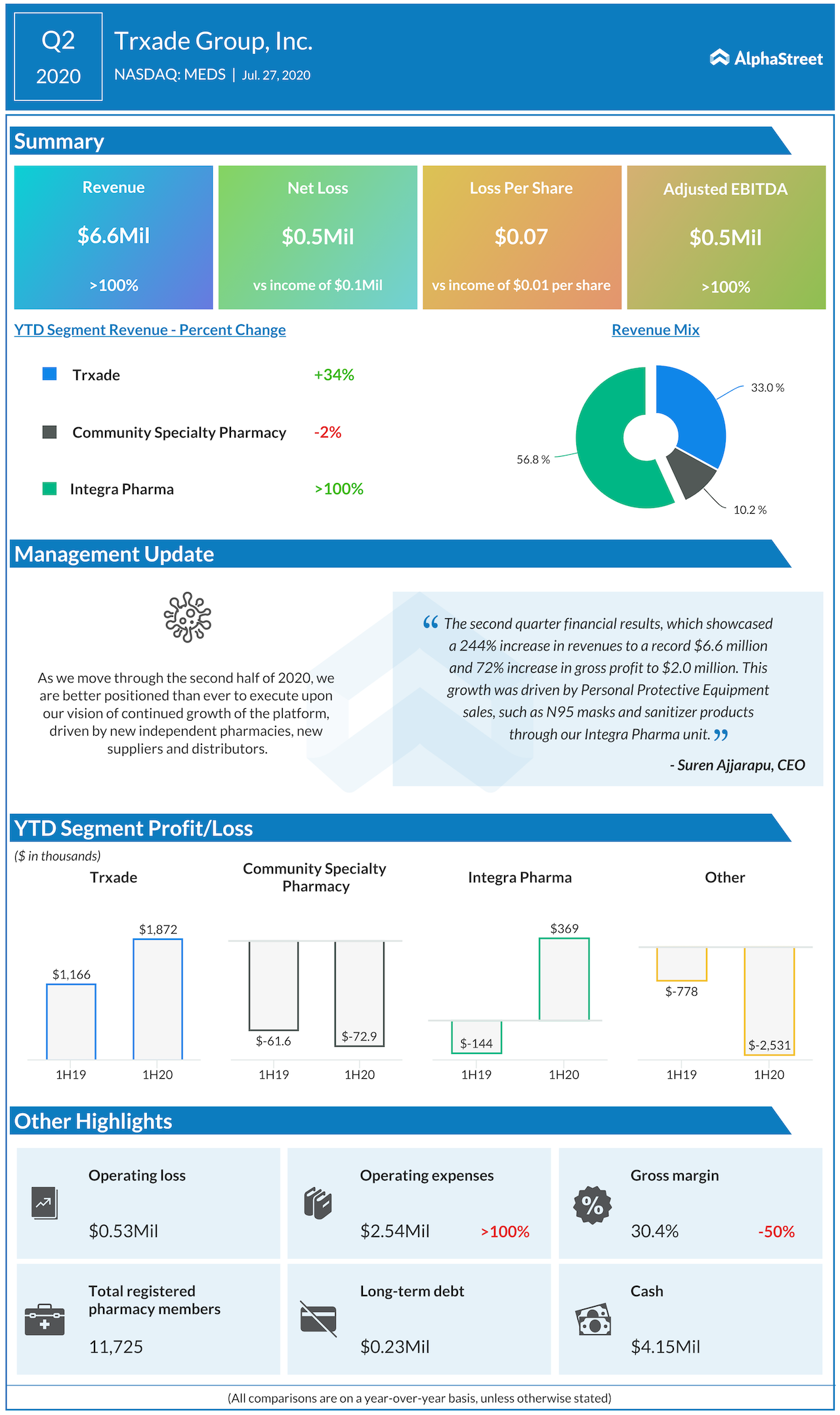

Trxade Group

Strictly speaking, with a market cap of just around $50 million, Trxade (NASDAQ: MEDS) is a micro-cap company. However, the firm’s vision and prospects appear a lot promising. The Florida-based firm brings independent pharmacies under its network to offer customers same-day delivery of drugs. It intends to create an alternative to major retail pharma chains such as CVS Health (NYSE: CVS) and Walgreens (NASDAQ: WBA).

When the company reported second-quarter results, it’s revenues had tripled on the strength of PPE. This was way ahead of the average Wall-Street projection.

Trxade has approximately 11,725 registered pharmacy members, with presence spread across all 50 states.

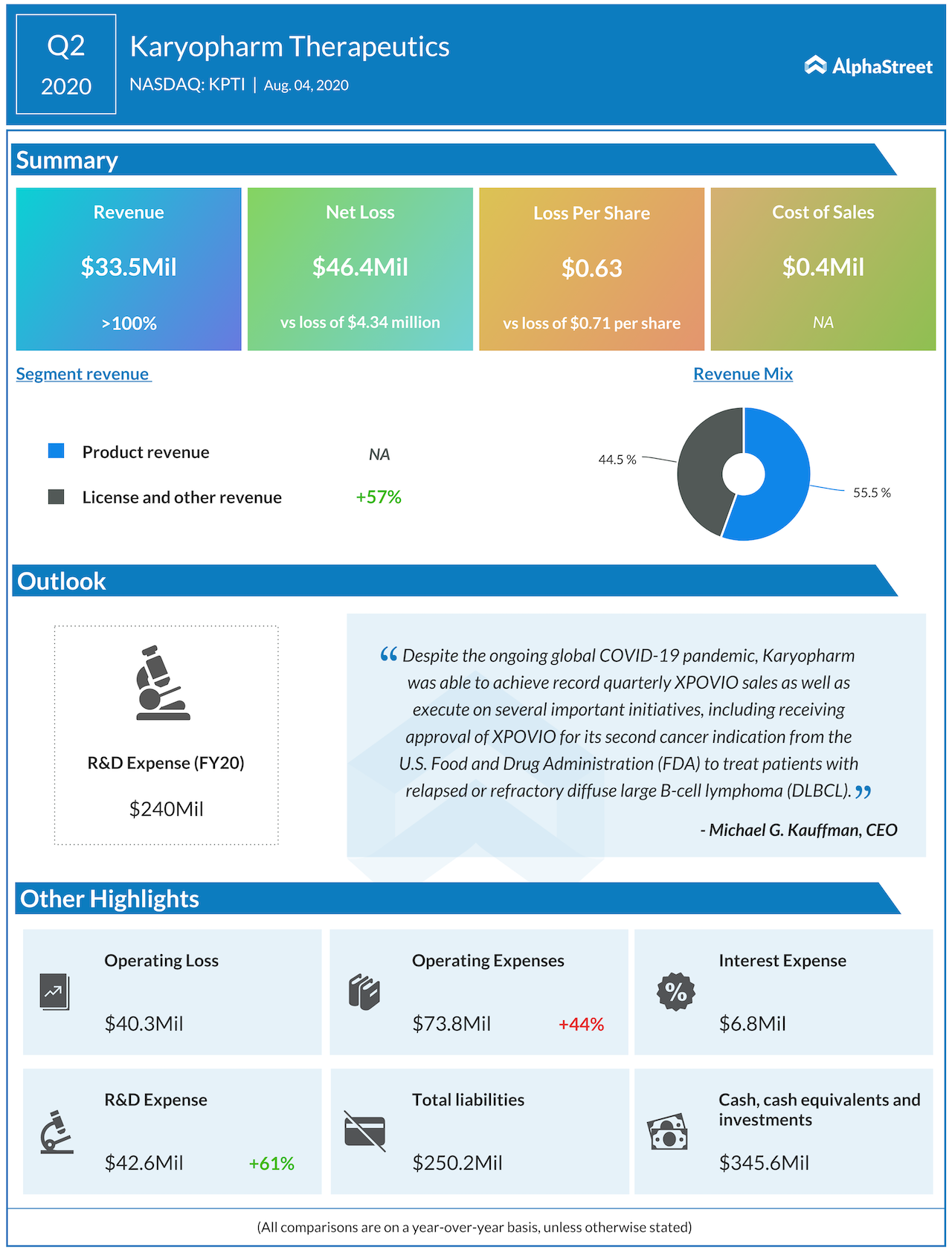

Karyopharm Therapeutics

Karyopharm’s (NASDAQ: KPTI) XPOVIO (selinexor) is the only FDA approved drug for both Multiple Myeloma and Diffuse large B-cell lymphoma (DLBCL), the latter approval coming as recently as in June. The highly sought commercial product-line drove the company’s topline to $33.5 million in the second quarter, compared to $9.5 million a year ago.

With steady revenues from XPOVIO, the company is rather self-sufficient in conducting trials on a promising line-up, that aims to treat solid tumors.

Karyopharm had also tested the efficacy of low-dose XPOVIO in Covid-19 patients, but the drug proved effective in only one subpopulation. The company is now looking forward to partnering with non-profit organizations to take the trials forward.

Limelight Networks

Though growth rate was rather muted compared to its high-flying rival Fastly (NYSE: FSLY), Limelight Networks (NASDAQ: LLNW) had a relatively stable shelter-at-home season. As more people spent time inside their houses with little but online streaming for entertainment, it also translated as a benefit to content delivery network providers like Limelight.

Even though there was hardly any sports streaming happening during the last quarter, the company still managed to post record revenues and narrowed losses in the second quarter. The stock has gained 44% since the beginning of this year, even though remained highly volatile.

With online streaming becoming a part of our lives, the scope for CDN providers cannot be overlooked.

[irp posts=”50215″]

_______