Kinder Morgan, Inc. (NYSE: KMI) reported Q1 2020 earnings results today. The company posted net loss attributable to KMI of $306 million, compared to net income attributable to KMI of $556 million in the same period last year, mainly due to $950 million of non-cash impairments of assets and goodwill associated with certain oil and gas producing assets in the CO2 segment driven by the recent decline in crude oil prices.

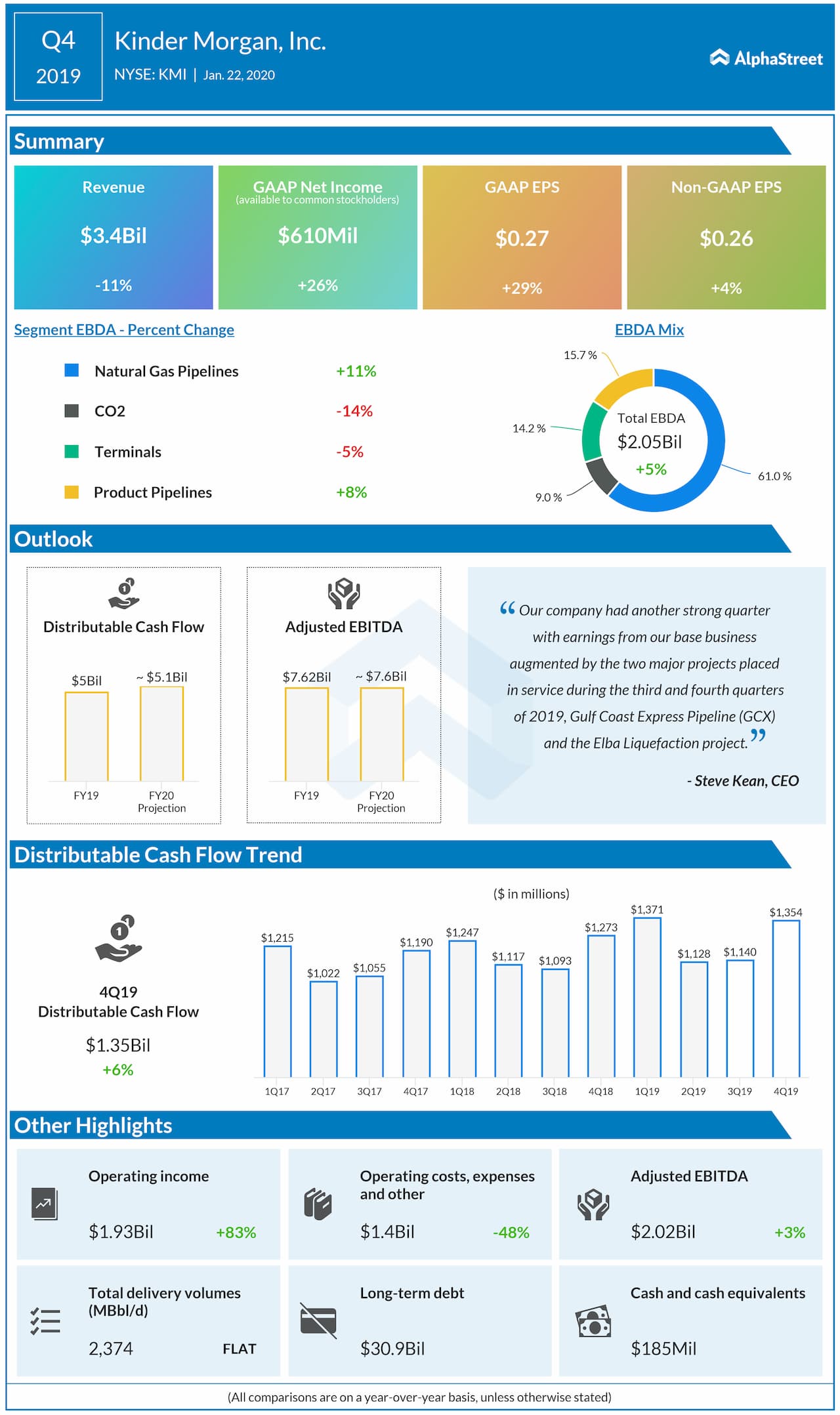

For 2020, Kinder Morgan had estimated DCF of approx. $5.1

billion, or $2.24 per common share, and adjusted EBITDA of approx. $7.6

billion. Due to the COVID-19 pandemic-related reduced energy demand and the

sharp decline in commodity prices, the company now expects DCF to be below plan

by about 10% and adjusted EBITDA to be below plan by around 8%.

The board of directors approved a cash dividend of $0.2625

per share for the first quarter, payable on May 15, 2020, to common

stockholders of record as of May 4, 2020. This dividend amounts to $1.05 on an annualized

basis and represents a 5% increase over the fourth quarter of 2019.

Past Performance