On Recovery Path

There has been an improvement in enrolments as the COVID-related movement restrictions eased and business activity resumed in many regions. While the management reiterated outlook for the second half, banking on its cost-saving initiatives and prudent capital allocation, there is a lingering concern that healthcare delivery would be affected by the current uncertainties. But the company’s long-term prospects look encouraging, thanks to its solid fundamentals and the thriving pharmacy benefit management business.

A key aspect of Cigna’s growth strategy is partnerships and acquisitions, which the company intends to continue leveraging its strong cash position. This year, pharmacy care was made more affordable for members of Medicare and Medicaid by adding new units to the pharmacy network. After the multi-billion-dollar acquisition of Express Scripts a couple of years ago — to give a fresh boost to the core Pharmacy Management business — the company joined hands with several firms including insurance major Oscar Health.

High Retention

Cost-savings for customers are mainly achieved through a combination of innovation, home-delivery, and generic push. The management also leverages the high purchase volumes to offer discounts. Those efforts have translated into impressive client retention rates that currently range between 95% and 98%. But the ongoing slump in healthcare activity, as patients keep away from medical facilities due to the COVID scare, would result in lower costs for health insurers like Cigna in the near term.

Related: A look at some of the pharma companies and their progress

However, once normalcy returns and major medical procedures like surgery are conducted, the companies will have to deal with high-value claims. Additional medical expenses related to COVID treatment and subdued enrolment in the recessionary environment will l put pressure on net investment income.

Macros Matter

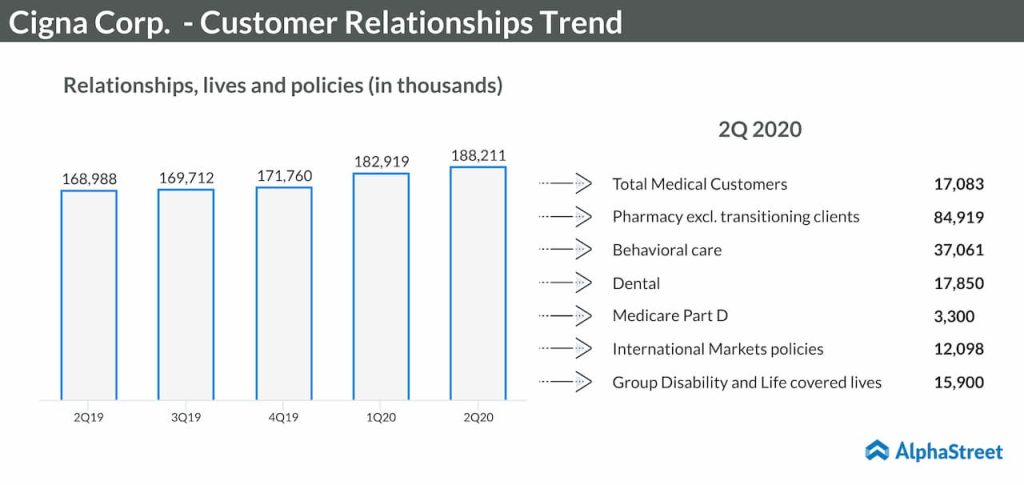

Going forward, the sustainability of Cigna’s commercial healthcare business would depend a lot on the recovery of insurance enrolment that got affected by the deterioration of the job market after the virus outbreak. Meanwhile, the company can focus more on the pharmacy benefit management business once it closes the sale of the Group Disability business, which accounted for about 3% of total revenues in the most recent quarter, later this year.

Solid Start to 2H

In the second quarter, Cigna witnessed an improvement in the number of patients seeking healthcare services, compared to the initial months of the year when people deferred pharmacy visits and non-essential procedures in response to the shelter-in-orders. Net income rose by a quarter to $1.75 billion even as the top-line moved up to $39.3 billion. Both the numbers topped the Street view.

“We’ve delivered strong fundamental performance this year, while also seeing lower medical costs from deferred care and we continue to provide financial support to our clients and customers. We expect our strong fundamentals across our diverse portfolio of growth businesses to enable us to manage through the various impacts of the current environment, and as such, we continue to expect 2020 full-year adjusted EPS of $18 to $18.60 per share,” said Cigna’s CFO Eric Palmer while commenting on the June-quarter report.

Read management/analysts’ comments on quarterly results

Cigna’s shares opened Thursday’s session at $164.08 and traded lower during the regular hours. It has dropped about 20% so far in 2020, after making a positive start to the year.