Stock Peaks

Read management/analysts’ comments on quarterly reports

A question many stakeholders might be asking now is whether AAPL would be able to maintain the current momentum. There is enough reason to believe that Apple would continue creating strong shareholder value in the long term, though a short-term slowdown is in the cards. It is worth noting that it took just above a year for its market cap to grow from $2 trillion to the current level, and the factors that contributed to the rally are still there.

In short, there is enough room for further growth. iPhone, the company’s flagship product, continues to be the main growth driver, but the service segment is expanding at a surprisingly rapid pace – accounted for more than a fifth of total revenues in the most recent quarter. With App Store downloads hitting record highs, the service business should stay on the high-growth path.

New Products

The company’s recent sales performance shows that the market responded positively to recent product launches, led by the iPhone 13 line-up. The innovative VR/AR headsets, which the company is reportedly planning to roll out, can elicit significant interest among both customers and investors.

“We estimate the impact from supply constraints will be larger during the December quarter. Despite this challenge, we are seeing high demands for our products and expect to achieve very solid year-over-year revenue growth and to set a new revenue record during the September the December quarter. We expect revenue for each product category to grow on a year-over-year basis, except for iPad, which we expect to decline year over year due to supply constraints,” said Apple’s CFO Luca Maestri during a recent interaction with analysts.

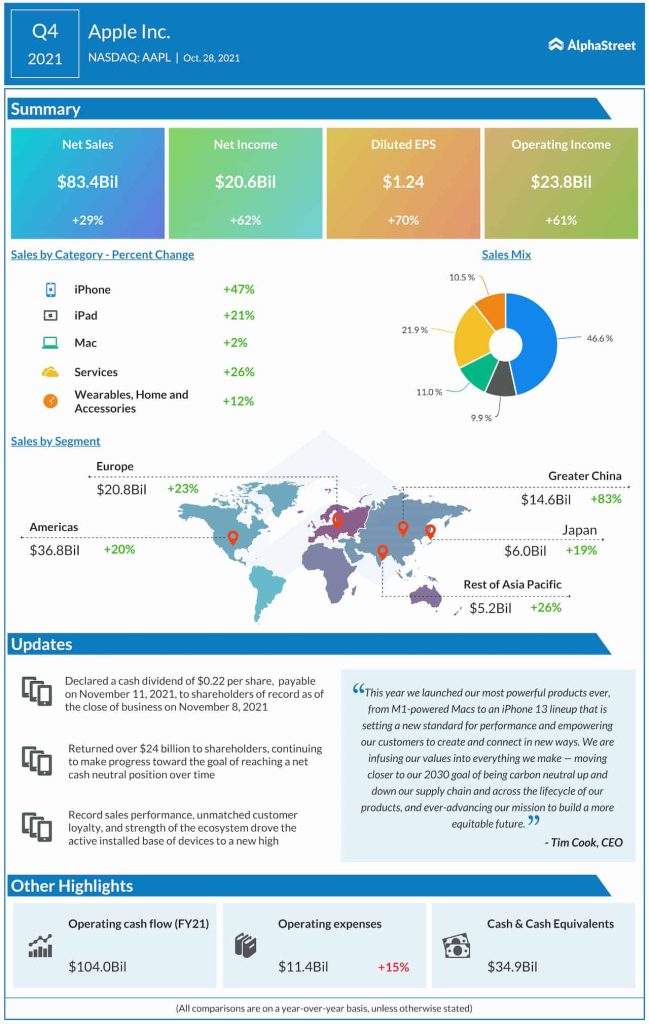

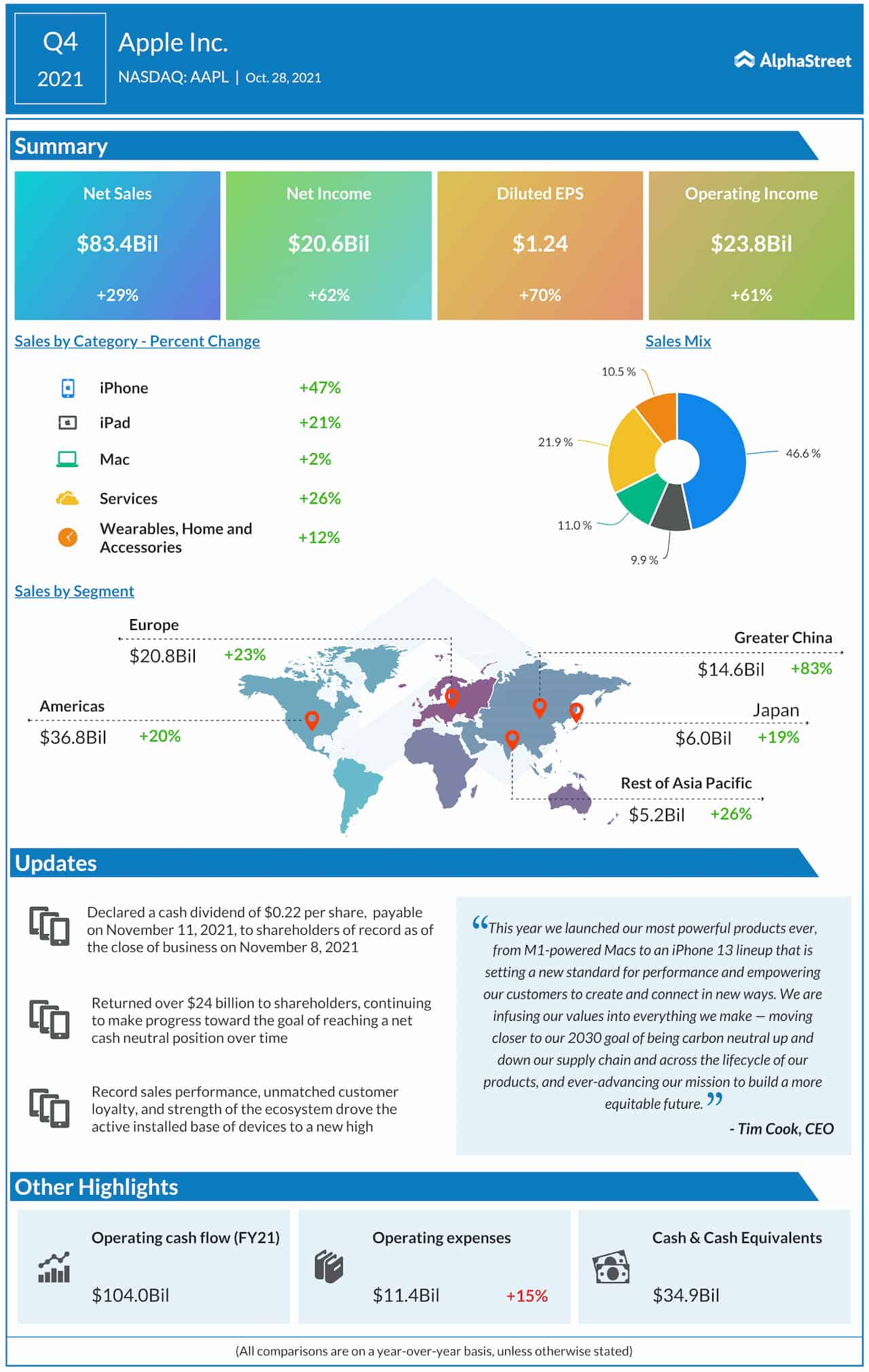

Record Sales

Over the past several years, Apple set new records regularly for quarterly sales, and earnings either beat or matched the consensus estimates. After a brief lull, iPhone sales bounced back and rose 47% in the final months of fiscal 2021, driving up total sales to $83.4 billion. All the product categories, except Mac, registered double-digit growth. As a result, fourth-quarter earnings surged 70% annually to $1.24 per share.

With a market cap of around $2.4 trillion, Microsoft Corporation (NASDAQ: MSFT) is currently the second most valuable company, followed by Google parent Alphabet Inc. (NASDAQ: GOOG, GOOGL) and e-commerce behemoth Amazon.com, Inc. (NASDAQ: AMZN) at $1.9 trillion and $1.7 trillion, respectively, as on January 5, 2022.

Infographic: Highlights of Hewlett Packard’s Q4 2021 earnings report

After hitting an all-time high on Monday, Apple’s stock pared most of the gains in the following sessions and settled at the pre-peak levels. It traded lower on Wednesday afternoon, after opening the session slightly below $180, which is well above its 52-week average.