Design software company Adobe Inc. (NASDAQ: ADBE) is all set to publish its third-quarter results on September 14, amid expectations for a positive outcome. The tech firm, which has been dominating the market for digital content creation and management for quite some time, thrives on the fast-paced digitization and growing demand for AI-supported offerings.

After falling to a three-year low about 12 months ago, Adobe’s stock made steady gains and stabilized in recent weeks ahead of the earnings. All along, it outperformed the market and is currently trading well above the 52-week average. The majority of analysts following the stock recommend buying it, citing the company’s bright growth prospects. However, the stock is priced at a premium.

‘Future Perfect’

The company owes its fast-paced growth to the shift to subscription-based business model, with the software-as-a-service approach boosting recurring revenue and driving earnings growth. Also, the healthy cash flows allow it to continue investing in innovation, particularly in high-return areas like AI, though aggressive capital spending negatively impacts margin performance.

Q3 Report Due

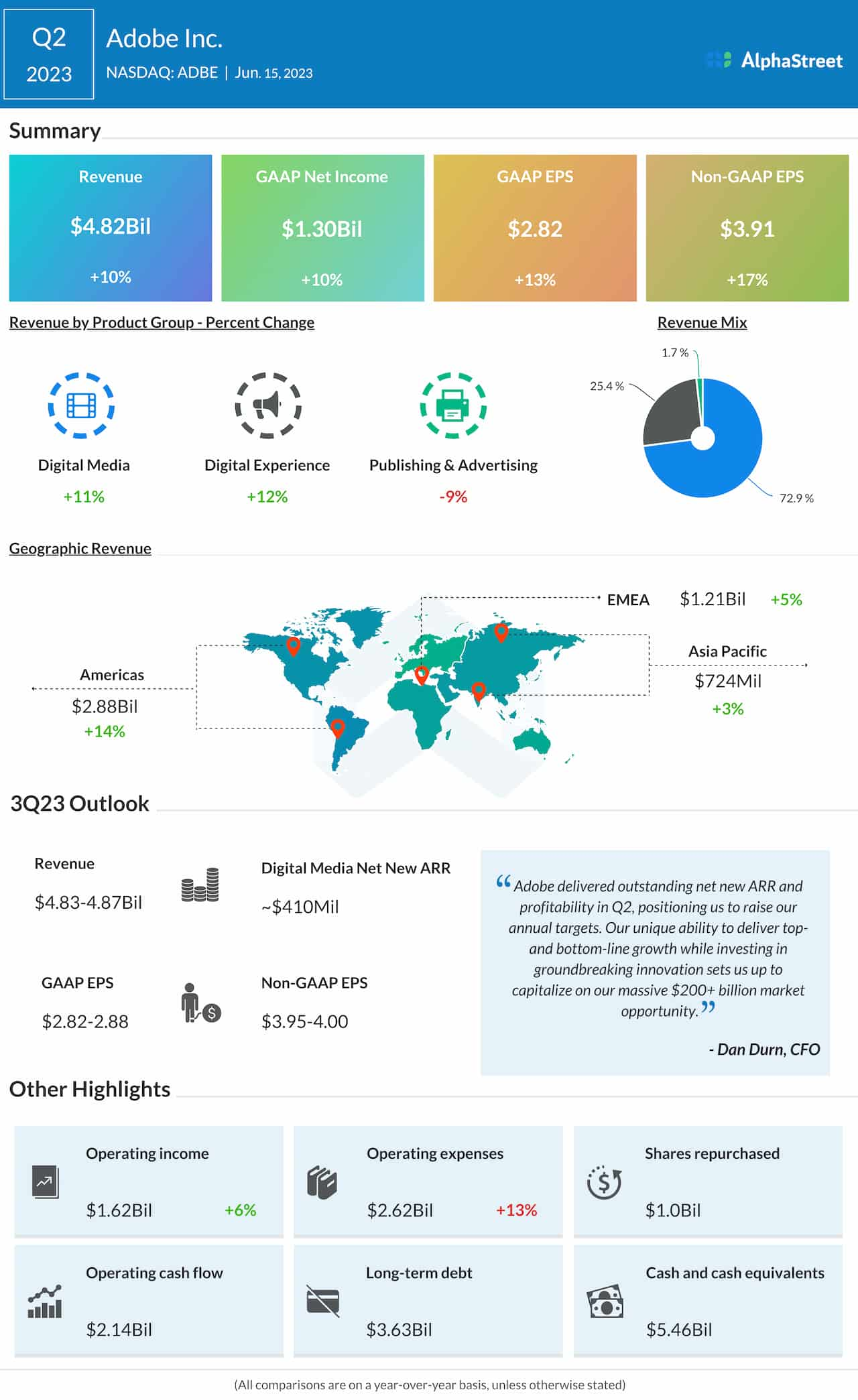

Adobe’s third-quarter report is slated for publication on September 14, after markets close. Experts are of the view that the tech firm would report strong results – adjusted profit is expected to grow 17% annually to $3.98 per share on revenues of $4.82 billion, which represents a 10% growth. The management in its latest guidance had forecast revenues in the range of $4.83 billion to $4.87 billion for the third quarter. The guidance for adjusted earnings is between $3.90 per share and $4.00 per share.

From Adobe’s Q2 2023 earnings conference call:

“Adobe’s mission to change the world through personalized digital experiences is more critical than ever as digital continues to rapidly transform work, live-and-play. Our groundbreaking innovations, including the new Adobe Express, the launch of Firefly, our family of creative generate of AI models, copilot functionality in our creative applications including Photoshop and Illustrator, AI-powered advancements in Acrobat, a new product Analytics solution, and the latest capabilities in real-time CDP are empowering an ever-expanding customer-base to imagine, create and deliver standout content and experiences.”

Key Numbers

The Q3 projection matches the growth achieved in the prior quarter when revenues rose to $4.82 billion, with the main Digital Media and Digital Experience segments expanding in double digits. The top line grew across all geographical regions. At $3.91 per share, May-quarter profit, excluding one-off items, was up 17%. For more than five years, the company’s quarterly earnings either matched or beat estimates regularly.

Shares of Adobe traded lower on Thursday afternoon and hovered near $560. The stock is up 66% since the beginning of 2023.