The outlook on the company — and the larger tech sector — is mixed as economic uncertainties and muted business sentiment offset the benefits of market reopening and continuing technology adoption across industries. But the company has a history of delivering quarterly results that regularly surpass the market’s expectations.

Check this space to read management/analysts’ comments on quarterly reports

It is very likely that the positive trend continued in the most recent quarter, and there is every reason to believe Adobe would create reasonably good shareholder value in the long term. In short, the company would not disappoint those who buy the stock ahead of next week’s earnings and hold it long enough to appreciate. Also, the stock is a safe bet, and the current valuation is just right.

But ADBE might still be affected by external factors that are not specific to the company or the industry, like the Fed’s hawkish monetary policy, lingering pandemic uncertainties, and the general slowdown in tech spending. That calls for caution when it comes to buying the stock for the short term.

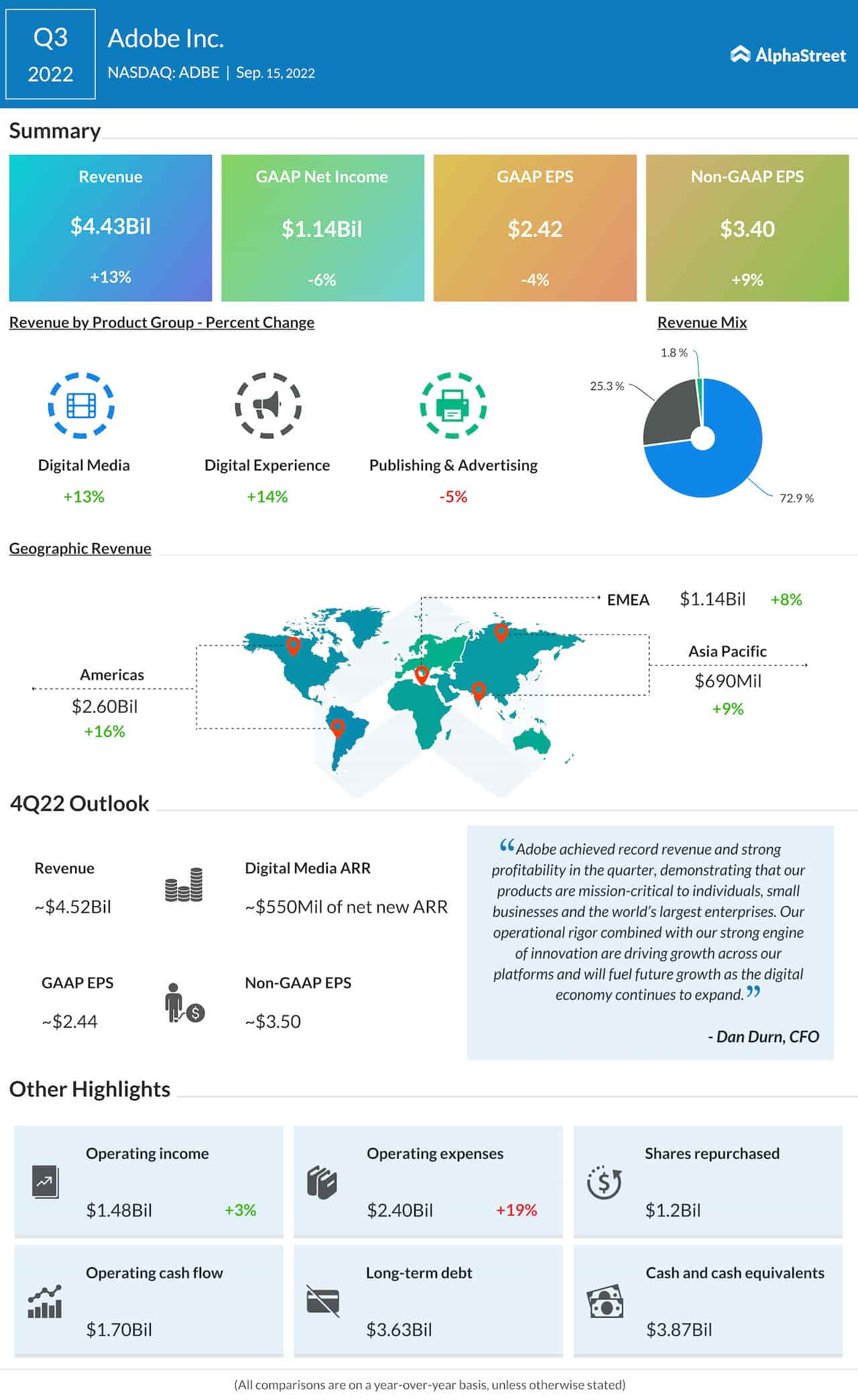

On December 15, the company will be publishing financial results for the final three months of fiscal 2022. As per experts’ consensus estimates, November-quarter revenues will grow 10% from last year to $4.53 billion. The top-line growth is expected to translate into a 9% increase in adjusted earnings to $3.5 per share.

From Adobe’s Q3 2022 earnings conference call:

“Throughout our history, Adobe’s innovations have touched billions of lives around the globe. From revolutionizing imaging and creative expression with Photoshop to pioneering electronic documents through PDF to creating the digital marketing category with Adobe Experience Cloud, Adobe continues to invent and transform categories. We are in the golden age of design, and we believe we have a unique opportunity to usher in a new era of collaborative creative computing.”

Why it’s a good idea to keep an eye on Autodesk’s stock

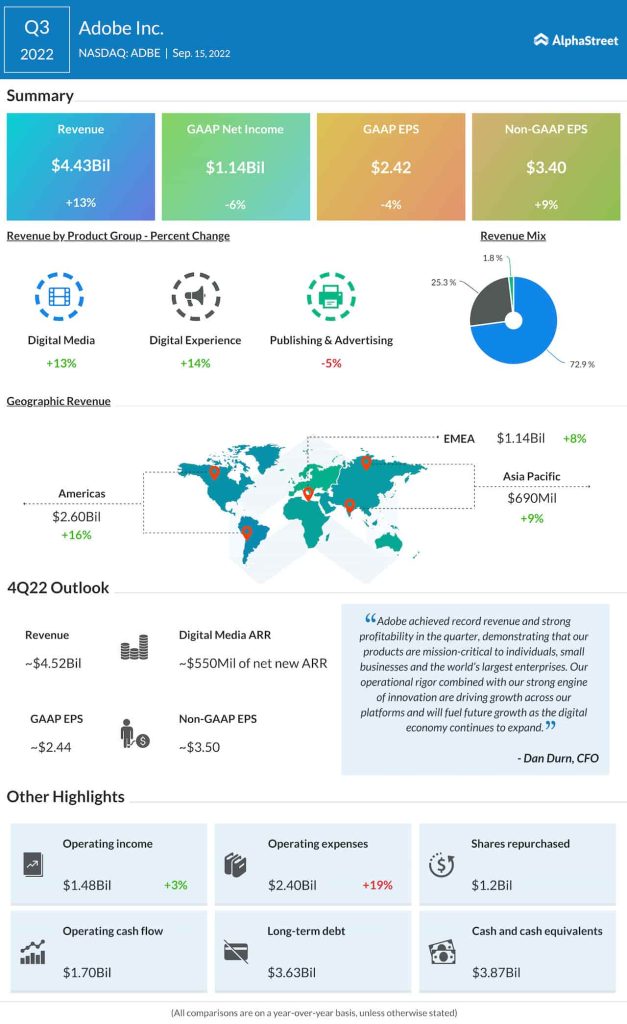

In the third quarter of 2022, the top line grew in double-digits to $4.43 billion, with most of that coming from the core Digital Media segment. As a result, adjusted profit grew by 9% to $3.40 per share. Interestingly, all three geographical segments registered growth.

ADBE is yet to fully recover from the selloff that followed the last earnings announcement. Currently, the stock is trading down 35% from the level at which it entered 2022.